Region:Asia

Author(s):Geetanshi

Product Code:KRAD1143

Pages:91

Published On:November 2025

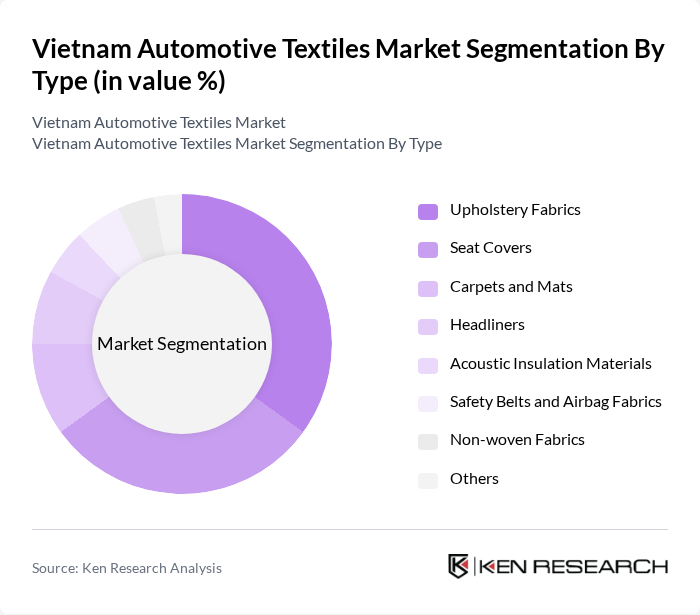

By Type:The market is segmented into various types of automotive textiles, including upholstery fabrics, seat covers, carpets and mats, headliners, acoustic insulation materials, safety belts and airbag fabrics, non-woven fabrics, and others. Among these, upholstery fabrics and seat covers remain the most dominant segments, driven by the growing demand for premium vehicle interiors, enhanced comfort, and customized aesthetics. The adoption of innovative materials such as recycled polyester, organic cotton, and technical fabrics is further fueling demand in these subsegments.

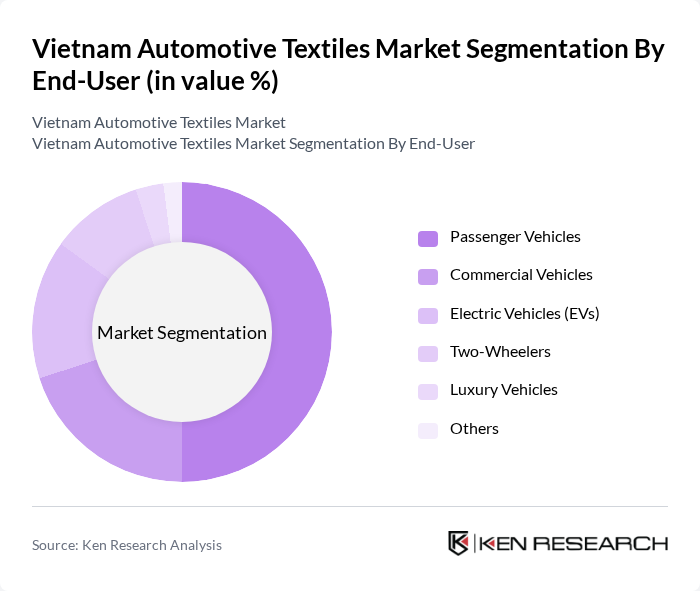

By End-User:The automotive textiles market is segmented by end-user into passenger vehicles, commercial vehicles, electric vehicles (EVs), two-wheelers, luxury vehicles, and others. The passenger vehicles segment holds the largest share, supported by robust vehicle registration growth and consumer preference for enhanced comfort and style. The expanding electric vehicle market is also driving demand for lightweight, sustainable, and high-performance textile solutions tailored for EV interiors.

The Vietnam Automotive Textiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as VinFast Trading and Production LLC, Freudenberg Performance Materials, Adient plc, Lear Corporation, Faurecia (FORVIA Group), Toyota Boshoku Corporation, Ahlstrom-Munksjö Oyj, Suminoe Textile Co., Ltd., Haining Tiansheng Textile Co., Ltd., Dongguan Huasheng Textile Co., Ltd., Jiangsu Guotai International Group, Zhejiang Huafon Spandex Co., Ltd., Shandong Jinfeng Textile Co., Ltd., Huafon Group, Vinatex (Vietnam National Textile and Garment Group), Thanh Cong Textile Garment Investment Trading JSC (TCM), TNG Investment and Trading JSC, Phong Phu Corporation, Saitex International Dong Nai (Vietnam) Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam automotive textiles market appears promising, driven by increasing consumer demand for customization and sustainability. As the automotive sector continues to expand, with production expected to reach 520,000 units in the future, the textiles market will likely experience parallel growth. Innovations in smart textiles and eco-friendly materials will further shape the industry landscape, providing opportunities for manufacturers to differentiate themselves and meet evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Upholstery Fabrics Seat Covers Carpets and Mats Headliners Acoustic Insulation Materials Safety Belts and Airbag Fabrics Non-woven Fabrics Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) Two-Wheelers Luxury Vehicles Others |

| By Vehicle Type | Sedans SUVs Trucks Buses Vans Others |

| By Material Type | Natural Fibers (Cotton, Wool, Jute) Synthetic Fibers (Polyester, Nylon 6, Nylon 66, Polypropylene) Blended Fabrics Vinyl & PVC Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers OEM Supply Agreements Others |

| By Application | Interior Applications (Seats, Door Panels, Roof Liners) Exterior Applications (Convertible Tops, Tire Cord, Trunk Liners) Safety Applications (Airbags, Seatbelts) Acoustic & Thermal Insulation Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Local Content Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 60 | Procurement Managers, Product Development Engineers |

| Textile Manufacturers | 50 | Production Managers, Quality Control Specialists |

| Automotive Aftermarket Suppliers | 40 | Sales Directors, Supply Chain Managers |

| Industry Experts and Consultants | 40 | Market Analysts, Textile Engineers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

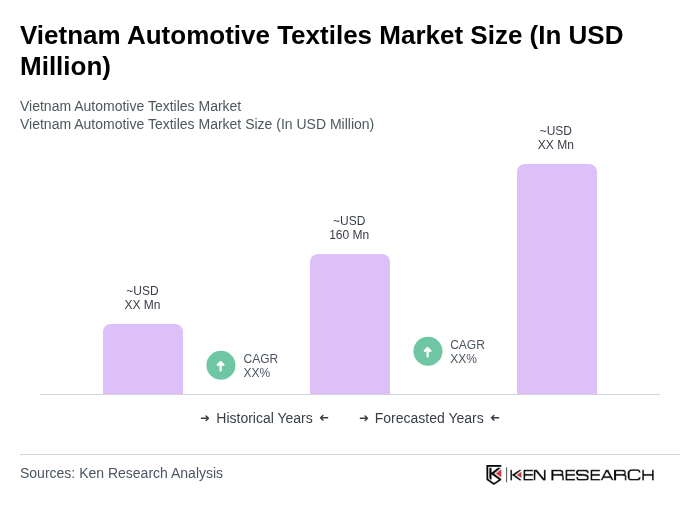

The Vietnam Automotive Textiles Market is valued at approximately USD 160 million, driven by the increasing demand for passenger and commercial vehicles, enhanced vehicle interior comfort, and the adoption of advanced technical fabrics.