Region:Asia

Author(s):Geetanshi

Product Code:KRAA6352

Pages:86

Published On:January 2026

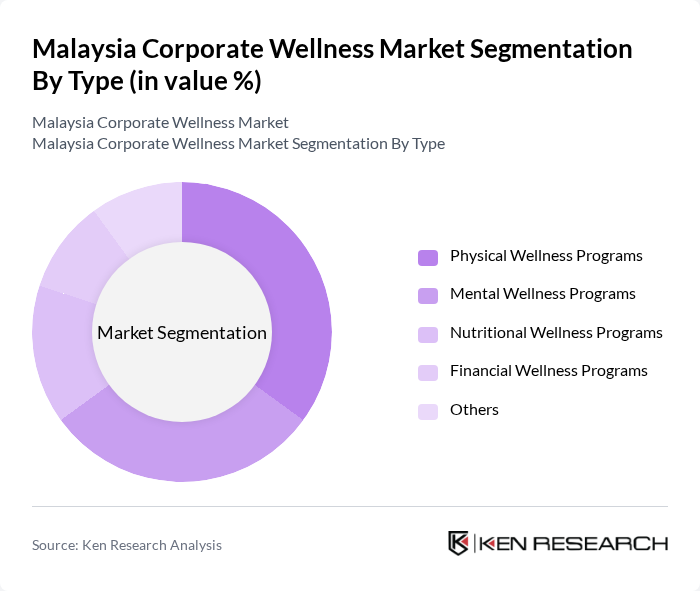

By Type:The market is segmented into various types of wellness programs, including Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, and Others. Each of these segments caters to different aspects of employee well-being, addressing physical health, nutrition, mental health, and other wellness needs.

The Physical Wellness Programs segment is currently dominating the market due to the increasing focus on fitness and health among employees. Companies are investing in gym memberships, fitness classes, and health screenings to promote physical activity and prevent lifestyle-related diseases. This trend is driven by a growing awareness of the benefits of physical health on productivity and morale, making it a priority for many organizations.

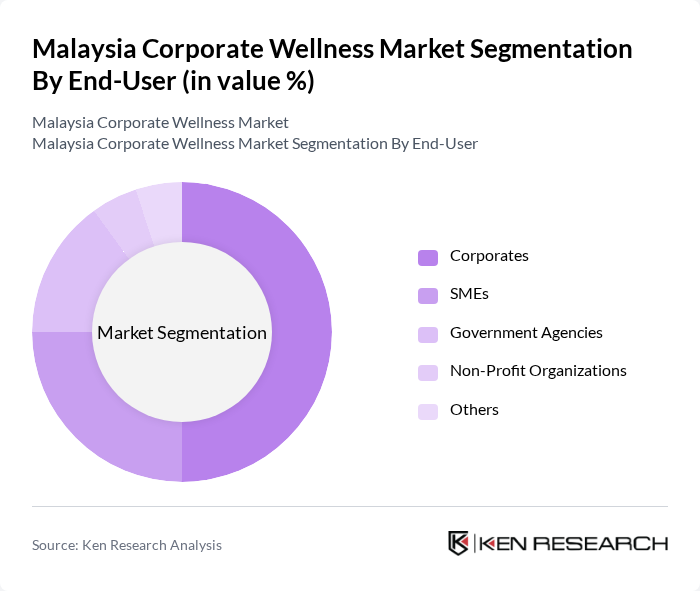

By End-User:The market is segmented by end-users, including Large Scale Organizations, Medium Scale Organizations, and Small Scale Organizations. Each end-user category has unique needs and approaches to implementing wellness programs, reflecting their organizational structure and employee demographics.

Large scale organizations are the leading end-user segment in the market, primarily due to their larger workforce and greater resources to invest in comprehensive wellness programs. These organizations recognize the importance of employee well-being in enhancing productivity and reducing healthcare costs, leading to a significant focus on wellness initiatives.

The Malaysia Corporate Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIA Group Berhad, Allianz Malaysia Berhad, Prudential Assurance Malaysia Berhad, Great Eastern Life Assurance (Malaysia) Berhad, Tune Protect Group Berhad, Sun Life Malaysia Assurance Berhad, AXA Affin Life Insurance Berhad, Kurnia Insurans (Malaysia) Berhad, Etiqa Insurance Berhad, FWD Takaful Berhad, Manulife Insurance Berhad, Tokio Marine Life Insurance Malaysia Berhad, Hong Leong Assurance Berhad, RHB Insurance Berhad, Zurich Insurance Malaysia Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia corporate wellness market appears promising, driven by increasing health awareness and government support. As more companies recognize the importance of employee well-being, the integration of technology in wellness programs is expected to rise. Additionally, the focus on mental health initiatives will likely gain momentum, reflecting a broader societal shift towards holistic health. This evolving landscape presents opportunities for innovative solutions that cater to diverse employee needs, enhancing overall workplace productivity and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Wellness Programs Nutritional Wellness Programs Mental Wellness Programs Financial Wellness Programs Others |

| By End-User | Corporates SMEs Government Agencies Non-Profit Organizations Others |

| By Industry | IT and Technology Manufacturing Healthcare Finance and Banking Others |

| By Program Delivery Method | On-site Wellness Programs Virtual Wellness Programs Hybrid Wellness Programs Others |

| By Duration of Programs | Short-term Programs Long-term Programs Ongoing Wellness Initiatives Others |

| By Geographic Presence | Urban Areas Rural Areas Suburban Areas Others |

| By Employee Engagement Level | High Engagement Programs Moderate Engagement Programs Low Engagement Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Wellness Program Evaluation | 150 | HR Managers, Wellness Coordinators |

| Employee Health and Satisfaction Surveys | 120 | Employees across various sectors |

| Wellness Service Provider Insights | 100 | Wellness Program Directors, Service Providers |

| Industry Trends and Challenges | 80 | Industry Experts, Consultants |

| Impact of Wellness Programs on Productivity | 110 | Business Leaders, Operations Managers |

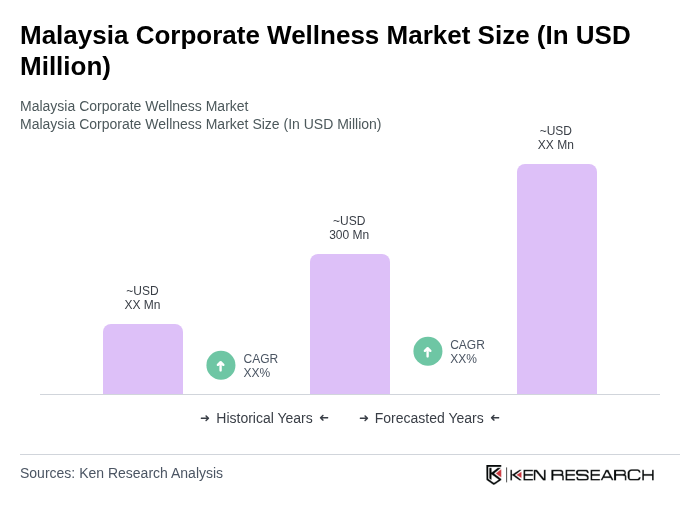

The Malaysia Corporate Wellness Market is valued at approximately USD 298 million, driven by increasing awareness of employee health, rising healthcare costs, and the need for organizations to enhance productivity and reduce absenteeism through wellness programs.