Region:Global

Author(s):Shubham

Product Code:KRAB0552

Pages:93

Published On:August 2025

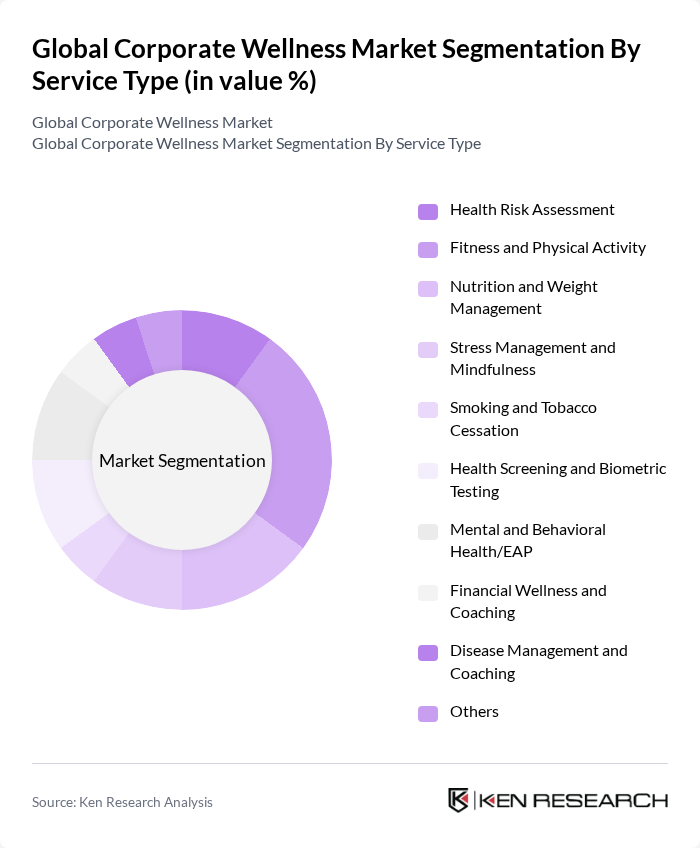

By Service Type:The service type segmentation includes various wellness services offered to employees. The subsegments are Health Risk Assessment, Fitness and Physical Activity, Nutrition and Weight Management, Stress Management and Mindfulness, Smoking and Tobacco Cessation, Health Screening and Biometric Testing, Mental and Behavioral Health/EAP, Financial Wellness and Coaching, Disease Management and Coaching, and Others. Among these, Mental and Behavioral Health/EAP and Health Screening/Biometric Testing are widely adopted cornerstone services, with growing emphasis on digital mental health, stress management, and preventive screening; fitness and physical activity remain important but are increasingly integrated through digital platforms and wearables rather than standalone onsite programs.

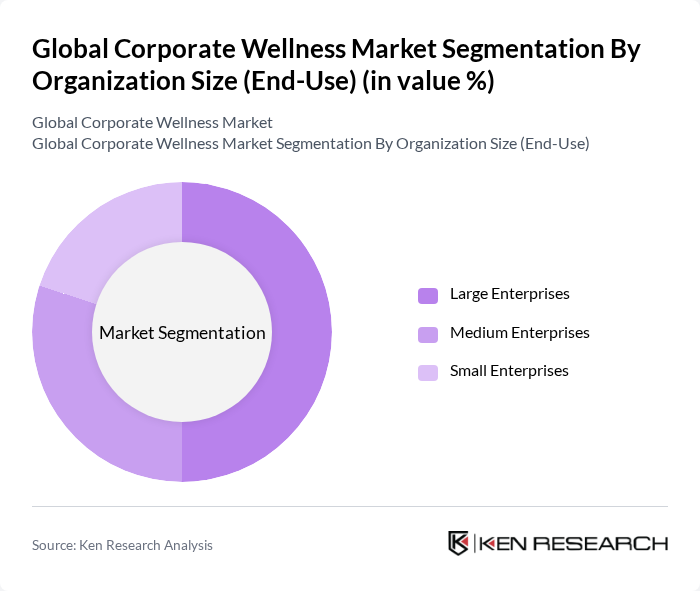

By Organization Size (End-Use):This segmentation categorizes organizations based on their size, which includes Large Enterprises, Medium Enterprises, and Small Enterprises. Large Enterprises are leading this segment as they have more resources to invest in comprehensive wellness programs. The trend towards employee wellness is particularly pronounced in larger organizations, where the scale of operations allows for more extensive wellness initiatives and programs, and data consistently show higher wellness program access among larger employers.

The Global Corporate Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Virgin Pulse (Inspire Brands/Marlin Equity portfolio), Limeade, Wellable, TotalWellness (TotalWellness, LLC), Optum (UnitedHealth Group), ComPsych Corporation, Health Advocate (Teleperformance), WebMD Health Services, Labcorp Employer Services, Wellness Corporate Solutions (WCS, a Labcorp company), LifeWorks (now TELUS Health), Spring Health, Virgin Active Corporate Wellness, Gympass, Headspace for Work contribute to innovation, geographic expansion, and service delivery in this space.

The corporate wellness landscape is poised for transformation as organizations increasingly adopt holistic approaches to employee health. In future, trends such as the integration of mental health services and personalized wellness programs are expected to gain traction. Companies will likely leverage technology, including AI and data analytics, to tailor wellness initiatives to individual employee needs, enhancing engagement and effectiveness. This shift towards comprehensive wellness solutions will redefine workplace health strategies, fostering a more productive and satisfied workforce.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Health Risk Assessment Fitness and Physical Activity Nutrition and Weight Management Stress Management and Mindfulness Smoking and Tobacco Cessation Health Screening and Biometric Testing Mental and Behavioral Health/EAP Financial Wellness and Coaching Disease Management and Coaching Others |

| By Organization Size (End-Use) | Large Enterprises Medium Enterprises Small Enterprises |

| By Delivery Model | Onsite Programs Offsite/Virtual Programs Hybrid Programs |

| By Deployment/Buyer Type | Organizations and Employers Psychological Therapists/Behavioral Health Providers Fitness and Nutrition Consultants |

| By Application | Health Assessment Nutrition and Fitness Stress and Mental Health Management Others |

| By Industry Vertical | Healthcare Information Technology and Services Manufacturing Retail and Consumer Banking, Financial Services and Insurance (BFSI) Government and Public Sector Others |

| By Geographic Scope | Local Programs National Programs Global Programs |

| By Pricing Model | Per-Member-Per-Month (PMPM) Subscription Outcome-based/Value-based Pricing Pay-Per-Use One-Time Implementation Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Wellness Program Implementation | 120 | HR Managers, Wellness Program Directors |

| Employee Engagement in Wellness Initiatives | 100 | Employees across various departments |

| Health and Wellness Service Providers | 80 | Wellness Consultants, Program Coordinators |

| Impact of Wellness Programs on Employee Productivity | 70 | Operations Managers, Team Leaders |

| Trends in Corporate Health Spending | 90 | CFOs, Financial Analysts in Corporations |

The Global Corporate Wellness Market is valued at approximately USD 65 billion, driven by increasing awareness of employee health and rising healthcare costs. Organizations are investing in wellness programs to enhance productivity and employee satisfaction.