Region:Global

Author(s):Rebecca

Product Code:KRAA2927

Pages:90

Published On:August 2025

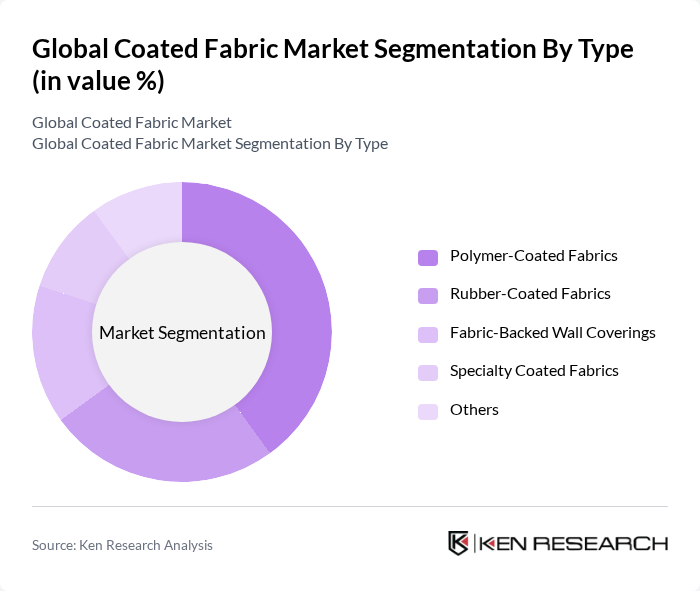

By Type:The market is segmented into various types of coated fabrics, including Polymer-Coated Fabrics, Rubber-Coated Fabrics, Fabric-Backed Wall Coverings, Specialty Coated Fabrics, and Others. Among these, Polymer-Coated Fabrics are leading the market due to their versatility, enhanced durability, and wide range of applications across industries. The increasing demand for lightweight, high-strength, and weather-resistant materials in automotive, construction, and protective clothing sectors is driving the growth of this segment. Advancements in polymer technology—such as UV resistance, flame retardancy, and chemical resistance—are further expanding the applicability of polymer-coated fabrics .

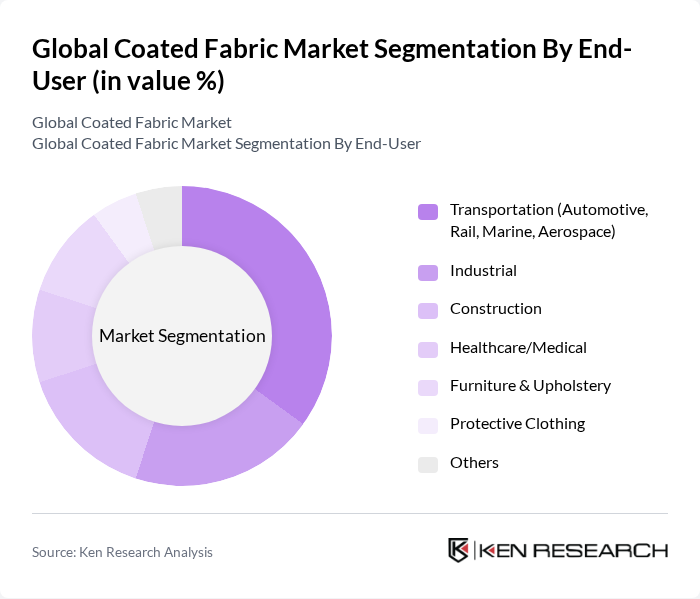

By End-User:The end-user segmentation includes Transportation (Automotive, Rail, Marine, Aerospace), Industrial, Construction, Healthcare/Medical, Furniture & Upholstery, Protective Clothing, and Others. The Transportation sector is the dominant end-user, driven by the increasing production of vehicles and the need for durable, weather-resistant, and lightweight materials for improved fuel efficiency. The automotive industry's shift towards sustainable and high-performance interior materials, as well as the growing use of coated fabrics in airbags, seat covers, and convertible tops, further boosts demand. Industrial and construction sectors are also witnessing robust growth due to the adoption of coated fabrics in conveyor belts, roofing membranes, and protective barriers .

The Global Coated Fabric Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Saint-Gobain S.A., 3M Company, Sioen Industries N.V., Continental AG, Cooley Group Holdings, Inc., Glen Raven, Inc., Herculite Products, Inc., Miller Weldmaster Corporation, Trelleborg AB, Ahlstrom-Munksjö Oyj, Serge Ferrari Group S.A.S., Spradling International, Inc., OMNOVA Solutions Inc. (a Synthomer company), Seaman Corporation, BASF SE, H.B. Fuller Company, Graniteville Specialty Fabrics, Mauritzon, Inc., and Regatta Professional contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coated fabric market appears promising, driven by increasing demand for sustainable and high-performance materials. As industries continue to prioritize eco-friendly solutions, innovations in coating technologies will likely play a crucial role in shaping product offerings. Additionally, the expansion of e-commerce platforms is expected to enhance market accessibility, allowing manufacturers to reach a broader customer base. This evolving landscape will create new opportunities for growth and diversification within the coated fabric sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer-Coated Fabrics Rubber-Coated Fabrics Fabric-Backed Wall Coverings Specialty Coated Fabrics Others |

| By End-User | Transportation (Automotive, Rail, Marine, Aerospace) Industrial Construction Healthcare/Medical Furniture & Upholstery Protective Clothing Others |

| By Application | Upholstery & Seating Protective Clothing Tarpaulins & Covers Roofing, Awnings & Canopies Wall Coverings Tents & Outdoor Equipment Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Economy Mid-Range Premium |

| By Coating Type | Water-Resistant Coatings Fire-Resistant Coatings UV-Resistant Coatings Anti-Microbial Coatings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coated Fabrics | 60 | Product Managers, Design Engineers |

| Industrial Applications | 50 | Operations Managers, Procurement Specialists |

| Consumer Goods Sector | 40 | Brand Managers, Product Development Teams |

| Construction and Infrastructure | 40 | Project Managers, Material Engineers |

| Textile and Fashion Industry | 50 | Fashion Designers, Supply Chain Managers |

The Global Coated Fabric Market is valued at approximately USD 24 billion, driven by increasing demand across various sectors such as automotive, construction, healthcare, and defense, highlighting the importance of coated fabrics in modern applications.