Region:Global

Author(s):Shubham

Product Code:KRAD0735

Pages:100

Published On:August 2025

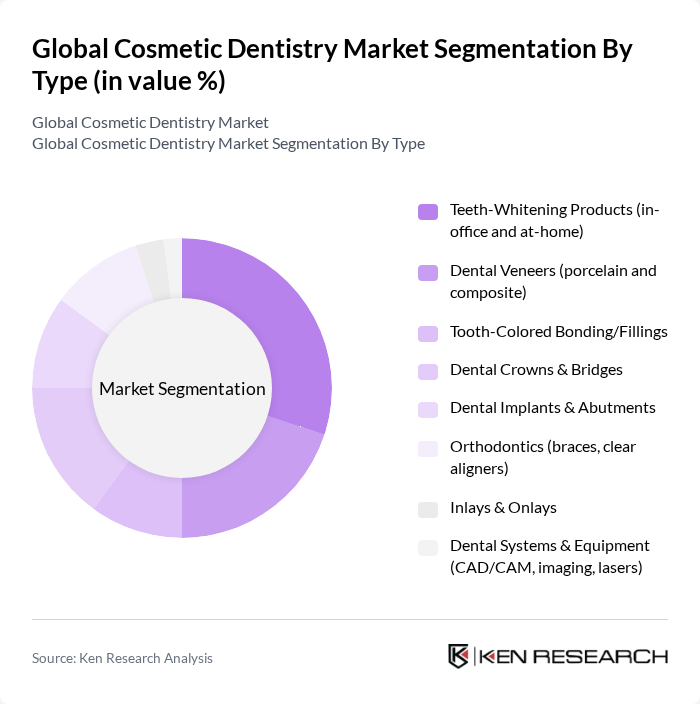

By Type:The cosmetic dentistry market is segmented into various types, including teeth-whitening products, dental veneers, tooth-colored bonding, dental crowns and bridges, dental implants, orthodontics, inlays and onlays, and dental systems and equipment. Among these, teeth-whitening products have gained significant popularity due to their affordability and immediate results, including strong at-home uptake alongside in-office bleaching. Dental veneers and implants are also in high demand, driven by the desire for durable aesthetic restoration and smile makeovers; clear aligners continue to expand rapidly with digital workflows improving case planning and patient experience.

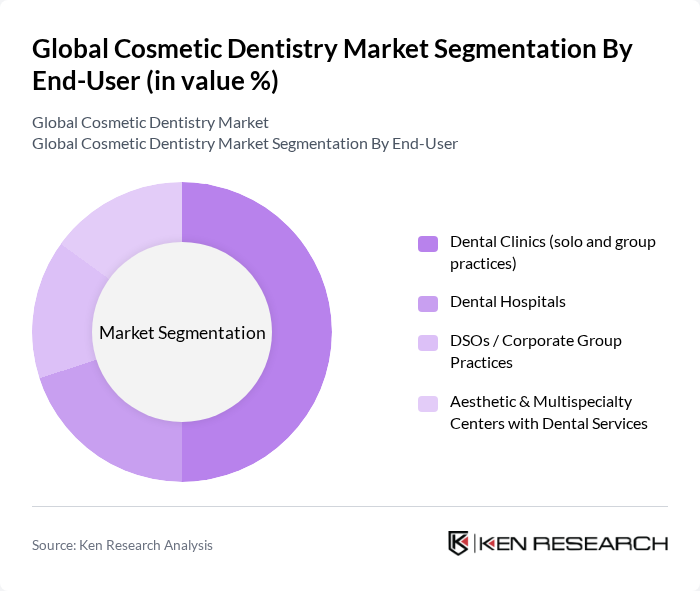

By End-User:The market is segmented by end-users, including dental clinics, dental hospitals, corporate group practices, and aesthetic centers. Dental clinics, both solo and group practices, dominate the market due to accessibility, strong demand for chairside cosmetic services, and rapid adoption of digital tools that shorten treatment time. The rise of DSOs/corporate group practices also contributes to growth by scaling advanced technologies and expanding access to cosmetic offerings.

The Global Cosmetic Dentistry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Align Technology, Inc., Dentsply Sirona Inc., Straumann Holding AG, Nobel Biocare Services AG (Envista), Henry Schein, Inc., Patterson Companies, Inc., 3M Company, Ivoclar Vivadent AG, KaVo Kerr (Envista), GC Corporation, COLTENE Holding AG, VOCO GmbH, Zyris, Inc. (formerly Isolite Systems), BIOLASE, Inc., 3Shape A/S, Planmeca Oy, Zimmer Biomet Holdings, Inc., Kuraray Co., Ltd., J. MORITA Corporation, VATECH Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cosmetic dentistry market appears promising, driven by ongoing technological advancements and increasing consumer demand for aesthetic enhancements. As digital dentistry continues to evolve, more personalized and efficient treatment options will emerge, catering to diverse patient needs. Additionally, the growing trend of wellness and self-care will likely propel the market forward, encouraging more individuals to invest in their dental aesthetics, particularly in regions with rising disposable incomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Teeth-Whitening Products (in-office and at-home) Dental Veneers (porcelain and composite) Tooth-Colored Bonding/Fillings Dental Crowns & Bridges Dental Implants & Abutments Orthodontics (braces, clear aligners) Inlays & Onlays Dental Systems & Equipment (CAD/CAM, imaging, lasers) |

| By End-User | Dental Clinics (solo and group practices) Dental Hospitals DSOs / Corporate Group Practices Aesthetic & Multispecialty Centers with Dental Services |

| By Age Group | Children Teenagers Adults Seniors |

| By Treatment Duration | Single-Visit/Short-Term Treatments Multi-Visit/Long-Term Treatments |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Payment Model | Out-of-Pocket Payments Insurance & Dental Financing Plans |

| By Distribution Channel | Offline (distributors, direct sales) Online (e-commerce, direct-to-consumer) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Dentistry Clinics | 150 | Cosmetic Dentists, Clinic Managers |

| Dental Product Manufacturers | 100 | Product Development Managers, Sales Directors |

| Patient Experience Surveys | 150 | Patients who have undergone cosmetic procedures |

| Insurance Providers | 80 | Underwriters, Claims Adjusters |

| Dental Associations | 50 | Association Executives, Policy Makers |

The Global Cosmetic Dentistry Market is valued at approximately USD 28 billion, reflecting significant growth driven by increasing consumer awareness of dental aesthetics and advancements in digital dentistry technologies.