Region:Asia

Author(s):Rebecca

Product Code:KRAC2479

Pages:91

Published On:October 2025

By Equipment Type:The equipment type segmentation includes Reach Stackers, Forklifts, Straddle Carriers, Automated Guided Vehicles (AGVs), Container Cranes (Ship-to-Shore, Rail Mounted Gantry, Rubber Tyred Gantry), Terminal Tractors, Empty Container Handlers, and Others. Each of these subsegments is essential for efficient container movement and port operations, with automation and electrification gaining traction as ports modernize to meet rising throughput and sustainability goals .

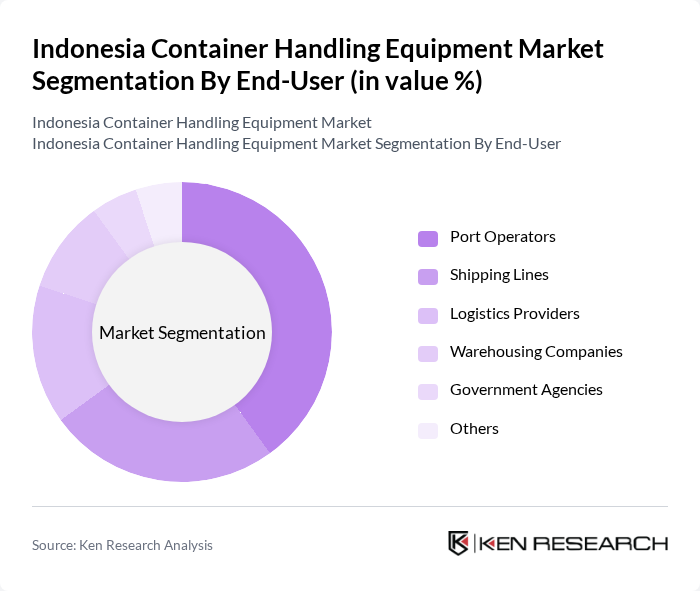

By End-User:The end-user segmentation includes Port Operators, Shipping Lines, Logistics Providers, Warehousing Companies, Government Agencies, and Others. Port operators remain the largest segment, driven by ongoing port modernization and expansion projects, while logistics providers and shipping lines are increasingly investing in advanced handling equipment to improve supply chain efficiency .

The Indonesia Container Handling Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Konecranes Oyj, Liebherr-International AG, Kalmar (Cargotec Corporation), Hyster-Yale Materials Handling Inc., Toyota Industries Corporation, Terex Corporation, Mitsubishi Logisnext Co., Ltd., Doosan Industrial Vehicle Co., Ltd., Cargotec Corporation, Hyundai Heavy Industries Co., Ltd., SANY Group Co., Ltd., XCMG Group (Xuzhou Construction Machinery Group Co., Ltd.), JCB (J.C. Bamford Excavators Limited), Manitou Group, Clark Material Handling Company, Anhui Heli Co., Ltd., Lonking Holdings Limited, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC), CVS Ferrari S.P.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indonesia container handling equipment market appears promising, driven by ongoing infrastructure investments and technological innovations. As the government continues to prioritize port development, the demand for efficient and advanced equipment will likely increase. Additionally, the integration of automation and IoT technologies will enhance operational efficiency, positioning companies to better meet the growing logistics demands. Overall, the market is set to evolve significantly, adapting to the changing landscape of global trade and logistics.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Reach Stackers Forklifts Straddle Carriers Automated Guided Vehicles (AGVs) Container Cranes (Ship-to-Shore, Rail Mounted Gantry, Rubber Tyred Gantry) Terminal Tractors Empty Container Handlers Others |

| By End-User | Port Operators Shipping Lines Logistics Providers Warehousing Companies Government Agencies Others |

| By Application | Container Loading and Unloading Stacking and Storage Transportation within Terminal Maintenance and Repair Others |

| By Propulsion Type | Diesel-powered Equipment Electric-powered Equipment Hybrid Equipment Others |

| By Tonnage Capacity | Up to 20 Tons –40 Tons –70 Tons Above 70 Tons |

| By Brand | Global Brands Local Brands Emerging Brands Others |

| By Ownership Type | Owned Equipment Leased Equipment Rented Equipment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Port Authority Operations | 100 | Port Managers, Operations Directors |

| Logistics Service Providers | 80 | Logistics Coordinators, Supply Chain Managers |

| Container Equipment Manufacturers | 60 | Product Development Managers, Sales Directors |

| Shipping Companies | 70 | Fleet Managers, Operations Analysts |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Indonesia Container Handling Equipment Market is valued at approximately USD 1.1 billion, driven by the growth of logistics, transportation sectors, and significant infrastructure investments in major ports.