Region:Global

Author(s):Shubham

Product Code:KRAD6594

Pages:83

Published On:December 2025

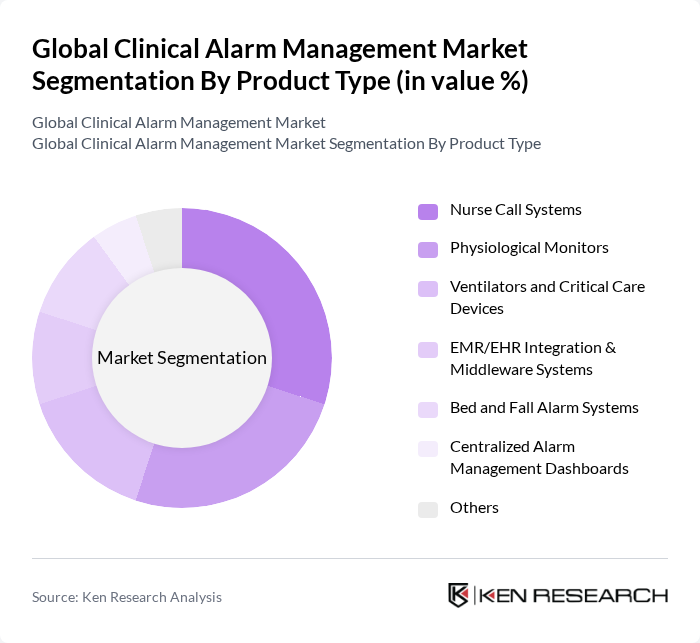

By Product Type:The product type segmentation includes various systems and devices that are essential for effective clinical alarm management. The subsegments are Nurse Call Systems, Physiological Monitors, Ventilators and Critical Care Devices, EMR/EHR Integration & Middleware Systems, Bed and Fall Alarm Systems, Centralized Alarm Management Dashboards, and Others. Among these, Nurse Call Systems are leading the market due to their critical role in facilitating communication between patients and healthcare providers, ensuring timely responses to patient needs.

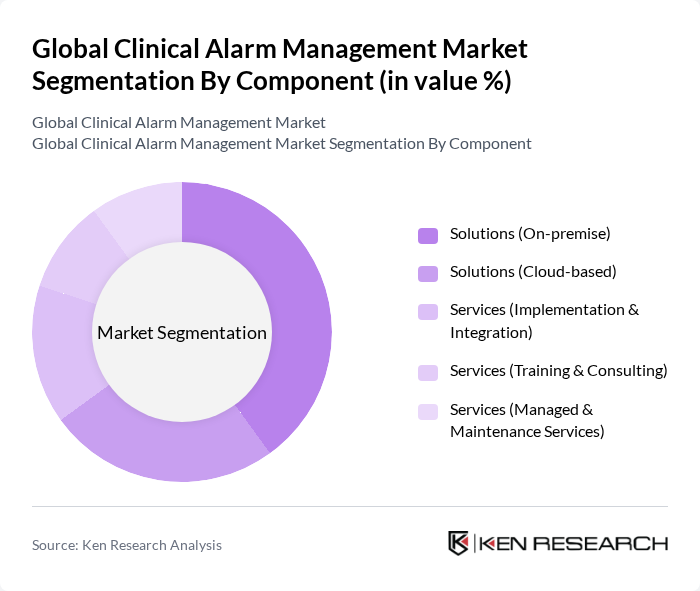

By Component:The component segmentation encompasses solutions and services that support clinical alarm management. This includes Solutions (On-premise), Solutions (Cloud-based), Services (Implementation & Integration), Services (Training & Consulting), and Services (Managed & Maintenance Services). The Solutions (On-premise) subsegment is currently dominating the market, as many healthcare facilities prefer on-premise solutions for better control over their data and systems, ensuring compliance with regulatory standards.

The Global Clinical Alarm Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koninklijke Philips N.V. (Philips Healthcare), GE HealthCare Technologies Inc., Drägerwerk AG & Co. KGaA, Ascom Holding AG, Spok Holdings, Inc., Vocera Communications LLC (Stryker Corporation), Hillrom (Baxter International Inc.), Spacelabs Healthcare (OSI Systems, Inc.), Capsule Technologies, Inc. (a Royal Philips company), Masimo Corporation, Nihon Kohden Corporation, Cerner Corporation (Oracle Health), Tunstall Healthcare Group, Koninklijke N.V. (Ascom–Philips Joint Deployments), Connexall (Globestar Systems Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of clinical alarm management in future is poised for significant transformation, driven by technological advancements and an increasing emphasis on patient safety. As healthcare facilities adopt centralized alarm management systems and integrate them with electronic health records, the efficiency of alarm responses will improve. Additionally, the rise of telehealth and remote monitoring will further enhance alarm management capabilities, allowing for real-time patient monitoring and timely interventions, ultimately leading to better patient outcomes and reduced healthcare costs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Nurse Call Systems Physiological Monitors Ventilators and Critical Care Devices EMR/EHR Integration & Middleware Systems Bed and Fall Alarm Systems Centralized Alarm Management Dashboards Others |

| By Component | Solutions (On?premise) Solutions (Cloud-based) Services (Implementation & Integration) Services (Training & Consulting) Services (Managed & Maintenance Services) |

| By End-User | Hospitals & Clinics Specialty & Intensive Care Centers Long-term Care Facilities Home Care Settings Ambulatory Care Centers Others |

| By Deployment Mode | On-premise Deployment Cloud-based Deployment Hybrid Deployment |

| By Application | Cardiac Monitoring Alarms Respiratory Monitoring Alarms Neurological Monitoring Alarms Maternal and Fetal Monitoring Alarms General Ward & Step-down Unit Alarms Telemetry & Remote Patient Monitoring Alarms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Facility Ownership | Public Healthcare Facilities Private Healthcare Facilities Government & Veterans Healthcare Institutions Non-profit Healthcare Organizations Others |

| By Service Type | Installation & Deployment Services Integration with Existing Healthcare IT Systems Maintenance & Support Services Training & Education Services Consulting & Workflow Optimization Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Alarm Management Practices | 120 | Clinical Engineers, Alarm Management Coordinators |

| Alarm Fatigue in Nursing Staff | 100 | Nurses, Charge Nurses, Nurse Managers |

| Regulatory Compliance in Alarm Systems | 80 | Healthcare Administrators, Compliance Officers |

| Technological Innovations in Alarm Systems | 70 | IT Managers, Biomedical Engineers |

| Patient Safety and Alarm Effectiveness | 90 | Patient Safety Officers, Quality Improvement Managers |

The Global Clinical Alarm Management Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by the increasing need for patient safety, chronic disease prevalence, and the adoption of advanced healthcare technologies.