Region:Global

Author(s):Shubham

Product Code:KRAC0649

Pages:89

Published On:August 2025

By Type:

By End-User:

By Service Type:

By Region:

By Transaction Type:

By Settlement Method:

By Regulatory Framework:

The Global Clearing Houses And Settlements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Depository Trust & Clearing Corporation (DTCC), LCH Limited (London Stock Exchange Group), Euroclear Group, Clearstream (Deutsche Börse Group), SIX x-clear & SIX SIS (SIX Group), Cboe Clear Europe, ICE Clear (ICE Clear U.S., ICE Clear Europe, ICE Clear Credit), Nasdaq Clearing AB, CME Clearing (CME Group), BNY Mellon (BNY Mellon CSD and custody/settlement), HSBC Securities Services (custody & settlement), State Street Corporation (Global Markets & custody), J.P. Morgan (Securities Services & J.P. Morgan Clearing Corp.), Citigroup (Citi Securities Services), Standard Chartered (Securities Services), CLS Group (Payment-versus-Payment FX settlement), Euro Banking Association (EBA CLEARING – EURO1/STEP2/RT1), Australian Securities Exchange (ASX Clear & Austraclear), Japan Securities Clearing Corporation (JSCC), Hong Kong Exchanges and Clearing (HKEX – OTC Clear & HKSCC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clearing houses and settlements market is poised for transformation, driven by technological innovations and evolving regulatory landscapes. As financial institutions increasingly adopt digital solutions, the demand for automated clearing systems will rise, enhancing transaction efficiency. Additionally, the focus on sustainability will shape operational practices, with firms seeking eco-friendly solutions. The integration of advanced technologies will not only streamline processes but also improve risk management, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

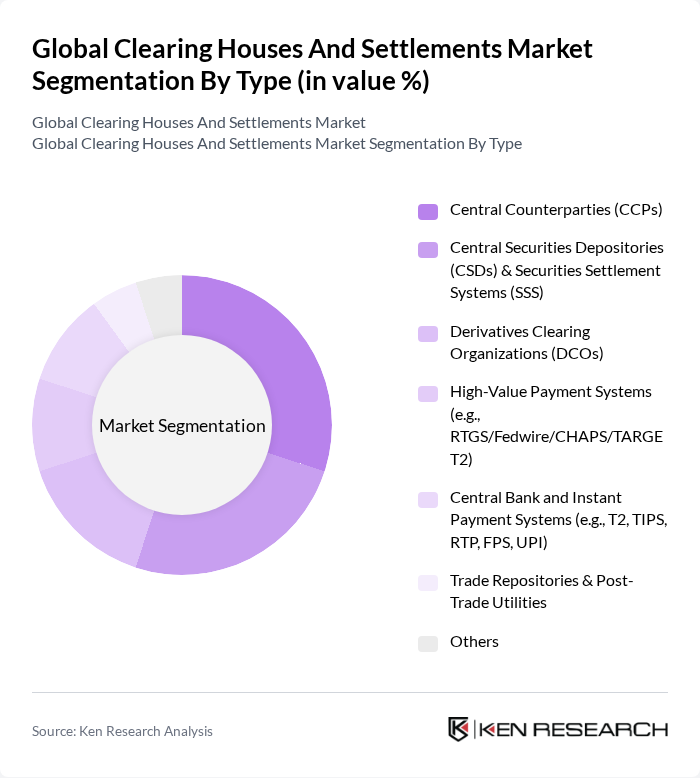

| By Type | Central Counterparties (CCPs) Central Securities Depositories (CSDs) & Securities Settlement Systems (SSS) Derivatives Clearing Organizations (DCOs) High-Value Payment Systems (e.g., RTGS/Fedwire/CHAPS/TARGET2) Central Bank and Instant Payment Systems (e.g., T2, TIPS, RTP, FPS, UPI) Trade Repositories & Post-Trade Utilities Others |

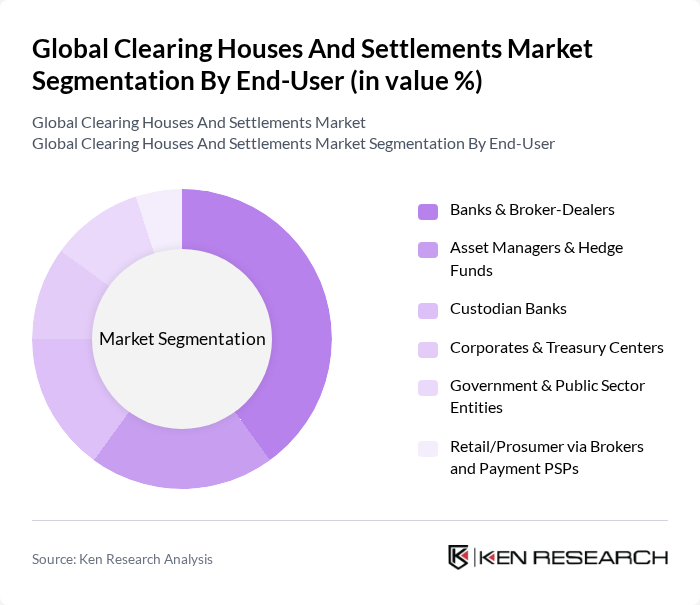

| By End-User | Banks & Broker-Dealers Asset Managers & Hedge Funds Custodian Banks Corporates & Treasury Centers Government & Public Sector Entities Retail/Prosumer via Brokers and Payment PSPs |

| By Service Type | Clearing & Novation Settlement & Central Securities Depository Services Collateral, Margin & Risk Management Netting, Liquidity & Treasury Services Corporate Actions, Asset Servicing & Reconciliation Data, Reporting (e.g., EMIR/SFTR) & Connectivity Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Transaction Type | Equities Fixed Income (Govt & Corporate Bonds, Repos) Exchange-Traded Derivatives (ETD) Over-the-Counter (OTC) Derivatives Foreign Exchange & Payments Commodities Others |

| By Settlement Method | Real-Time Gross Settlement (RTGS) Deferred Net Settlement (DNS) Delivery versus Payment (DvP) Models 1/2/3 Payment versus Payment (PvP) & CLS Instant/Faster Payments Others |

| By Regulatory Framework | CPMI-IOSCO Principles for Financial Market Infrastructures (PFMI) EMIR/EMIR Refit (EU) and UK EMIR Dodd-Frank (Title VII), CFTC/SEC Clearing Mandates (US) MiFIR/MiFID II, CSDR, and SFTR Regional Payments Directives (e.g., PSD2/PSD3, UPI, NPP, FedNow) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global Clearing House Operations | 140 | Chief Operating Officers, Risk Management Executives |

| Settlement Systems in Banking | 100 | Settlement Managers, Compliance Officers |

| Technological Innovations in Clearing | 80 | IT Directors, Fintech Innovators |

| Regulatory Impact on Clearing Houses | 70 | Regulatory Affairs Specialists, Legal Advisors |

| Market Trends in Financial Transactions | 90 | Market Analysts, Financial Consultants |

The Global Clearing Houses and Settlements Market is valued at approximately USD 11.5 billion, based on a five-year historical analysis. This valuation reflects the consolidated revenues of clearing and settlement service providers and related post-trade infrastructure.