Region:Global

Author(s):Dev

Product Code:KRAA3001

Pages:83

Published On:August 2025

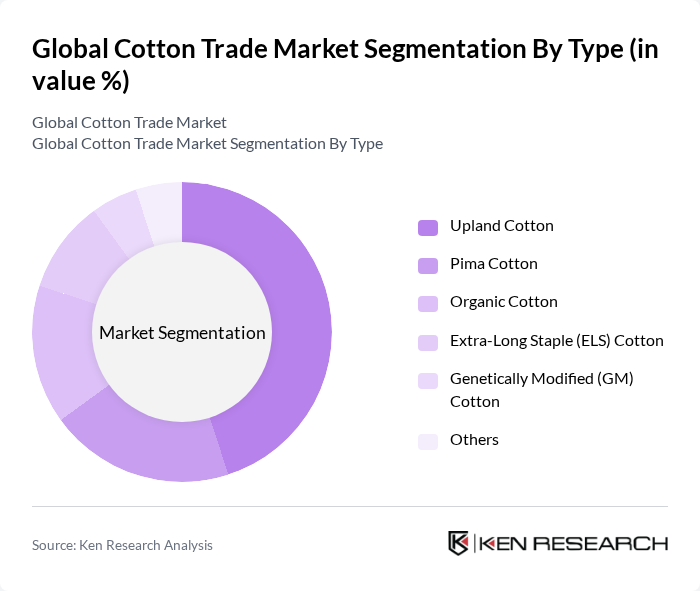

By Type:The cotton market is segmented into various types, including Upland Cotton, Pima Cotton, Organic Cotton, Extra-Long Staple (ELS) Cotton, Genetically Modified (GM) Cotton, and Others. Upland Cotton is the most widely produced type globally due to its adaptability, high yield, and suitability for mass-market textile applications. Pima Cotton, valued for its superior fiber length and softness, is increasingly used in premium and luxury textiles. Organic Cotton is gaining traction among environmentally conscious consumers and brands seeking sustainable sourcing. Genetically Modified (GM) Cotton is favored for its pest resistance and higher productivity, especially in regions with challenging growing conditions. ELS Cotton and other specialty types serve niche markets requiring specific fiber characteristics .

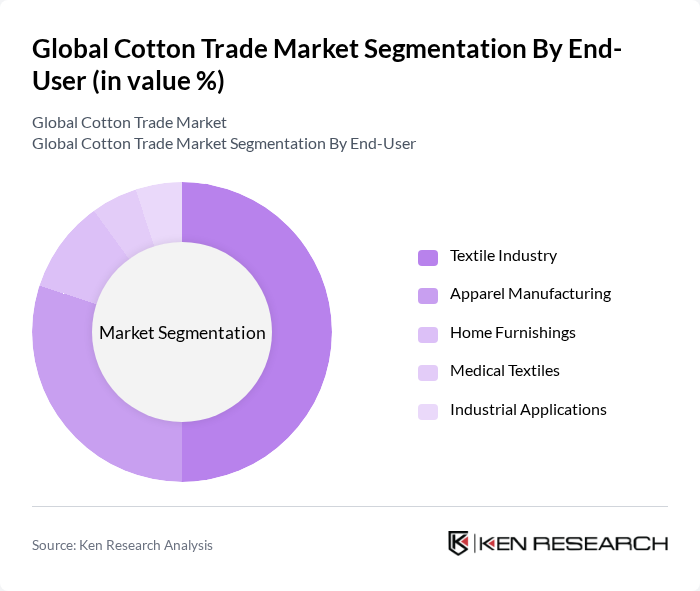

By End-User:The cotton market serves various end-user segments, including the Textile Industry, Apparel Manufacturing, Home Furnishings, Medical Textiles, and Industrial Applications. The Textile Industry is the largest consumer of cotton, driven by robust demand for clothing, yarn, and fabrics. Apparel Manufacturing remains a key segment, as cotton continues to be a staple material for garments worldwide. Home Furnishings, such as bed linens, towels, and curtains, contribute significantly to cotton consumption. Medical Textiles—including bandages and surgical fabrics—along with Industrial Applications, such as filtration and insulation, represent emerging areas of growth for cotton usage .

The Global Cotton Trade Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cotton Incorporated, Bayer Crop Science, Olam International, Cargill, Inc., Louis Dreyfus Company, ADM (Archer Daniels Midland), Allenberg Cotton Co., Staplcotn Cooperative Association, Texport Industries Pvt. Ltd., Paul Reinhart AG, Plexus Cotton Ltd., TCM (Tennessee Cotton Merchants), Cotton Australia, National Cotton Council of America, International Cotton Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cotton trade market appears promising, driven by increasing consumer awareness of sustainable practices and the shift towards organic cotton production. As more brands commit to sustainability, the demand for eco-friendly cotton products is expected to rise. Additionally, emerging markets in Africa and Southeast Asia are likely to present new opportunities for cotton exports, further diversifying the global supply chain and enhancing market resilience against economic fluctuations.

| Segment | Sub-Segments |

|---|---|

| By Type | Upland Cotton Pima Cotton Organic Cotton Extra-Long Staple (ELS) Cotton Genetically Modified (GM) Cotton Others |

| By End-User | Textile Industry Apparel Manufacturing Home Furnishings Medical Textiles Industrial Applications |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, France, Italy, Spain, Germany, Rest of Europe) Asia-Pacific (China, India, Vietnam, Australia, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Africa (South Africa, Rest of Africa) |

| By Application | Clothing Industrial Textiles Agricultural Textiles Home Textiles Technical Textiles |

| By Sales Channel | Direct Sales Online Retail Wholesale Distribution Trading Companies Others |

| By Price Range | Premium Cotton Mid-Range Cotton Budget Cotton |

| By Policy Support | Government Subsidies Tax Incentives Trade Agreements Minimum Support Price (MSP) Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cotton Export Market | 100 | Export Managers, Trade Analysts |

| Textile Manufacturing Sector | 80 | Procurement Managers, Production Supervisors |

| Cotton Farming Practices | 60 | Farm Owners, Agricultural Consultants |

| Retail Cotton Products | 50 | Merchandising Managers, Brand Strategists |

| Sustainability Initiatives in Cotton | 40 | Sustainability Officers, CSR Managers |

The Global Cotton Trade Market is valued at approximately USD 43 billion, driven by increasing demand from the textile and apparel industries, sustainable cotton preferences, and advancements in agricultural technology that enhance yield and fiber quality.