Region:Middle East

Author(s):Dev

Product Code:KRAC2020

Pages:84

Published On:October 2025

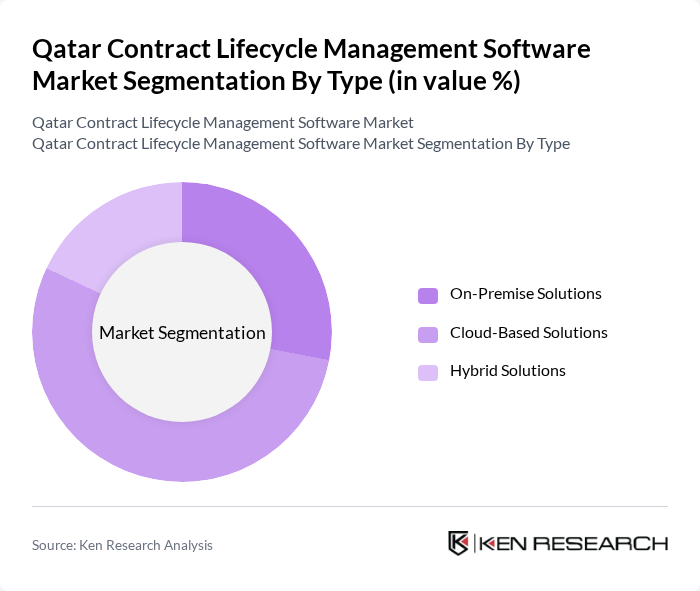

By Type:The market is segmented into three main types: On-Premise Solutions, Cloud-Based Solutions, and Hybrid Solutions. Each of these types caters to different organizational needs and preferences, with cloud-based solutions gaining significant traction due to their flexibility and cost-effectiveness. On-premise solutions remain popular among larger enterprises that prioritize data security and control.

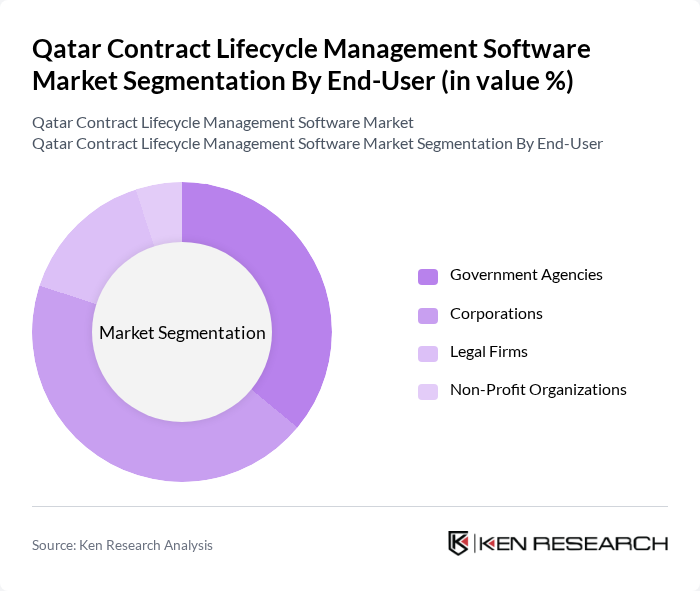

By End-User:The end-user segmentation includes Government Agencies, Corporations, Legal Firms, and Non-Profit Organizations. Government agencies are increasingly adopting contract lifecycle management software to comply with new regulations and improve operational efficiency. Corporations, particularly in sectors like construction and energy, are also significant users, driven by the need for streamlined contract processes and risk management.

The Qatar Contract Lifecycle Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Icertis, Inc., Coupa Software Incorporated, DocuSign, Inc., Agiloft, Inc., ContractWorks, Concord, JAGGAER, Zycus, SirionLabs, Contract Logix, PandaDoc, Ironclad, Inc., ContractSafe, Conga, Zoho Corporation, ContractPodAi, IBM Corporation, Adobe Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar contract lifecycle management software market appears promising, driven by ongoing digital transformation and increasing regulatory demands. As organizations prioritize efficiency and compliance, the adoption of advanced technologies such as AI and machine learning is expected to rise. Furthermore, the integration of mobile solutions will enhance accessibility and user engagement, positioning businesses to leverage contract management tools effectively in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By End-User | Government Agencies Corporations Legal Firms Non-Profit Organizations |

| By Industry | Construction Healthcare Energy Financial Services Oil & Gas Telecommunications Government/Public Sector |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Contract Creation & Authoring Contract Execution & E-signature Contract Repository & Storage Contract Analytics & Reporting Compliance & Risk Management |

| By Sales Channel | Direct Sales Resellers Online Sales |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Contract Management | 100 | Project Managers, Legal Advisors |

| Healthcare Sector Compliance Management | 60 | Compliance Officers, Procurement Managers |

| Financial Services Contract Automation | 70 | Risk Managers, Contract Administrators |

| Government Procurement Processes | 55 | Public Sector Contract Managers, Policy Advisors |

| IT Sector Software Licensing Agreements | 50 | IT Managers, Legal Counsel |

The Qatar Contract Lifecycle Management Software Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient contract management solutions across various sectors, including construction, healthcare, and energy.