Region:Global

Author(s):Geetanshi

Product Code:KRAA2766

Pages:83

Published On:August 2025

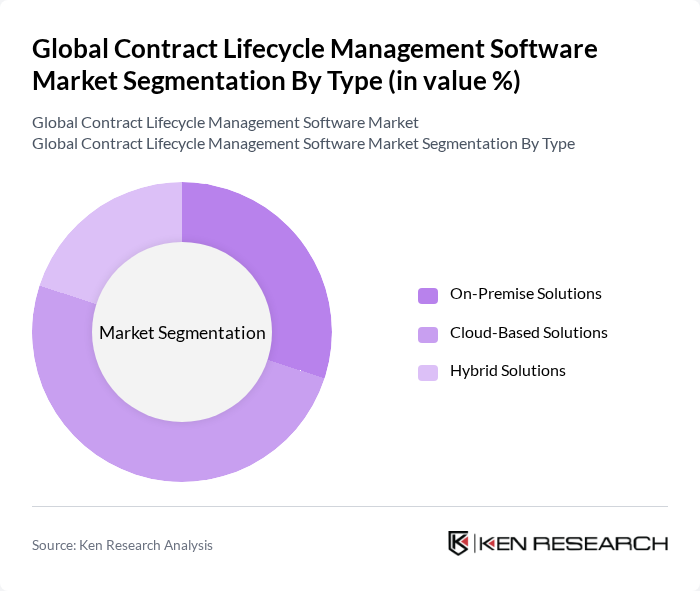

By Type:The market is segmented into On-Premise Solutions, Cloud-Based Solutions, and Hybrid Solutions. Among these, Cloud-Based Solutions are gaining significant traction due to their scalability, cost-effectiveness, and ease of access. Organizations are increasingly opting for cloud solutions to enhance collaboration, enable remote access, and streamline contract management processes. Cloud deployment allows for real-time collaboration, centralized visibility, and faster approvals, making it the preferred choice for enterprises seeking agility and operational efficiency .

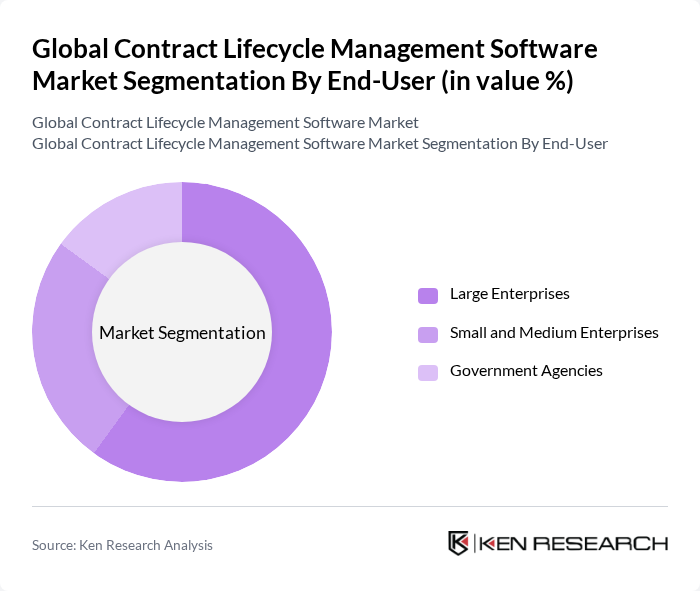

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises, and Government Agencies. Large Enterprises dominate the market due to their extensive contract management needs and the ability to invest in comprehensive software solutions. The increasing complexity and volume of contracts in large organizations necessitate advanced management tools to ensure compliance, efficiency, and risk mitigation. Small and Medium Enterprises are increasingly adopting CLM solutions to automate workflows and improve contract governance, while government agencies leverage these platforms for regulatory compliance and transparency .

The Global Contract Lifecycle Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Icertis, Coupa Software, DocuSign, Agiloft, Concord, ContractWorks, JAGGAER, Zycus, Onit, Contract Logix, SirionLabs, Oracle Corporation, Ironclad, IBM, BravoSolution, Summize, Filevine, Contracked, PandaDoc, ContractSafe, Ariba (SAP Ariba), Infor contribute to innovation, geographic expansion, and service delivery in this space.

The future of contract lifecycle management software is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly adopt cloud-based solutions, the market is expected to witness a shift towards more flexible and scalable platforms. Additionally, the integration of AI and machine learning will enhance contract analytics capabilities, enabling businesses to derive actionable insights from their contracts. This transformation will likely lead to improved compliance and risk management, positioning CLM solutions as essential tools for modern enterprises.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By End-User | Large Enterprises Small and Medium Enterprises Government Agencies |

| By Industry Vertical | Healthcare Financial Services Manufacturing Retail Pharmaceuticals IT & Telecom Government & Public Sector |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Contract Creation Contract Execution Contract Management Compliance & Risk Management Analytics & Reporting |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Contract Management | 100 | Legal Counsel, Compliance Officers |

| Financial Services CLM Solutions | 80 | Contract Managers, Risk Management Professionals |

| Manufacturing Sector Contract Lifecycle | 70 | Procurement Managers, Operations Directors |

| Technology Sector CLM Adoption | 90 | IT Managers, Software Development Leads |

| Government and Public Sector Contracts | 60 | Contract Administrators, Policy Advisors |

The Global Contract Lifecycle Management Software Market is valued at approximately USD 2.65 billion, reflecting a significant growth trend driven by the need for organizations to streamline contract processes and enhance compliance.