Region:Global

Author(s):Dev

Product Code:KRAC0544

Pages:87

Published On:August 2025

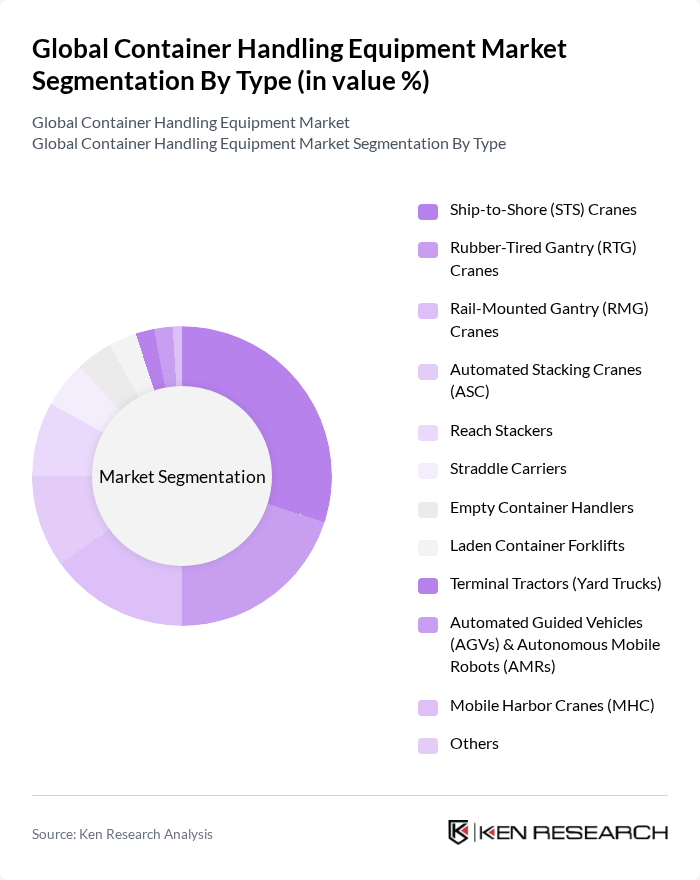

By Type:The container handling equipment market is segmented into various types, including Ship-to-Shore (STS) Cranes, Rubber-Tired Gantry (RTG) Cranes, Rail-Mounted Gantry (RMG) Cranes, Automated Stacking Cranes (ASC), Reach Stackers, Straddle Carriers, Empty Container Handlers, Laden Container Forklifts, Terminal Tractors (Yard Trucks), Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs), Mobile Harbor Cranes (MHC), and Others. Among these, the Ship-to-Shore (STS) Cranes segment is leading due to their critical role in loading and unloading containers from ships, which is essential for port operations.

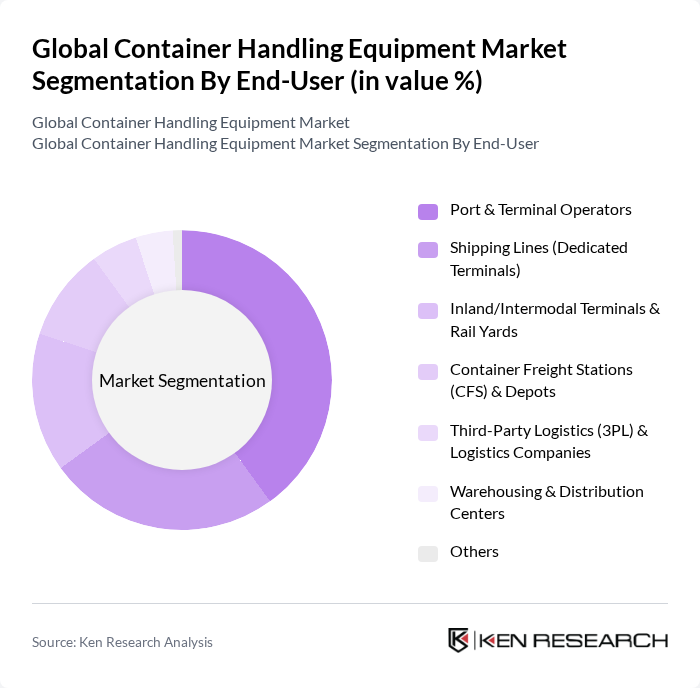

By End-User:The end-user segmentation of the container handling equipment market includes Port & Terminal Operators, Shipping Lines (Dedicated Terminals), Inland/Intermodal Terminals & Rail Yards, Container Freight Stations (CFS) & Depots, Third-Party Logistics (3PL) & Logistics Companies, Warehousing & Distribution Centers, and Others. The Port & Terminal Operators segment is the most significant, driven by the increasing volume of containerized cargo and the need for efficient handling solutions to manage the growing throughput.

The Global Container Handling Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Konecranes Plc, Liebherr Group, Kalmar (Cargotec Corporation), Hyster-Yale Materials Handling, Inc., ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.), SANY Group, Konecranes Navis (TOS & Automation), Toyota Industries Corporation, Mitsubishi Logisnext Co., Ltd., Terex Corporation, CCCC Tianjin Port Machinery (TPM), Kalmarglobal Automation (OneTerminal), Künz GmbH, Gottwald Mobile Harbor Cranes (by Konecranes), ZPMC Shanghai Electric Heavy Industry Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the container handling equipment market is poised for significant transformation, driven by ongoing technological advancements and evolving logistics demands. As e-commerce continues to expand, the need for efficient and automated handling solutions will intensify. Additionally, the integration of IoT technologies will enhance operational visibility and efficiency. Companies that invest in sustainable practices and smart port developments will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ship-to-Shore (STS) Cranes Rubber-Tired Gantry (RTG) Cranes Rail-Mounted Gantry (RMG) Cranes Automated Stacking Cranes (ASC) Reach Stackers Straddle Carriers Empty Container Handlers Laden Container Forklifts Terminal Tractors (Yard Trucks) Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs) Mobile Harbor Cranes (MHC) Others |

| By End-User | Port & Terminal Operators Shipping Lines (Dedicated Terminals) Inland/Intermodal Terminals & Rail Yards Container Freight Stations (CFS) & Depots Third-Party Logistics (3PL) & Logistics Companies Warehousing & Distribution Centers Others |

| By Application | Quay & Yard Container Handling Stacking & Storage Horizontal Transport (Yard/Intermodal Transfers) Container Loading/Unloading & Hoisting Maintenance, Repair & Retrofits Others |

| By Distribution Channel | Direct Sales (OEM to Operator) Authorized Dealers/Distributors System Integrators/EPC Online/Procurement Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Powertrain/Propulsion | Diesel Electric (Battery/Battery-Swap) Hybrid (Diesel-Electric) Hydrogen Fuel Cell Others |

| By Payload/Tonnage | Below 10 Tons –40 Tons –70 Tons –100 Tons Above 100 Tons |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Port Authority Operations | 100 | Operations Managers, Port Directors |

| Container Equipment Manufacturers | 80 | Product Development Managers, Sales Directors |

| Logistics Service Providers | 90 | Supply Chain Managers, Logistics Coordinators |

| Shipping Companies | 70 | Fleet Managers, Operations Analysts |

| Regulatory Bodies | 50 | Policy Advisors, Compliance Officers |

The Global Container Handling Equipment Market is valued at approximately USD 8 billion, driven by the increasing demand for efficient logistics and supply chain management, as well as the expansion of global trade and containerized shipping.