Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9409

Pages:88

Published On:November 2025

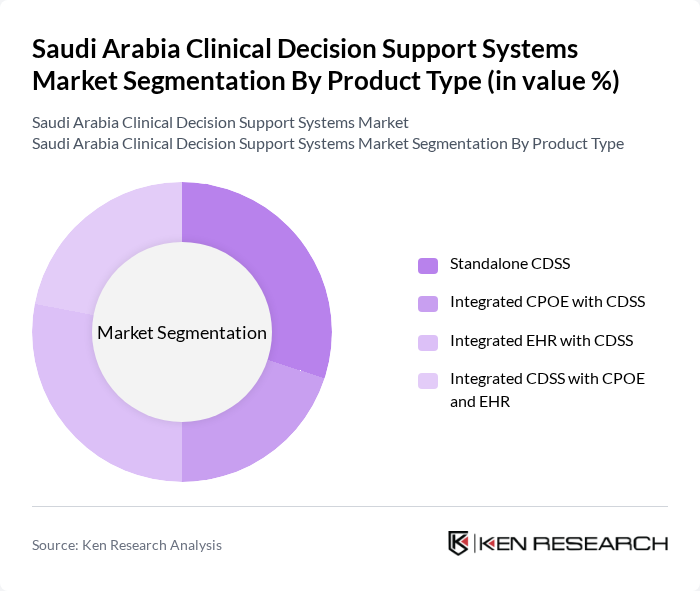

By Product Type:The product type segmentation includes Standalone CDSS, Integrated CPOE with CDSS, Integrated EHR with CDSS, and Integrated CDSS with CPOE and EHR. Among these, Standalone CDSS currently holds the largest market share, attributed to its established deployment in major hospitals and ease of implementation. However, Integrated EHR with CDSS is the fastest-growing subsegment, driven by the increasing demand for seamless clinical workflows and enhanced interoperability between decision support and patient records .

By Technology:The technology segmentation encompasses Rule-based Systems, Knowledge-based Systems, Machine Learning Systems, and Others. Rule-based Systems remain the leading subsegment due to their reliability, regulatory acceptance, and proven ability to reduce medication errors. However, Machine Learning Systems are gaining traction, supported by increased investments in AI-driven clinical analytics and predictive modeling in Saudi healthcare .

The Saudi Arabia Clinical Decision Support Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation (Oracle Health), Epic Systems Corporation, Philips Healthcare, Siemens Healthineers, GE Healthcare, Dedalus Group, InterSystems Corporation, Allscripts Healthcare Solutions (now Altera Digital Health), IBM Watson Health (Merative), Health Insights (Saudi Arabia), Lean Business Services (Saudi Arabia), Elsevier, Wolters Kluwer (UpToDate, Medi-Span), Zynx Health, and eClinicalWorks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clinical decision support systems market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence and machine learning into CDSS is expected to enhance diagnostic accuracy and treatment personalization. Furthermore, the government's commitment to digital health transformation will likely foster an environment conducive to innovation, enabling healthcare providers to leverage these systems effectively for improved patient outcomes and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Standalone CDSS Integrated CPOE with CDSS Integrated EHR with CDSS Integrated CDSS with CPOE and EHR |

| By Technology | Rule-based Systems Knowledge-based Systems Machine Learning Systems Others |

| By Application | Diagnostic Support Treatment Recommendations Clinical Workflow Optimization Medication Error Prevention Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By End-User | Hospitals Clinics Research Institutions Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital CDSS Implementation | 45 | IT Managers, Clinical Directors |

| Primary Care CDSS Usage | 38 | General Practitioners, Family Medicine Specialists |

| Specialty Clinics CDSS Adoption | 32 | Specialist Physicians, Clinic Administrators |

| Health Insurance CDSS Integration | 25 | Policy Analysts, Claims Managers |

| Regulatory Perspectives on CDSS | 20 | Healthcare Regulators, Compliance Officers |

The Saudi Arabia Clinical Decision Support Systems market is valued at approximately USD 30 million, reflecting significant growth driven by the adoption of digital health technologies and government investments in healthcare IT infrastructure.