Region:Central and South America

Author(s):Dev

Product Code:KRAA2207

Pages:81

Published On:August 2025

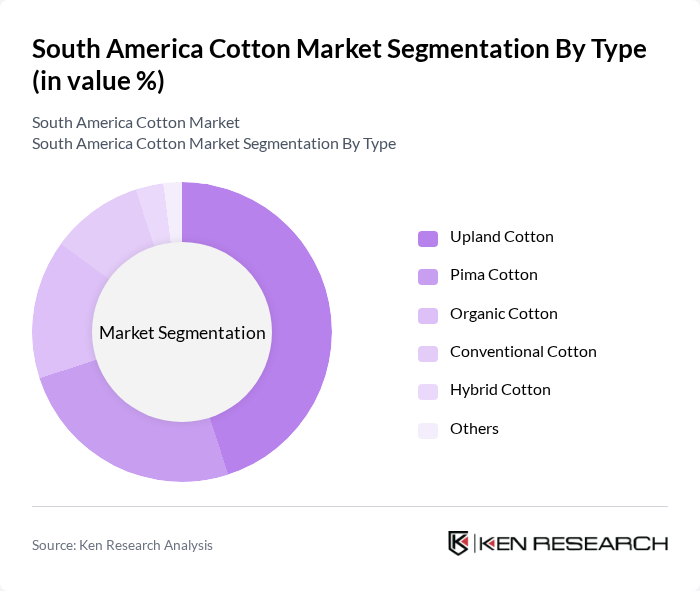

By Type:The cotton market in South America is segmented into various types, including Upland Cotton, Pima Cotton, Organic Cotton, Conventional Cotton, Hybrid Cotton, and Others. Upland Cotton is the most widely produced type due to its adaptability, high yield, and suitability for large-scale mechanized farming, making it a preferred choice among farmers. Pima Cotton, known for its superior fiber length and softness, is also gaining traction, particularly in the luxury textile segment. Organic Cotton is increasingly popular as consumers become more environmentally conscious and as certification schemes expand. Conventional and Hybrid Cotton types continue to cater to different market needs, with hybrid varieties offering improved pest resistance and yield stability .

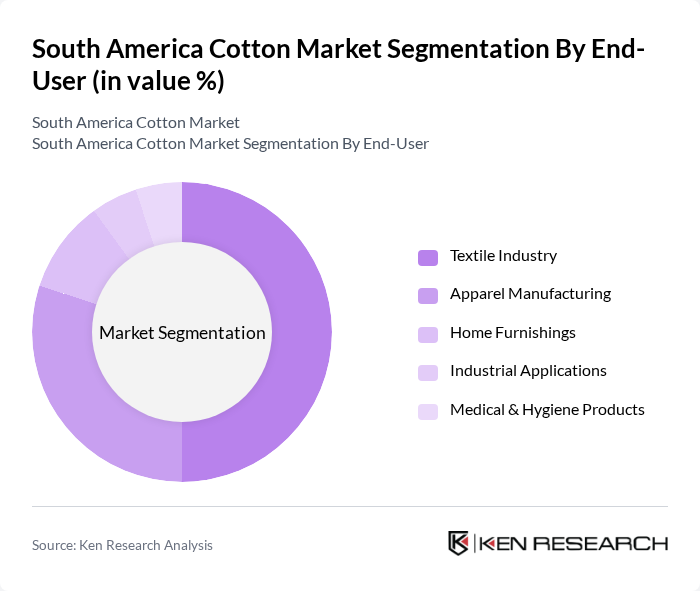

By End-User:The South America Cotton Market serves various end-user segments, including the Textile Industry, Apparel Manufacturing, Home Furnishings, Industrial Applications, and Medical & Hygiene Products. The Textile Industry is the largest consumer of cotton, driven by the growing demand for clothing, home textiles, and technical fabrics. Apparel Manufacturing follows closely, with a strong focus on sustainable and traceable sourcing. Home Furnishings and Industrial Applications are also significant, as cotton is used in products such as upholstery, technical textiles, and filtration materials. The Medical & Hygiene Products segment is expanding, with cotton used in surgical dressings, sanitary items, and personal care products .

The South America Cotton Market is characterized by a dynamic mix of regional and international players. Leading participants such as Associação Brasileira dos Produtores de Algodão (ABRAPA), Sodecar S.A., Olam International Ltd., Grupo Los Grobo, Cootagro Cooperativa Agroindustrial, Cia. de Comércio e Indústria de Algodão, Agropecuaria La Primavera S.A., Cia. Algodoeira de São Paulo, Cia. Algodoeira de Santa Cruz, Cia. Algodoeira do Brasil, Cia. de Algodão do Nordeste, Cia. de Algodão do Sul, Cia. de Algodão do Centro-Oeste, Vicentin S.A.I.C., LDC Argentina S.A. (Louis Dreyfus Company) contribute to innovation, geographic expansion, and service delivery in this space.

The South American cotton market is poised for transformation as sustainability and technological innovation take center stage. With increasing consumer demand for eco-friendly textiles and government support for farmers, the region is likely to enhance its production capabilities. Additionally, the integration of precision agriculture techniques will further optimize yields. However, challenges such as climate change and price volatility will require adaptive strategies. Overall, the market is expected to evolve, focusing on sustainable practices and technological advancements to meet future demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Upland Cotton Pima Cotton Organic Cotton Conventional Cotton Hybrid Cotton Others |

| By End-User | Textile Industry Apparel Manufacturing Home Furnishings Industrial Applications Medical & Hygiene Products |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distributors Export Markets |

| By Geographic Region | Brazil Argentina Paraguay Uruguay Colombia |

| By Quality Grade | High-Quality Cotton Medium-Quality Cotton Low-Quality Cotton |

| By Processing Method | Ginning Spinning Weaving Dyeing & Finishing |

| By Price Range | Premium Cotton Mid-Range Cotton Budget Cotton |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cotton Farming Practices | 120 | Cotton Farmers, Agricultural Cooperative Leaders |

| Textile Manufacturing Insights | 90 | Production Managers, Sourcing Specialists |

| Market Trends in Cotton Exports | 60 | Export Managers, Trade Analysts |

| Consumer Preferences for Cotton Products | 100 | Retail Buyers, Brand Managers |

| Sustainability Practices in Cotton Production | 50 | Sustainability Officers, Environmental Consultants |

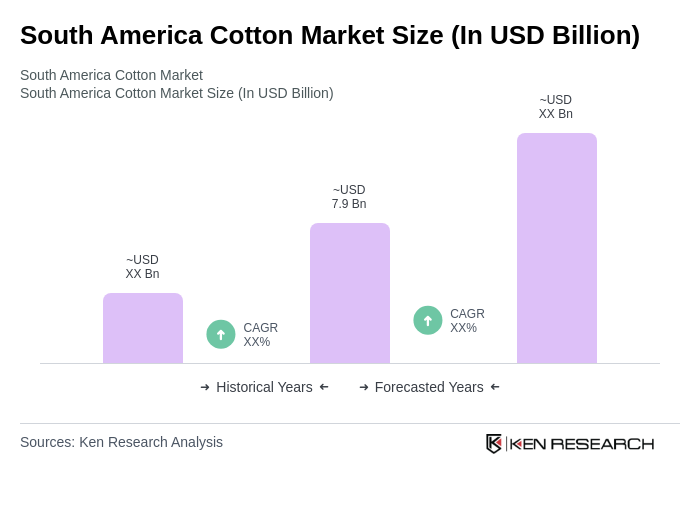

The South America Cotton Market is valued at approximately USD 7.9 billion, reflecting a five-year historical analysis. This growth is driven by increasing demand in the textile and apparel industries, along with a shift towards sustainable and organic products.