Region:Middle East

Author(s):Rebecca

Product Code:KRAC4713

Pages:90

Published On:October 2025

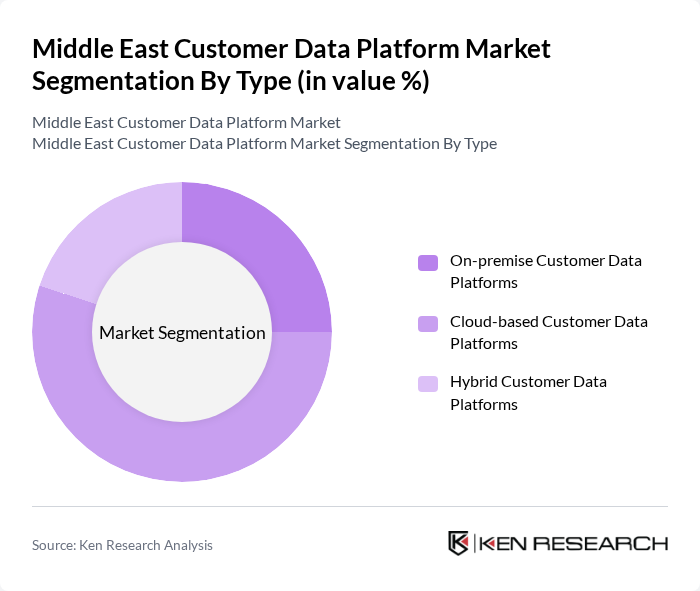

By Type:The market is segmented into three types: On-premise Customer Data Platforms, Cloud-based Customer Data Platforms, and Hybrid Customer Data Platforms. The Cloud-based segment is currently dominating the market due to its scalability, cost-effectiveness, and ease of integration with existing systems. Businesses are increasingly opting for cloud solutions to leverage advanced analytics, real-time data processing capabilities, and seamless omnichannel integration. The adoption of cloud-based platforms is further accelerated by the need for centralized data management and enhanced data privacy compliance .

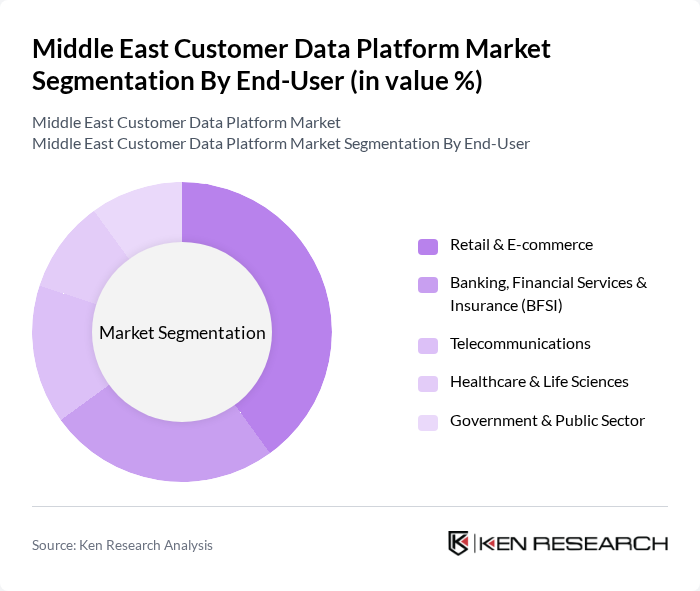

By End-User:The end-user segmentation includes Retail & E-commerce, Banking, Financial Services & Insurance (BFSI), Telecommunications, Healthcare & Life Sciences, and Government & Public Sector. The Retail & E-commerce segment is leading the market, driven by the need for personalized marketing strategies, enhanced customer engagement through data-driven insights, and the rapid growth of online shopping. BFSI and Telecommunications sectors are also expanding their adoption of customer data platforms to improve customer retention, fraud detection, and targeted service offerings .

The Middle East Customer Data Platform market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Adobe Experience Cloud, Oracle, SAP Customer Data Cloud, Twilio Segment, BlueConic, Tealium, Amperity, Zeta Global, Acquia CDP, Bloomreach, mParticle, Treasure Data, Lytics, Optimove, Meiro, Lexer, SAS Customer Intelligence 360, ActionIQ, Zeotap contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East customer data platform market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize data-driven decision-making, the adoption of AI and machine learning technologies is expected to enhance customer insights. Furthermore, the growing emphasis on customer experience will likely lead to more investments in CDPs, enabling organizations to create personalized marketing strategies that resonate with their target audiences and foster brand loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | On-premise Customer Data Platforms Cloud-based Customer Data Platforms Hybrid Customer Data Platforms |

| By End-User | Retail & E-commerce Banking, Financial Services & Insurance (BFSI) Telecommunications Healthcare & Life Sciences Government & Public Sector |

| By Industry Vertical | E-commerce & Online Marketplaces Travel, Tourism & Hospitality Media, Entertainment & Publishing Education & EdTech Automotive |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Customer Data Integration & Unification Predictive Analytics & Insights Campaign Management & Personalization Identity Resolution |

| By Sales Channel | Direct Sales Online Sales Value-added Resellers & System Integrators |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, etc.) Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Customer Data Utilization | 120 | Marketing Managers, Data Analysts |

| Financial Services Data Management | 90 | Chief Data Officers, Risk Management Heads |

| Healthcare Data Integration | 60 | IT Directors, Compliance Officers |

| Telecommunications Customer Insights | 50 | Product Managers, Customer Experience Leaders |

| Travel and Hospitality Data Strategies | 40 | Operations Managers, Digital Marketing Specialists |

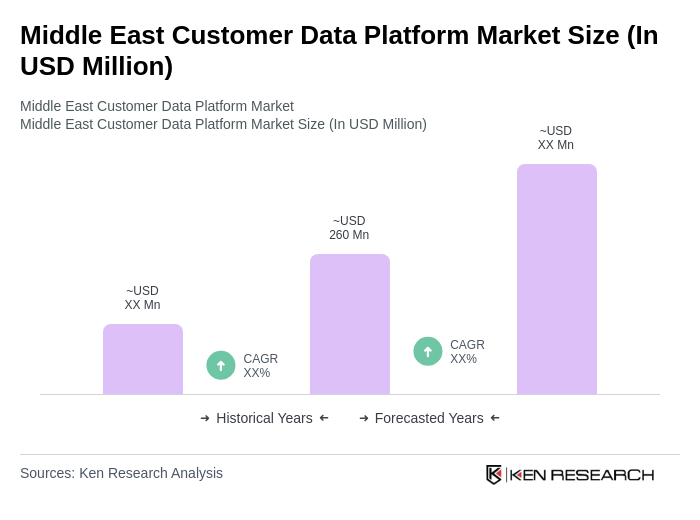

The Middle East Customer Data Platform market is valued at approximately USD 260 million, reflecting robust growth driven by the demand for personalized customer experiences and the rise of digital marketing strategies.