Region:Middle East

Author(s):Dev

Product Code:KRAA9599

Pages:95

Published On:November 2025

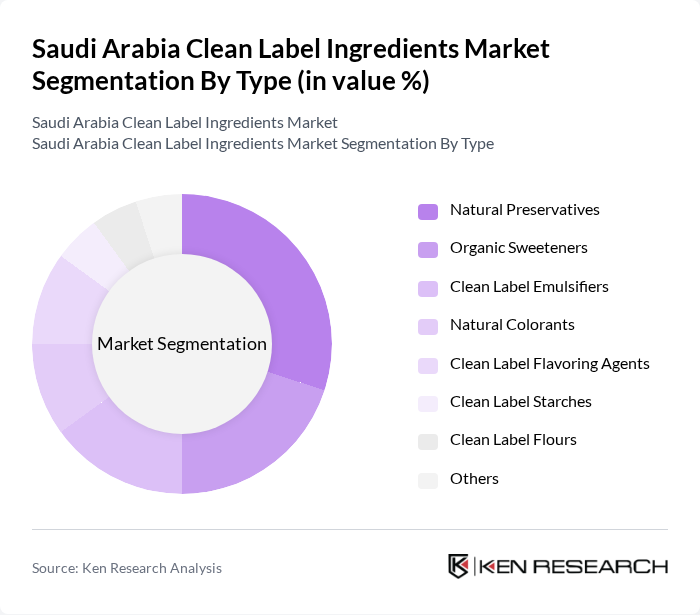

By Type:The clean label ingredients market is segmented into various types, including natural preservatives, organic sweeteners, clean label emulsifiers, natural colorants, clean label flavoring agents, clean label starches, clean label flours, and others. Among these, natural preservatives are gaining significant traction due to their ability to extend shelf life without compromising product integrity. Consumers are increasingly opting for products that are free from synthetic additives, which is driving the demand for natural preservatives. This trend is further supported by the growing awareness of health and wellness, leading to a preference for products that align with clean label principles. The demand for natural colorants and organic sweeteners is also rising as manufacturers respond to consumer preference for recognizable, plant-based ingredients .

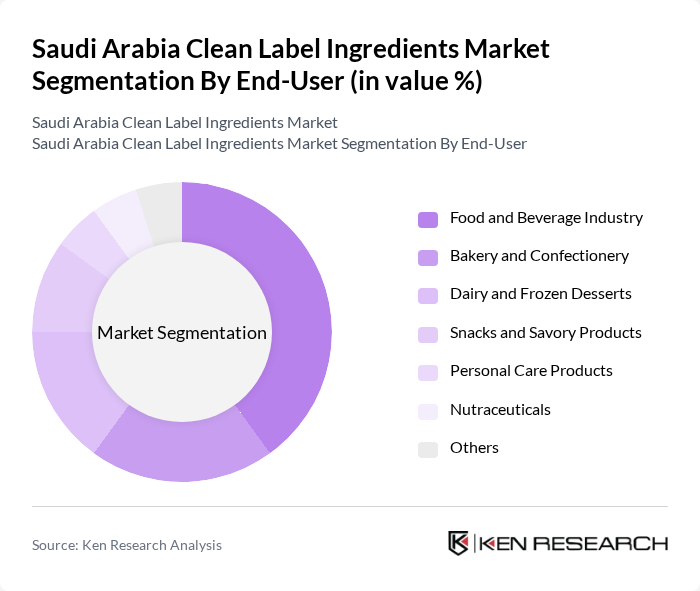

By End-User:The end-user segmentation of the clean label ingredients market includes the food and beverage industry, bakery and confectionery, dairy and frozen desserts, snacks and savory products, personal care products, nutraceuticals, and others. The food and beverage industry is the leading segment, driven by the increasing consumer preference for clean label products. As consumers become more health-conscious, they are seeking products that are free from artificial ingredients and additives. This shift in consumer behavior is prompting manufacturers to reformulate their products using clean label ingredients, thereby driving growth in this segment. The bakery and confectionery segment is also expanding, supported by demand for clean label flours and sweeteners, while the personal care sector is increasingly adopting natural and transparent ingredient labeling .

The Saudi Arabia Clean Label Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group, National Agricultural Development Company (Nadec), Al-Othaim Holding, Al-Faisaliah Group, United Food Industries Corporation, Al-Watania Poultry, Al-Jazeera Foods Company, Al-Muhaidib Group, Albaik Food Systems Company, Al-Hokair Group, Al Safi Danone, Archer Daniels Midland Company, Chr. Hansen Holding A/S, Sensient Technologies Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clean label ingredients market in Saudi Arabia appears promising, driven by increasing consumer awareness and government support. As health consciousness continues to rise, the demand for transparency in food labeling will likely grow. Innovations in clean label technologies and sustainable sourcing practices are expected to enhance product offerings. Furthermore, the expansion of e-commerce platforms will facilitate greater access to clean label products, allowing consumers to make informed choices and driving market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Preservatives Organic Sweeteners Clean Label Emulsifiers Natural Colorants Clean Label Flavoring Agents Clean Label Starches Clean Label Flours Others |

| By End-User | Food and Beverage Industry Bakery and Confectionery Dairy and Frozen Desserts Snacks and Savory Products Personal Care Products Nutraceuticals Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Food Service Providers Others |

| By Application | Bakery Products Dairy Products Snacks and Confectionery Beverages Sauces, Dressings, and Condiments Meat and Poultry Products Others |

| By Source | Plant-Based Sources Animal-Based Sources Microbial Sources Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 80 | Product Development Managers, Quality Assurance Specialists |

| Retail Sector Insights | 60 | Category Managers, Store Owners |

| Consumer Preferences | 120 | Health-Conscious Consumers, Nutritionists |

| Ingredient Suppliers | 50 | Sales Managers, Product Line Directors |

| Regulatory Bodies | 40 | Policy Makers, Food Safety Inspectors |

The Saudi Arabia Clean Label Ingredients Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by consumer demand for transparency, health consciousness, and a shift towards natural and organic products.