Region:Middle East

Author(s):Shubham

Product Code:KRAA8745

Pages:86

Published On:November 2025

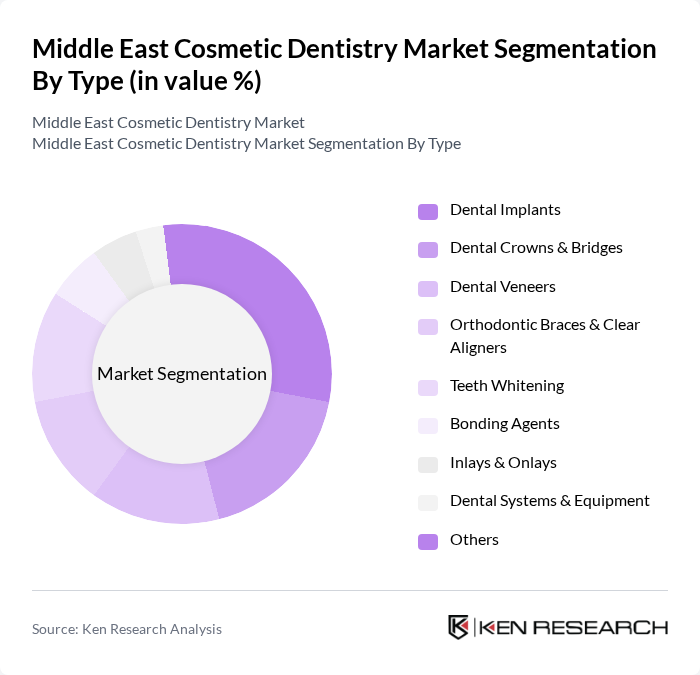

By Type:The market is segmented into various types of cosmetic dentistry procedures, including Dental Implants, Dental Crowns & Bridges, Dental Veneers, Orthodontic Braces & Clear Aligners, Teeth Whitening, Bonding Agents, Inlays & Onlays, Dental Systems & Equipment, and Others. Among these, Dental Implants and Teeth Whitening are particularly popular due to their effectiveness in enhancing dental aesthetics and improving oral health. The increasing trend of aesthetic dentistry, supported by the adoption of digital workflows and minimally invasive techniques, has led to a significant rise in the adoption of these procedures .

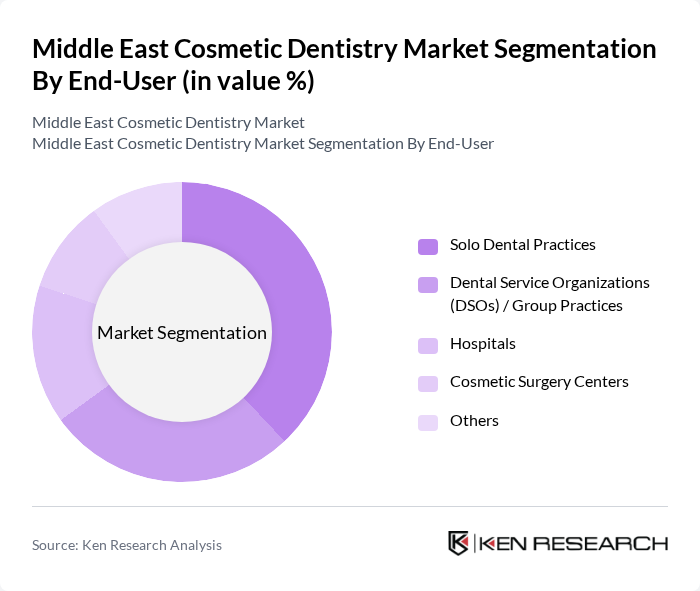

By End-User:The market is segmented based on end-users, including Solo Dental Practices, Dental Service Organizations (DSOs) / Group Practices, Hospitals, Cosmetic Surgery Centers, and Others. Solo Dental Practices hold a substantial share due to their personalized services and strong patient relationships. However, the rise of DSOs is notable as they offer a broader range of services, leverage economies of scale, and invest in advanced technologies, making them increasingly popular among patients seeking comprehensive dental care .

The Middle East Cosmetic Dentistry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dr. Michael's Dental Clinic (UAE), Dental Studio (UAE), American Dental Clinic (UAE), Dentakay Dental Clinic (Turkey), DentGroup (Turkey), Istanbul Dental Center (Turkey), Asnan Tower (Kuwait), Al Muhaidib Dental Group (Saudi Arabia), Saudi German Hospital Dental Center (Saudi Arabia), Shams Dental Clinic (Qatar), Dental Experts Center (Egypt), Bupa Arabia (Saudi Arabia), Al-Farabi Dental Center (Saudi Arabia), Al Wehda Dental Center (UAE), Dr. Firas Dental & Orthodontic Center (Jordan) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East cosmetic dentistry market appears promising, driven by increasing consumer awareness and technological advancements. As disposable incomes rise, more individuals are likely to invest in aesthetic dental procedures. Additionally, the integration of digital solutions and tele-dentistry is expected to enhance service delivery, making cosmetic dentistry more accessible. The market is poised for growth as dental professionals adapt to evolving consumer preferences and leverage innovative technologies to meet demand effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Dental Implants Dental Crowns & Bridges Dental Veneers Orthodontic Braces & Clear Aligners Teeth Whitening Bonding Agents Inlays & Onlays Dental Systems & Equipment Others |

| By End-User | Solo Dental Practices Dental Service Organizations (DSOs) / Group Practices Hospitals Cosmetic Surgery Centers Others |

| By Age Group | Children Adolescents Adults Seniors |

| By Gender | Male Female |

| By Geographic Distribution | Saudi Arabia United Arab Emirates Turkey Egypt Qatar Rest of Middle East |

| By Treatment Duration | Short-term Treatments Long-term Treatments |

| By Insurance Coverage | Insured Patients Uninsured Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Dentistry Clinics | 150 | Clinic Owners, Lead Dentists |

| Dental Product Suppliers | 100 | Sales Managers, Product Development Heads |

| Patients Undergoing Cosmetic Procedures | 150 | Recent Patients, Dental Care Advocates |

| Dental Insurance Providers | 80 | Policy Managers, Claims Analysts |

| Regulatory Bodies in Dental Health | 50 | Health Policy Makers, Regulatory Officers |

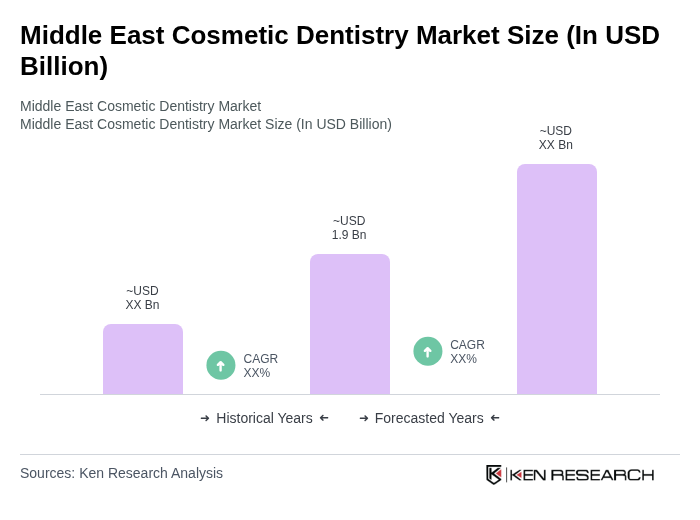

The Middle East Cosmetic Dentistry Market is valued at approximately USD 1.9 billion, driven by increasing consumer awareness of dental aesthetics, advancements in digital dental technologies, and rising disposable incomes among the population.