Region:Global

Author(s):Geetanshi

Product Code:KRAA0109

Pages:100

Published On:August 2025

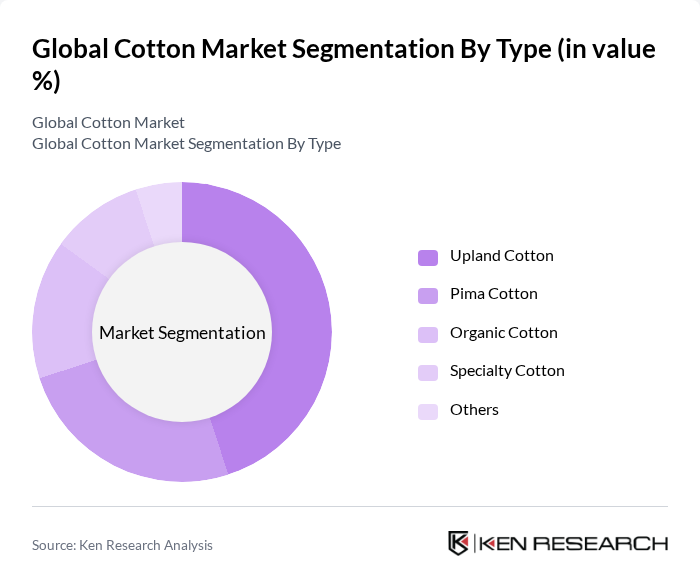

By Type:The cotton market is segmented into Upland Cotton, Pima Cotton, Organic Cotton, Specialty Cotton, and Others. Upland Cotton is the most widely produced type due to its adaptability, high yield, and suitability for mass-market textiles. Pima Cotton, known for its longer staple length and superior softness, is favored in luxury and premium apparel. Organic Cotton is gaining traction as consumers and brands increasingly prioritize sustainability and eco-friendly sourcing. Specialty Cotton includes varieties tailored for specific industrial or technical applications, catering to niche markets with unique requirements .

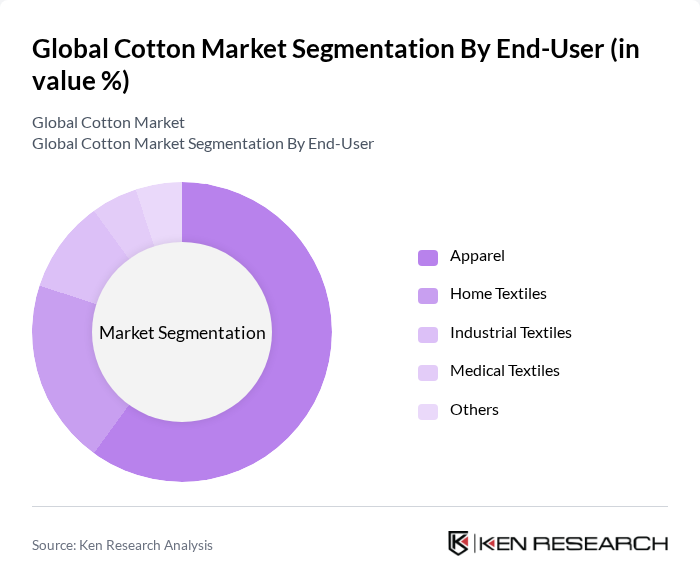

By End-User:The end-user segmentation includes Apparel, Home Textiles, Industrial Textiles, Medical Textiles, and Others. The Apparel segment dominates the market, driven by the high demand for cotton clothing due to its comfort, breathability, and versatility. Home Textiles, including bed linens and towels, represent a significant portion of the market as consumers prioritize quality and sustainability in household products. Industrial Textiles utilize cotton for applications such as filters, tarpaulins, and canvas, while Medical Textiles include products like bandages and gauze, reflecting the versatility of cotton in various applications .

The Global Cotton Market is characterized by a dynamic mix of regional and international players. Leading participants such as China National Cotton Group Corporation, Vardhman Textiles Ltd., Olam International, Louis Dreyfus Company, Cargill, Inc., Archer Daniels Midland (ADM), Allenberg Cotton Company, Staplcotn, Nishat Mills Limited, Plexus Cotton Ltd., Paul Reinhart AG, Toyobo Co., Ltd., Gokak Textiles Ltd., Weil Brothers-Cotton, Inc., Calcot, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cotton market is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As consumer preferences shift towards eco-friendly products, the demand for organic cotton is expected to rise significantly. Additionally, innovations in processing technologies will enhance efficiency and reduce waste, making cotton production more sustainable. The integration of digital tools in supply chains will also improve traceability, aligning with consumer expectations for transparency and ethical sourcing, thus shaping a resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Upland Cotton Pima Cotton Organic Cotton Specialty Cotton Others |

| By End-User | Apparel Home Textiles Industrial Textiles Medical Textiles Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Pakistan, Bangladesh, Vietnam, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Egypt, Turkey, West Africa, Rest of MEA) |

| By Application | Clothing Home Furnishings Technical Applications Others |

| By Processing Method | Ginning Spinning Weaving Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Sustainability Certification | GOTS Certified OEKO-TEX Certified Fair Trade Certified Better Cotton Initiative (BCI) Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cotton Farmers | 100 | Farm Owners, Agricultural Consultants |

| Textile Manufacturers | 80 | Production Managers, Supply Chain Directors |

| Exporters and Importers | 60 | Trade Managers, Logistics Coordinators |

| Retail Sector Buyers | 50 | Merchandise Managers, Procurement Officers |

| Industry Analysts | 40 | Market Researchers, Economic Analysts |

The Global Cotton Market is valued at approximately USD 43 billion, driven by increasing demand in the textile and clothing industry, improved production efficiency, and the growing use of cotton in medical and industrial applications.