Region:Global

Author(s):Geetanshi

Product Code:KRAA1263

Pages:88

Published On:August 2025

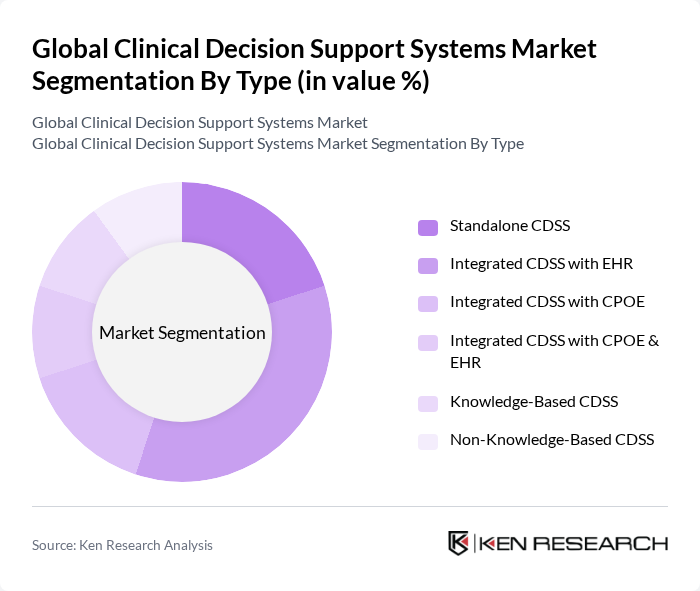

By Type:

TheIntegrated CDSS with EHRsegment is dominating the market due to the increasing integration of clinical decision support systems with electronic health records. This integration enhances the efficiency of healthcare delivery by providing real-time data and alerts to healthcare professionals, thereby improving patient safety and outcomes. The growing trend towards value-based care and the need for comprehensive patient data management further support the dominance of this segment.

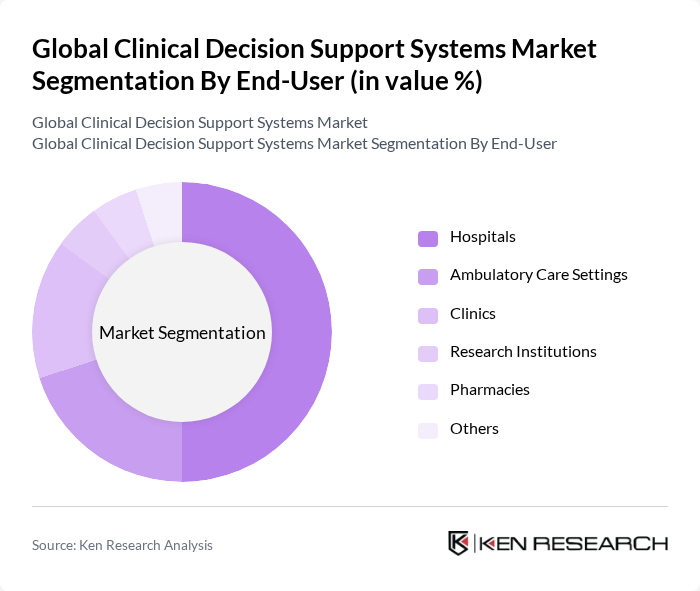

By End-User:

Hospitalsare the leading end-user segment, accounting for a significant share of the market. This dominance is driven by the increasing complexity of patient care and the need for efficient decision-making tools to enhance clinical outcomes. Hospitals are increasingly adopting CDSS to streamline workflows, reduce errors, and improve patient safety, which further solidifies their position as the primary end-user in the market.

The Global Clinical Decision Support Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Health (formerly Cerner Corporation), Allscripts Healthcare Solutions, Inc. (now Veradigm Inc.), McKesson Corporation, Philips Healthcare (Koninklijke Philips N.V.), IBM Watson Health (now Merative), Siemens Healthineers, athenahealth, Inc., GE HealthCare, Optum, Inc. (UnitedHealth Group), NextGen Healthcare, Inc., Wolters Kluwer N.V., Nuance Communications, Inc. (Microsoft), Zynx Health (Hearst Health), eClinicalWorks LLC, Agfa-Gevaert Group, Becton, Dickinson and Company (BD), Cabot Technology Solutions, Nordic Consulting Partners, Inc., BeeKeeperAI contribute to innovation, geographic expansion, and service delivery in this space.

The future of clinical decision support systems is poised for transformative growth, driven by technological advancements and evolving healthcare needs. As healthcare providers increasingly prioritize patient-centric care, the integration of CDSS with telehealth and mobile health applications will enhance accessibility and improve patient engagement. Furthermore, the ongoing development of AI and machine learning capabilities will enable more accurate predictive analytics, fostering better clinical outcomes and operational efficiencies across healthcare systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Standalone CDSS Integrated CDSS with EHR Integrated CDSS with CPOE Integrated CDSS with CPOE & EHR Knowledge-Based CDSS Non-Knowledge-Based CDSS |

| By End-User | Hospitals Ambulatory Care Settings Clinics Research Institutions Pharmacies Others |

| By Component | Software Hardware Services |

| By Application | Drug-Drug Interaction Alerts Drug Allergy Alerts Clinical Reminders Clinical Guidelines Drug Dosing Support Diagnostic Support Treatment Recommendations Clinical Workflow Optimization Others |

| By Deployment Mode | On-Premise Deployment Web-Based Deployment Cloud-Based Deployment |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital CDSS Implementation | 120 | IT Directors, Clinical Informatics Specialists |

| Ambulatory Care CDSS Usage | 90 | Primary Care Physicians, Nurse Practitioners |

| Telehealth CDSS Integration | 60 | Telehealth Coordinators, Health IT Managers |

| Pharmacy Decision Support Systems | 50 | Pharmacists, Pharmacy Managers |

| Clinical Research CDSS Applications | 40 | Clinical Researchers, Data Analysts |

The Global Clinical Decision Support Systems Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by the adoption of electronic health records, improved patient outcomes, and advancements in personalized medicine and technology integration.