Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2345

Pages:82

Published On:October 2025

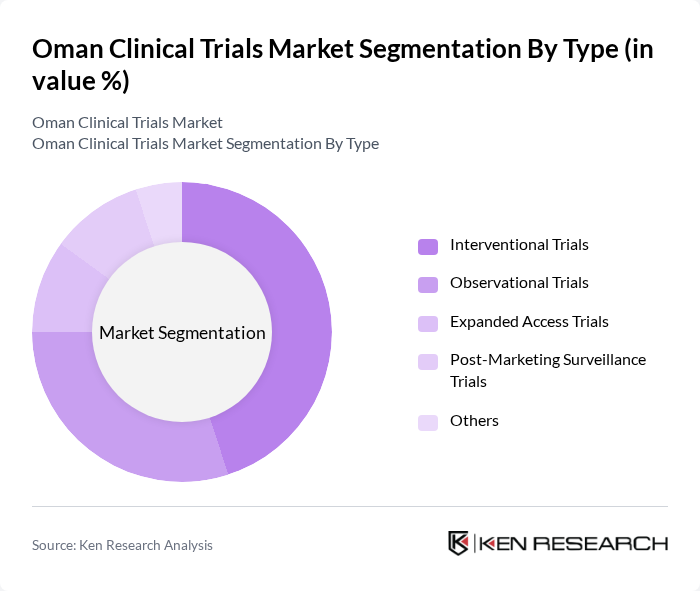

By Type:The market is segmented into various types of clinical trials, including interventional trials, observational trials, expanded access trials, post-marketing surveillance trials, and others. Interventional trials are currently the most dominant segment due to the increasing number of new drug developments and the need for rigorous testing before market approval. Observational trials are also gaining traction as they provide valuable data on drug effectiveness in real-world settings.

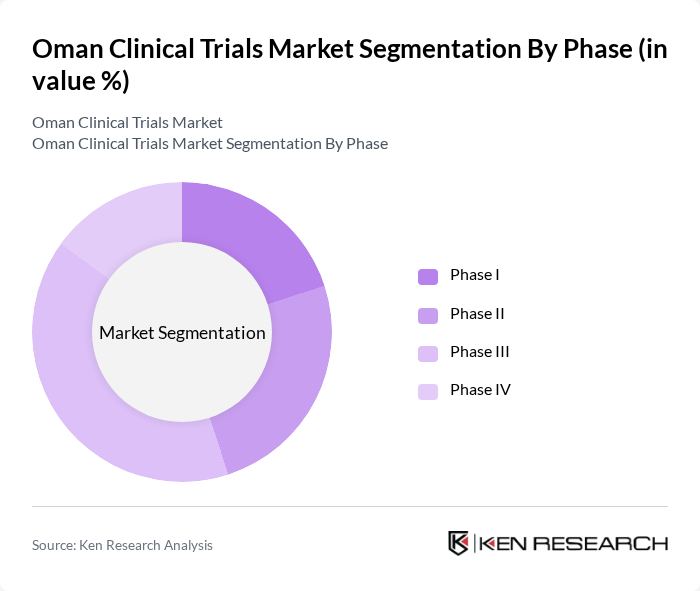

By Phase:The clinical trials market is categorized into different phases, including Phase I, Phase II, Phase III, and Phase IV. Phase III trials dominate the market as they are crucial for determining the efficacy and safety of new treatments before they receive regulatory approval. The increasing number of pharmaceutical companies conducting Phase III trials in Oman is a significant factor contributing to this segment's growth.

The Oman Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Medical Specialty Centre, Sultan Qaboos University Hospital, Muscat Private Hospital, Al Nahda Hospital, Aster DM Healthcare, Gulf Medical University, Oman Pharmaceutical Products Co. LLC, Al Hayat International Hospital, Badr Al Samaa Group of Hospitals, Dhofar University, Oman Medical Association, Muscat University, Oman Clinical Research Institute, Al Noor Hospital, Oman Health Services contribute to innovation, geographic expansion, and service delivery in this space.

The Oman clinical trials market is poised for significant growth, driven by increasing healthcare investments and a rising burden of chronic diseases. As the government continues to enhance regulatory frameworks and infrastructure, the market will likely attract more international collaborations. Additionally, the integration of digital technologies and patient-centric approaches will reshape trial methodologies, making them more efficient and accessible. These trends indicate a promising future for clinical research in Oman, fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Interventional Trials Observational Trials Expanded Access Trials Post-Marketing Surveillance Trials Others |

| By Phase | Phase I Phase II Phase III Phase IV |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Diabetes Obesity Others |

| By Sponsor Type | Pharmaceutical Companies Biotechnology Firms Academic Institutions Government Agencies |

| By Patient Population | Adult Patients Pediatric Patients Geriatric Patients |

| By Study Design | Randomized Controlled Trials Non-Randomized Trials Cross-Sectional Studies |

| By Funding Source | Public Funding Private Funding Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 100 | Oncologists, Clinical Research Associates |

| Cardiovascular Studies | 80 | Cardiologists, Trial Coordinators |

| Diabetes Management Trials | 70 | Endocrinologists, Research Nurses |

| Pediatric Clinical Trials | 60 | Pediatricians, Clinical Trial Managers |

| Neurology Research Initiatives | 90 | Neurologists, Regulatory Affairs Specialists |

The Oman Clinical Trials Market is valued at approximately USD 100 million, reflecting a robust growth trajectory driven by increased healthcare investments, a rise in chronic diseases, and a focus on pharmaceutical research and development.