Region:Global

Author(s):Dev

Product Code:KRAC4804

Pages:94

Published On:October 2025

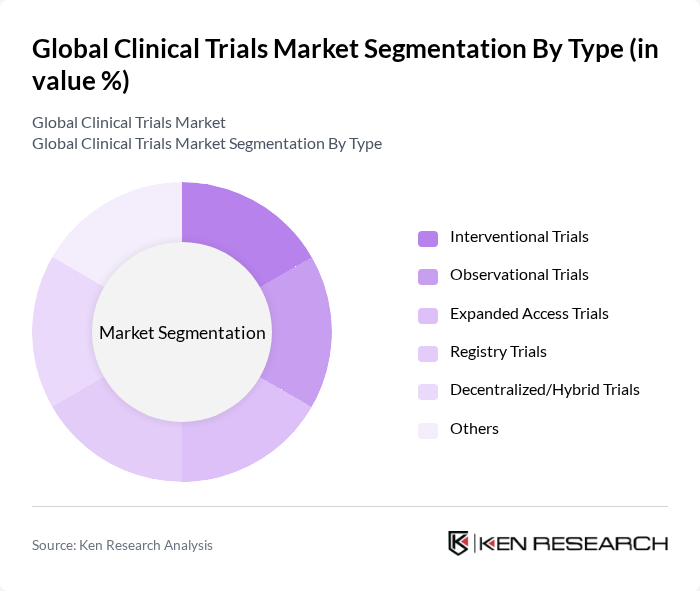

By Type:The clinical trials market is segmented into various types, including interventional trials, observational trials, expanded access trials, registry trials, decentralized/hybrid trials, and others. Interventional trials are the most prominent, as they involve the active intervention of researchers to test new treatments or drugs. Observational trials follow closely, focusing on collecting data without intervention. The rise of decentralized and hybrid trials is notable, driven by digital health technologies, remote patient monitoring, and the need for more patient-centric and accessible research models .

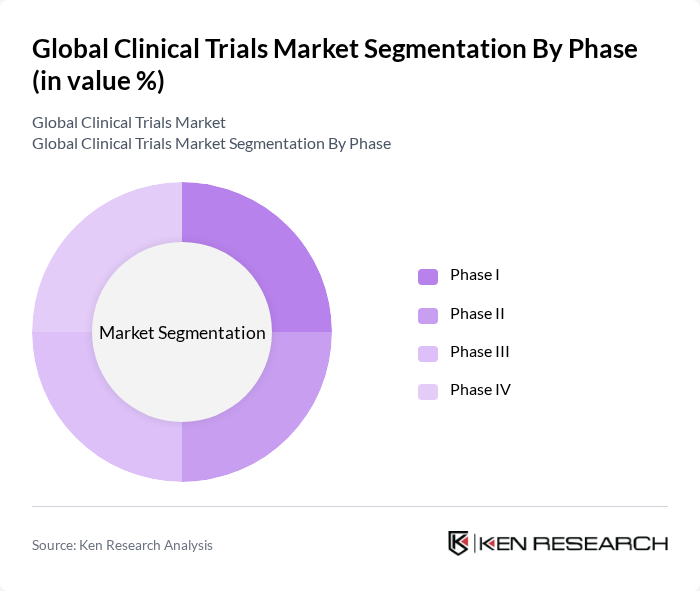

By Phase:The market is also categorized by phases, including Phase I, Phase II, Phase III, and Phase IV trials. Phase III trials dominate the market due to their critical role in determining the efficacy and safety of new treatments before they receive regulatory approval. Phase I and II trials are essential for initial safety assessments and dosage determination, while Phase IV trials are conducted post-marketing to monitor long-term effects. The distribution reflects the high cost and complexity of Phase III trials, which typically involve the largest patient populations and most rigorous protocols .

The Global Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Novartis AG, Roche Holding AG, Merck & Co., Inc., AstraZeneca PLC, GSK (GlaxoSmithKline) PLC, Sanofi S.A., Eli Lilly and Company, Amgen Inc., Biogen Inc., AbbVie Inc., Bayer AG, Takeda Pharmaceutical Company Limited, Vertex Pharmaceuticals Incorporated, IQVIA Holdings Inc., ICON plc, Syneos Health, Inc., Labcorp Drug Development (formerly Covance), Parexel International Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clinical trials market appears promising, driven by ongoing advancements in technology and a growing emphasis on patient-centric approaches. As regulatory bodies adapt to new methodologies, the integration of real-world evidence will become increasingly important. Additionally, the rise of decentralized trials is expected to enhance patient participation and streamline processes, ultimately leading to more efficient drug development. These trends will likely shape the landscape of clinical research in the coming years, fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Interventional Trials Observational Trials Expanded Access Trials Registry Trials Decentralized/Hybrid Trials Others |

| By Phase | Phase I Phase II Phase III Phase IV |

| By Indication | Oncology Cardiovascular Diseases Neurological Disorders Infectious Diseases Autoimmune Diseases Diabetes & Metabolic Disorders Rare Diseases Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sponsor Type | Pharmaceutical Companies Biotechnology Firms Academic Institutions Contract Research Organizations (CROs) Government Organizations |

| By Study Design | Randomized Controlled Trials Non-Randomized Trials Cross-Sectional Studies Cohort Studies |

| By Funding Source | Public Funding Private Funding Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 120 | Clinical Trial Managers, Oncologists |

| Cardiovascular Studies | 90 | Cardiologists, Research Coordinators |

| Neurology Trials | 70 | Neurologists, Clinical Research Associates |

| Pediatric Clinical Trials | 50 | Pediatricians, Clinical Trial Investigators |

| Rare Disease Research | 40 | Rare Disease Specialists, Patient Advocacy Representatives |

The Global Clinical Trials Market is valued at approximately USD 85 billion, driven by increasing demand for innovative therapies, advancements in technology, and rising prevalence of chronic diseases. This valuation is based on a comprehensive five-year historical analysis.