Region:Global

Author(s):Shubham

Product Code:KRAD1936

Pages:80

Published On:December 2025

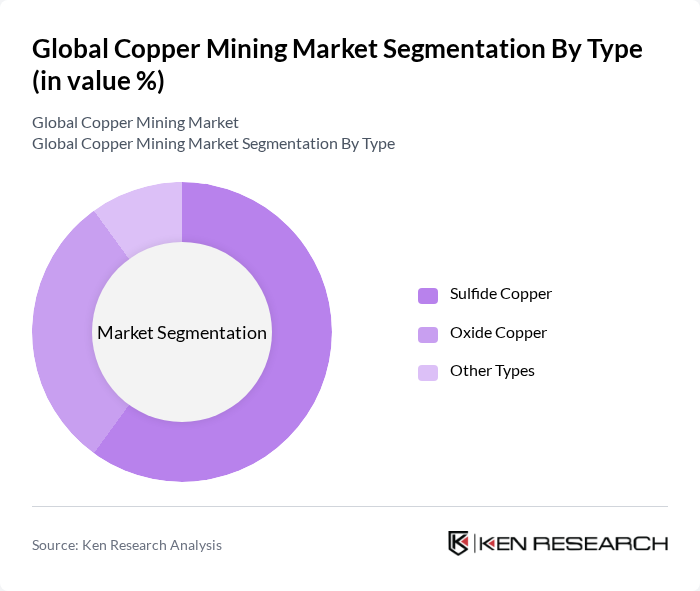

By Type:The copper mining market is segmented into sulfide copper, oxide copper, and other types. Sulfide copper is the dominant segment due to its higher copper content and lower production costs compared to oxide copper. The demand for sulfide copper is driven by its extensive use in electrical applications and construction, making it a preferred choice among manufacturers.

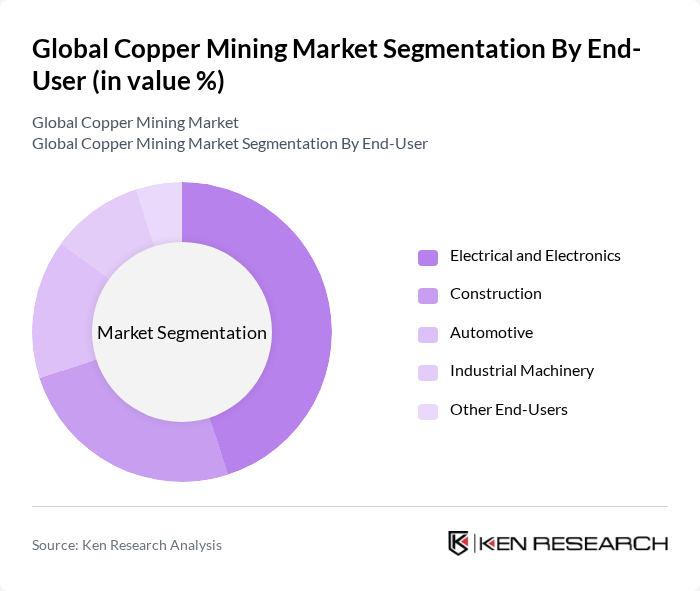

By End-User:The end-user segmentation includes electrical and electronics, construction, automotive, industrial machinery, and other end-users. The electrical and electronics segment leads the market due to the increasing demand for copper in wiring, motors, and electronic components. This segment's growth is fueled by the rise of electric vehicles and renewable energy technologies, which require significant copper usage.

The Global Copper Mining Market is characterized by a dynamic mix of regional and international players. Leading participants such as BHP Group, Freeport-McMoRan Inc., Glencore International AG, Southern Copper Corporation, Rio Tinto Group, Antofagasta PLC, First Quantum Minerals Ltd., Teck Resources Limited, Lundin Mining Corporation, KGHM Polska Mied? S.A., Vedanta Resources Limited, Newmont Corporation, Anglo American PLC, Northern Dynasty Minerals Ltd., and South32 Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the copper mining industry appears to be characterized by a persistent refined copper deficit, projected at approximately 330,000 tonnes by future. This situation is expected to elevate prices, potentially reaching US$12,500 per tonne in future. The urgency for investment in new mining projects and sustainable practices is critical, as the demand for copper continues to rise, driven by its essential role in clean energy and technological advancements in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Sulfide Copper Oxide Copper Other Types |

| By End-User | Electrical and Electronics Construction Automotive Industrial Machinery Other End-Users |

| By Mining Method | Open-Pit Mining Underground Mining Other Mining Methods |

| By Geography | North America South America Asia-Pacific Europe Africa |

| By Application | Electrical Wiring Plumbing Roofing Other Applications |

| By Product Form | Copper Cathodes Copper Rods Copper Wires Other Product Forms |

| By Others | Recycled Copper Specialty Copper Alloys |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global Copper Production Insights | 150 | Mining Executives, Operations Managers |

| Copper Supply Chain Dynamics | 100 | Supply Chain Analysts, Procurement Managers |

| Market Demand Analysis by Sector | 80 | Industry Analysts, Market Researchers |

| Regulatory Impact on Mining Operations | 70 | Compliance Officers, Environmental Managers |

| Technological Innovations in Copper Mining | 60 | R&D Managers, Technology Officers |

The Global Copper Mining Market is valued at approximately USD 10 billion, driven by increasing demand from sectors such as renewable energy, electric vehicles, urbanization, and digitalization, which require significant copper resources for wiring and circuitry.