Region:North America

Author(s):Dev

Product Code:KRAA1479

Pages:91

Published On:August 2025

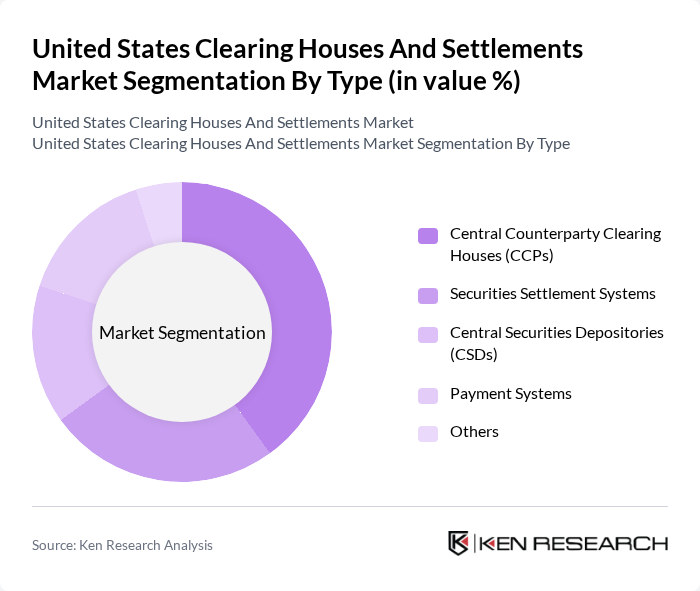

By Type:

The Central Counterparty Clearing Houses (CCPs) segment is dominating the market due to their critical role in mitigating counterparty risk in financial transactions. CCPs act as intermediaries between buyers and sellers, ensuring that trades are settled efficiently and securely. The increasing complexity of financial products and the growing volume of derivatives trading have further solidified the importance of CCPs in the market. Their ability to provide risk management services and enhance market stability makes them a preferred choice for financial institutions.

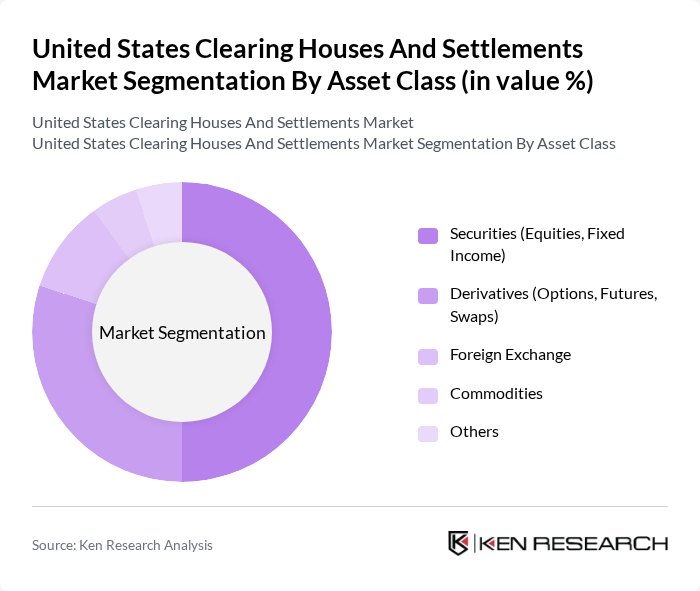

By Asset Class:

The Securities (Equities, Fixed Income) segment leads the market, driven by the high volume of trading activities in stock and bond markets. The demand for clearing and settlement services in this asset class is fueled by the increasing participation of institutional investors and retail traders. Additionally, the rise of electronic trading platforms and real-time payment technologies has accelerated transaction volumes, necessitating efficient clearing solutions to manage the associated risks effectively.

The United States Clearing Houses And Settlements Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Depository Trust & Clearing Corporation (DTCC), National Securities Clearing Corporation (NSCC), Fixed Income Clearing Corporation (FICC), Options Clearing Corporation (OCC), Chicago Mercantile Exchange (CME Group), Intercontinental Exchange (ICE), Cboe Global Markets, New York Stock Exchange (NYSE), NASDAQ, Miami International Holdings (MIAX), Bank of New York Mellon, State Street Corporation, Citigroup Inc., JPMorgan Chase & Co., Goldman Sachs Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. clearing houses and settlements market is poised for transformation, driven by technological advancements and evolving regulatory landscapes. As firms increasingly adopt blockchain technology, transaction transparency and efficiency are expected to improve significantly. Additionally, the rise of digital currencies will likely reshape traditional settlement processes, necessitating adaptations in existing frameworks. The focus on sustainability will also influence operational practices, pushing firms to adopt greener technologies and practices, ultimately enhancing their competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Counterparty Clearing Houses (CCPs) Securities Settlement Systems Central Securities Depositories (CSDs) Payment Systems Others |

| By Asset Class | Securities (Equities, Fixed Income) Derivatives (Options, Futures, Swaps) Foreign Exchange Commodities Others |

| By End-User | Financial Institutions Corporations Government Entities Retail Investors Others |

| By Service Type | Transaction Processing Risk Management Services Compliance Services Reporting Services Others |

| By Transaction Type | Equity Transactions Derivative Transactions Fixed Income Transactions Foreign Exchange Transactions Others |

| By Settlement Method | Real-Time Gross Settlement (RTGS) Deferred Net Settlement (DNS) Continuous Linked Settlement (CLS) Others |

| By Geographic Coverage | National Coverage Regional Coverage International Coverage Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Clearing Services | 100 | Clearing House Executives, Equity Traders |

| Fixed Income Settlement Processes | 70 | Bond Market Analysts, Settlement Managers |

| Derivatives Clearing Operations | 60 | Risk Management Officers, Derivatives Traders |

| Digital Asset Settlement | 50 | Blockchain Specialists, Compliance Officers |

| Cross-Border Settlement Services | 80 | International Trade Analysts, Financial Regulators |

The United States Clearing Houses and Settlements Market is valued at approximately USD 6.5 billion, reflecting a significant growth driven by the increasing adoption of electronic payments and the rising complexity of financial instruments.