Global Customer Relationship Management Market Overview

- The Global Customer Relationship Management Market is valued at USD 101 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing need for businesses to enhance customer engagement, streamline operations, and leverage data analytics for better decision-making. The rise of digital transformation initiatives, the integration of artificial intelligence, and the adoption of cloud-based and mobile CRM solutions across various sectors have further fueled the demand for CRM platforms, enabling organizations to build stronger relationships with their customers.

- Key players in this market include the United States, Germany, and the United Kingdom, which dominate due to their advanced technological infrastructure, high adoption rates of CRM solutions, and a strong presence of leading CRM vendors. The presence of a large number of SMEs in these regions also contributes to the market's growth, as these businesses increasingly recognize the importance of customer relationship management in driving sales and improving customer satisfaction. North America holds the largest market share, with the United States generating the highest CRM software revenue globally.

- The General Data Protection Regulation (GDPR), formally titled “Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016,” issued by the European Union, significantly impacts the CRM market by enforcing strict data protection and privacy requirements. This regulation mandates that organizations must obtain explicit consent from customers before collecting and processing their personal data, influencing how CRM systems are designed and operated to ensure compliance across all sectors handling EU customer data.

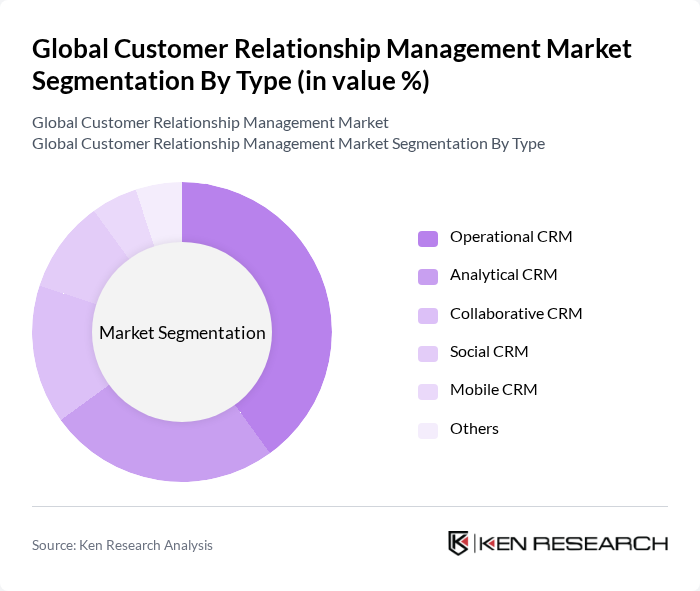

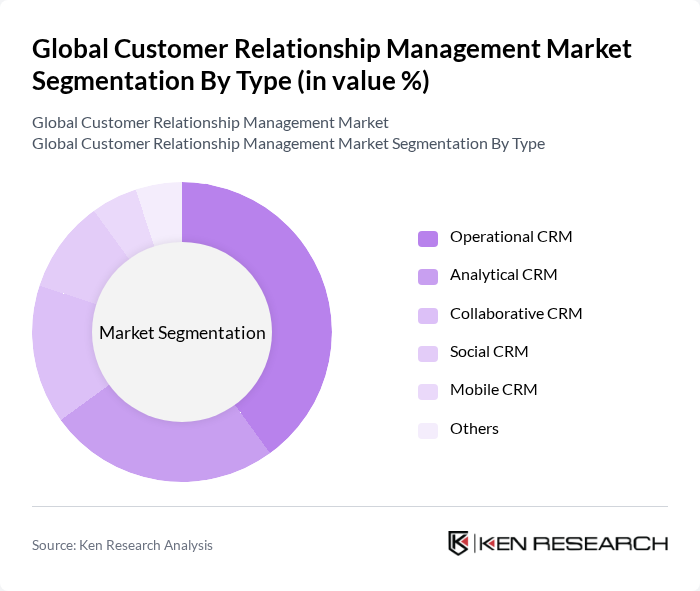

Global Customer Relationship Management Market Segmentation

By Type:The segmentation of the market by type includes Operational CRM, Analytical CRM, Collaborative CRM, Social CRM, Mobile CRM, and Others. Among these,Operational CRMis currently the leading sub-segment, as it focuses on automating and improving customer-facing processes, which is essential for businesses aiming to enhance customer service and streamline sales operations. The increasing demand for efficient customer management solutions, integration with marketing automation, and omnichannel engagement has led to a significant rise in the adoption of Operational CRM systems, making it a dominant force in the market.

By End-User:The market segmentation by end-user includes Small and Medium Enterprises (SMEs), Large Enterprises, Non-Profit Organizations, Government & Public Sector, and Others. TheSmall and Medium Enterprises (SMEs)segment is currently leading the market due to the increasing recognition of CRM systems as essential tools for enhancing customer engagement and driving sales growth. SMEs are increasingly adopting CRM solutions to compete effectively, leveraging cloud-based and mobile CRM offerings that cater to their specific needs, and benefiting from scalable, cost-effective platforms that support business expansion.

Global Customer Relationship Management Market Competitive Landscape

The Global Customer Relationship Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, HubSpot, Inc., Zoho Corporation Pvt. Ltd., Adobe Inc., Freshworks Inc., Pipedrive, Inc., Insightly Inc., SugarCRM Inc., Creatio, Pegasystems Inc., Copper CRM, Inc., Sage Group plc contribute to innovation, geographic expansion, and service delivery in this space.

Global Customer Relationship Management Market Industry Analysis

Growth Drivers

- Increasing Demand for Customer Engagement:The global push for enhanced customer engagement is evident, with businesses investing approximately $1.7 trillion in customer experience initiatives in future. This investment is driven by the need to improve customer retention rates, which can increase profits by 30% to 100%. Companies are focusing on personalized interactions, leading to a projected increase in CRM software adoption by 35% in sectors like retail and e-commerce, where customer engagement is critical.

- Rise of Cloud-Based Solutions:The shift towards cloud-based CRM solutions is accelerating, with the global cloud computing market expected to reach $1.8 trillion in future. This transition allows businesses to reduce IT costs by up to 25% while enhancing scalability and accessibility. As organizations increasingly adopt remote work policies, the demand for cloud-based CRM systems is projected to grow by 45%, enabling real-time data access and collaboration across teams, which is essential for modern customer relationship management.

- Integration of AI and Machine Learning:The integration of AI and machine learning technologies into CRM systems is transforming customer interactions. In future, the AI market is anticipated to reach $600 billion, with CRM applications accounting for a significant share. AI-driven analytics can enhance customer insights, leading to a 25% increase in sales productivity. Companies leveraging AI for customer segmentation and predictive analytics are expected to see a 20% improvement in customer satisfaction scores, driving further CRM adoption.

Market Challenges

- High Implementation Costs:The initial costs associated with implementing CRM systems can be a significant barrier for many businesses. In future, the average cost of deploying a comprehensive CRM solution is estimated at $160,000 for mid-sized companies. This includes software licensing, training, and integration expenses. Many organizations struggle to justify these costs, especially in uncertain economic climates, leading to slower adoption rates and potential underutilization of CRM capabilities.

- Data Privacy Concerns:With increasing regulations such as GDPR and CCPA, data privacy has become a critical challenge for CRM systems. In future, companies face potential fines exceeding $25 million for non-compliance with data protection laws. This has led to heightened scrutiny over customer data usage, causing organizations to invest heavily in compliance measures. The fear of data breaches and loss of customer trust can hinder CRM adoption, as businesses prioritize security over functionality.

Global Customer Relationship Management Market Future Outlook

The future of the CRM market is poised for significant transformation, driven by technological advancements and evolving customer expectations. As businesses increasingly prioritize customer experience, the integration of AI and automation will become essential for enhancing service delivery. Moreover, the shift towards omnichannel strategies will enable companies to engage customers across various platforms seamlessly. This evolution will likely lead to a more personalized approach in CRM, fostering deeper customer relationships and driving long-term loyalty in an increasingly competitive landscape.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present a significant opportunity for CRM growth, with an expected increase in technology adoption rates. In future, regions like Asia-Pacific are projected to see a 30% rise in CRM software usage, driven by increasing internet penetration and mobile device adoption. This growth will enable businesses to tap into new customer bases, enhancing their competitive edge in these rapidly developing economies.

- Increasing Adoption of Mobile CRM:The mobile CRM segment is set to expand, with an estimated 50% of CRM users expected to access systems via mobile devices in future. This trend is fueled by the growing reliance on mobile technology for business operations. Companies that invest in mobile-friendly CRM solutions can enhance their responsiveness and customer engagement, leading to improved sales performance and customer satisfaction in a mobile-first world.