Region:Middle East

Author(s):Dev

Product Code:KRAC4076

Pages:84

Published On:October 2025

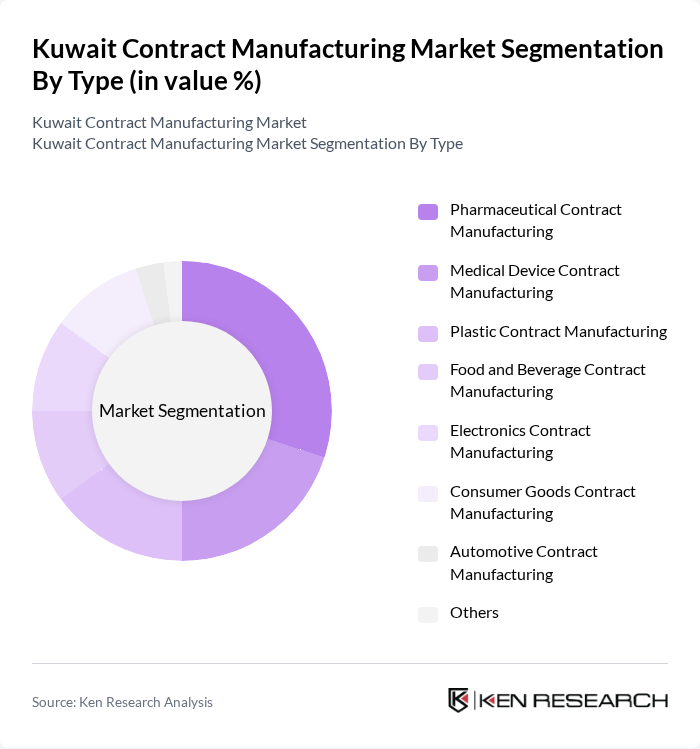

By Type:The contract manufacturing market can be segmented into various types, including Pharmaceutical Contract Manufacturing, Medical Device Contract Manufacturing, Plastic Contract Manufacturing, Food and Beverage Contract Manufacturing, Electronics Contract Manufacturing, Consumer Goods Contract Manufacturing, Automotive Contract Manufacturing, and Others. Each of these segments plays a crucial role in catering to the diverse needs of industries in Kuwait. Pharmaceutical contract manufacturing dominates, driven by demand for finished dose formulations and APIs, while medical device and plastic contract manufacturing are experiencing rapid growth due to healthcare infrastructure expansion and increased demand for specialized packaging and components .

By End-User:The end-user segmentation includes Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Healthcare Providers, Retail, Automotive, Industrial, Electronics, and Others. This segmentation highlights the diverse applications of contract manufacturing across various sectors, reflecting the market's adaptability and responsiveness to industry demands. Pharmaceutical and biopharmaceutical companies represent the largest end-user segment, followed by medical device companies, as both sectors increasingly outsource manufacturing to focus on innovation and reduce time-to-market .

The Kuwait Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Warba Medical Supplies Company, Almahaba Medical Company, Gulf Pharmaceutical Industries (Julphar), Alghanim Industries, KIPCO (Kuwait Projects Company Holding), Al-Mansoori Specialized Engineering, Al-Bahar Group, Al-Khaldiya Group, Al-Muhalab Group, Al-Sayer Group, Al-Qatami Group, Al-Mazaya Holding, Al-Sabih Group, Al-Hamra Group, Gulf Plastic Industries Company, Kuwait Medical Device Company, International Contract Manufacturers with Kuwait Operations (e.g., Lonza Group Ltd, Piramal Pharma Solutions, Catalent Inc) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait contract manufacturing market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt automation and digital solutions, production efficiency is expected to improve significantly. Additionally, the shift towards sustainable practices will likely attract environmentally conscious consumers and investors. In the future, the integration of smart manufacturing technologies could enhance operational capabilities, positioning Kuwait as a competitive player in the regional manufacturing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Contract Manufacturing Medical Device Contract Manufacturing Plastic Contract Manufacturing Food and Beverage Contract Manufacturing Electronics Contract Manufacturing Consumer Goods Contract Manufacturing Automotive Contract Manufacturing Others |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Medical Device Companies Healthcare Providers Retail Automotive Industrial Electronics Others |

| By Application | Product Assembly Packaging Services Quality Control Services Logistics and Distribution Assay Development Others |

| By Business Model | Full-Service Contract Manufacturing Component Manufacturing Private Label Manufacturing Technology Transfer Partnerships Others |

| By Contract Type | Long-Term Contracts Short-Term Contracts Project-Based Contracts Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Pricing Strategy | Cost-Plus Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Contract Manufacturing | 100 | Production Managers, Quality Assurance Heads |

| Electronics Assembly Services | 80 | Operations Directors, Supply Chain Managers |

| Consumer Goods Packaging Solutions | 70 | Procurement Managers, Product Development Leads |

| Automotive Component Manufacturing | 50 | Engineering Managers, Quality Control Supervisors |

| Textile and Apparel Production | 60 | Production Supervisors, Sourcing Managers |

The Kuwait Contract Manufacturing Market is valued at approximately USD 850 million, driven by the increasing demand for outsourcing manufacturing processes, particularly in pharmaceuticals and consumer goods, as companies aim to reduce costs and enhance operational efficiency.