Region:Global

Author(s):Shubham

Product Code:KRAB0780

Pages:95

Published On:August 2025

By Type:The contract manufacturing market is segmented into Electronics Manufacturing Services (EMS), Pharmaceutical Contract Manufacturing Organizations (CMO/CDMO), Aerospace and Defense Contract Manufacturing, Food and Beverage Contract Manufacturing, Consumer Goods Contract Manufacturing, Automotive Contract Manufacturing, Industrial Equipment Contract Manufacturing, and Others. Each segment addresses the diverse manufacturing needs of industries worldwide, with electronics and pharmaceuticals representing the largest shares due to rapid technological advancement and increased outsourcing in these sectors .

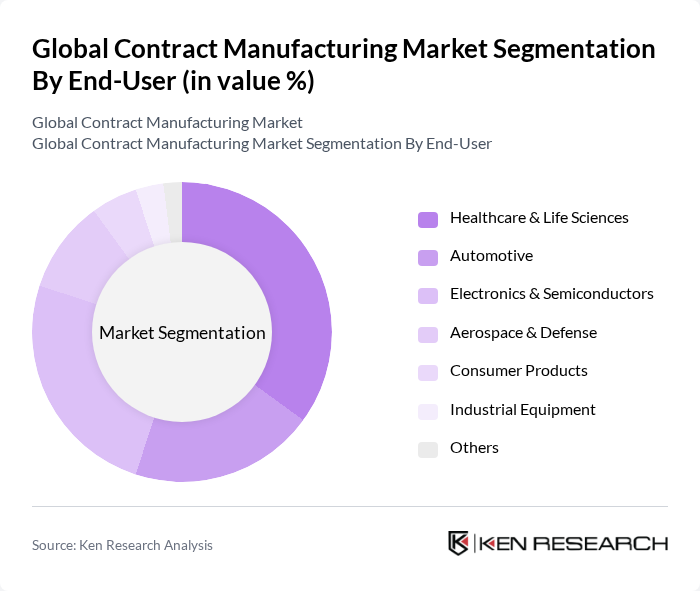

By End-User:The end-user segmentation of the contract manufacturing market includes Healthcare & Life Sciences, Automotive, Electronics & Semiconductors, Aerospace & Defense, Consumer Products, Industrial Equipment, and Others. Each end-user segment has unique requirements and contributes to the overall demand for contract manufacturing services, with healthcare and electronics leading due to rising demand for advanced medical devices and consumer electronics .

The Global Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Jabil Inc., Flex Ltd., Celestica Inc., Sanmina Corporation, Benchmark Electronics, Inc., Plexus Corp., Wistron Corporation, TTM Technologies, Inc., Asteelflash (part of USI/ASE Technology Holding), Lonza Group AG, Catalent, Inc., Samsung Biologics, Motherson Sumi Systems Ltd. (Samvardhana Motherson International Ltd.), Recipharm AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of contract manufacturing in None is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and digital supply chain solutions, operational efficiencies will improve. Additionally, the focus on sustainability will lead to the development of eco-friendly manufacturing practices. These trends indicate a shift towards more agile and responsive manufacturing environments, positioning contract manufacturers as key players in meeting the demands of a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronics Manufacturing Services (EMS) Pharmaceutical Contract Manufacturing Organizations (CMO/CDMO) Aerospace and Defense Contract Manufacturing Food and Beverage Contract Manufacturing Consumer Goods Contract Manufacturing Automotive Contract Manufacturing Industrial Equipment Contract Manufacturing Others |

| By End-User | Healthcare & Life Sciences Automotive Electronics & Semiconductors Aerospace & Defense Consumer Products Industrial Equipment Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Vietnam, Malaysia, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Application | Contract Assembly Product Design and Development Packaging Services Quality Assurance and Testing Logistics and Supply Chain Management Aftermarket Services Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants and Subsidies Others |

| By Policy Support | Tax Incentives Subsidies for Manufacturing Trade Agreements Regulatory Support Others |

| By Distribution Mode | Direct Sales Online Sales Distributors and Wholesalers Retail Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Contract Manufacturing | 100 | Production Managers, Quality Assurance Directors |

| Consumer Goods Contract Manufacturing | 80 | Supply Chain Managers, Product Development Leads |

| Electronics Contract Manufacturing | 60 | Operations Managers, Procurement Specialists |

| Aerospace & Defense Contract Manufacturing | 50 | Engineering Managers, Compliance Officers |

| Food & Beverage Contract Manufacturing | 40 | Quality Control Managers, R&D Directors |

The Global Contract Manufacturing Market is valued at approximately USD 650 billion, driven by the increasing demand for outsourcing manufacturing processes across various sectors, including consumer electronics, pharmaceuticals, and automotive industries.