Region:Global

Author(s):Dev

Product Code:KRAB0488

Pages:87

Published On:August 2025

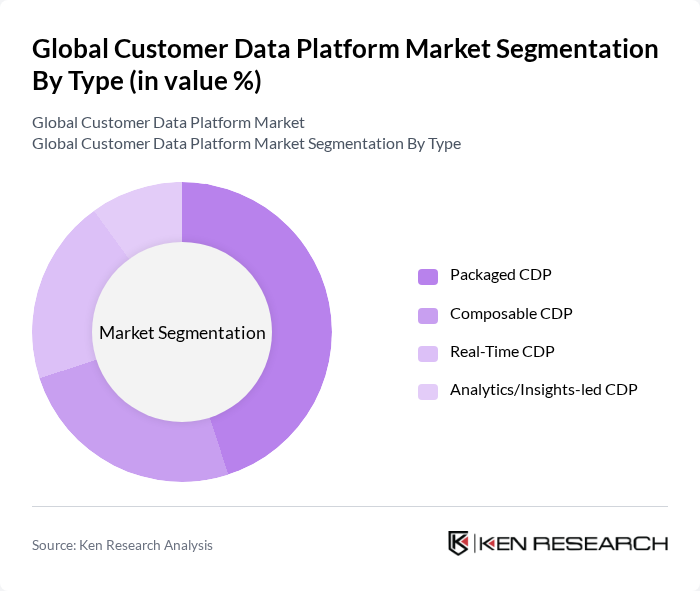

By Type:The market is segmented into four main types: Packaged CDP, Composable CDP, Real-Time CDP, and Analytics/Insights-led CDP. Among these, theremains widely adopted by enterprises seeking out-of-the-box capabilities and faster time-to-value across identity resolution, segmentation, and activation. At the same time, demand foris rising as organizations favor modular architectures that integrate with existing data warehouses and reverse ETL, enabling more flexible, developer-led stacks .

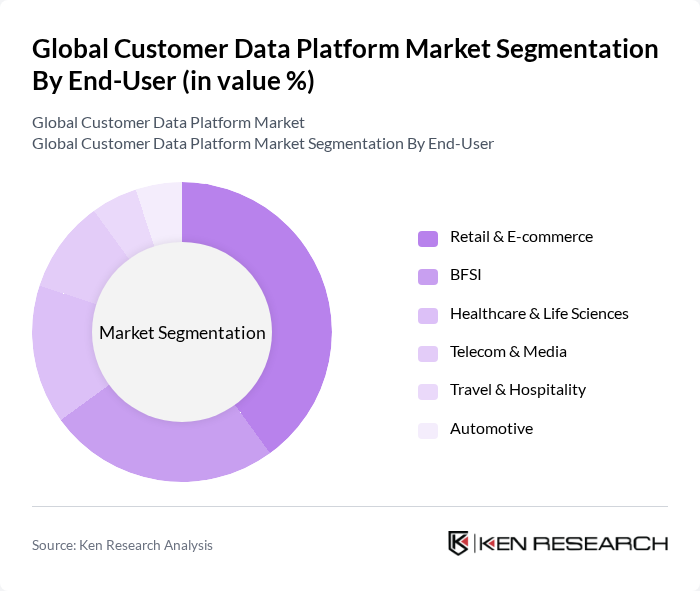

By End-User:The end-user segmentation includes Retail & E-commerce, BFSI (Banking, Financial Services & Insurance), Healthcare & Life Sciences, Telecom & Media, Travel & Hospitality, and Automotive. The Retail & E-commerce sector is the dominant segment due to intensive omnichannel personalization requirements and large volumes of first-party data. BFSI demonstrates strong adoption as institutions leverage CDPs for personalization, risk-aware outreach, and regulatory-compliant data unification; healthcare and telecom are also notable adopters given patient/member 360 and subscriber experience use cases .

The Global Customer Data Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce (Data Cloud), Adobe (Adobe Experience Platform), Oracle (Unity Customer Data Platform), SAP (Emarsys Customer Engagement), Twilio Segment, BlueConic, Tealium (AudienceStream CDP), Amperity, mParticle, Zeta Global, Acquia (Acquia CDP), Salesforce Interaction Studio (now Marketing Cloud Personalization), Lytics, Optimove, Treasure Data, ActionIQ, Hightouch, RudderStack, Zeotap CDP, Celebrus contribute to innovation, geographic expansion, and service delivery in this space .

The future of the customer data platform market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize data-driven decision-making, the demand for sophisticated analytics tools will rise in future. Furthermore, the integration of artificial intelligence and machine learning into customer data platforms is expected to enhance data processing capabilities, enabling real-time insights in future. This evolution will likely foster greater customer engagement and loyalty, positioning companies to thrive in an increasingly competitive digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Packaged CDP Composable CDP Real-Time CDP Analytics/Insights-led CDP |

| By End-User | Retail & E-commerce BFSI (Banking, Financial Services & Insurance) Healthcare & Life Sciences Telecom & Media Travel & Hospitality Automotive |

| By Industry Vertical | Consumer Goods (CPG) Technology & Software Education Government & Public Sector |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Data Integration & Identity Resolution Audience Segmentation & Personalization Analytics, Propensity & Predictive Modeling Real-Time Activation & Orchestration Data Governance, Consent & Privacy |

| By Data Type / Channel | First-Party & Zero-Party Data Web & Mobile App Events CRM, POS & Transactional Data Advertising & Social Platforms IoT & Offline Sources |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector CDP Implementation | 120 | Marketing Directors, Data Analysts |

| Financial Services Data Management | 100 | Chief Data Officers, Compliance Managers |

| Healthcare Patient Data Integration | 80 | IT Managers, Data Governance Officers |

| Travel and Hospitality Customer Insights | 70 | Customer Experience Managers, Marketing Strategists |

| Technology Sector User Data Analytics | 90 | Product Managers, Data Scientists |

The Global Customer Data Platform Market is valued at approximately USD 6.26 billion, reflecting a significant increase driven by the growing need for unified customer profiles and real-time data activation across enterprises.