Region:Asia

Author(s):Geetanshi

Product Code:KRAA6362

Pages:95

Published On:January 2026

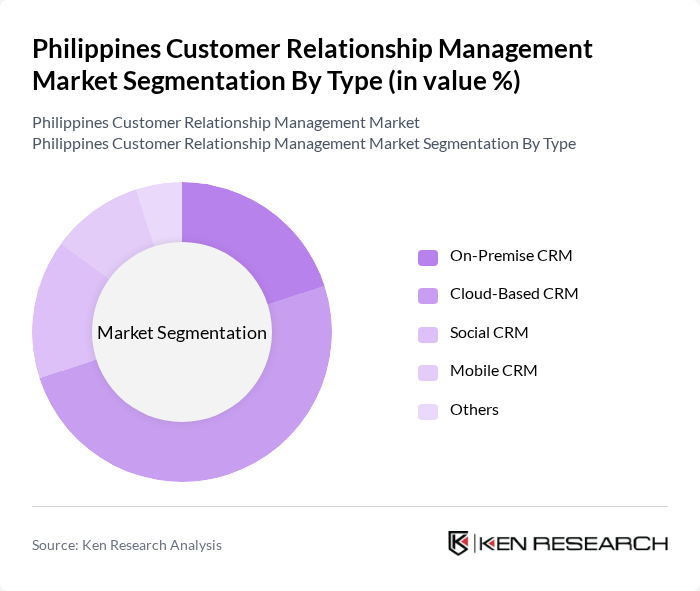

By Type:The CRM market can be segmented into various types, including On-Premise CRM, Cloud-Based CRM, Social CRM, Mobile CRM, and Others. Each of these segments caters to different business needs and preferences, with cloud-based solutions gaining significant traction due to their flexibility, cost-effectiveness, scalability, and remote accessibility.

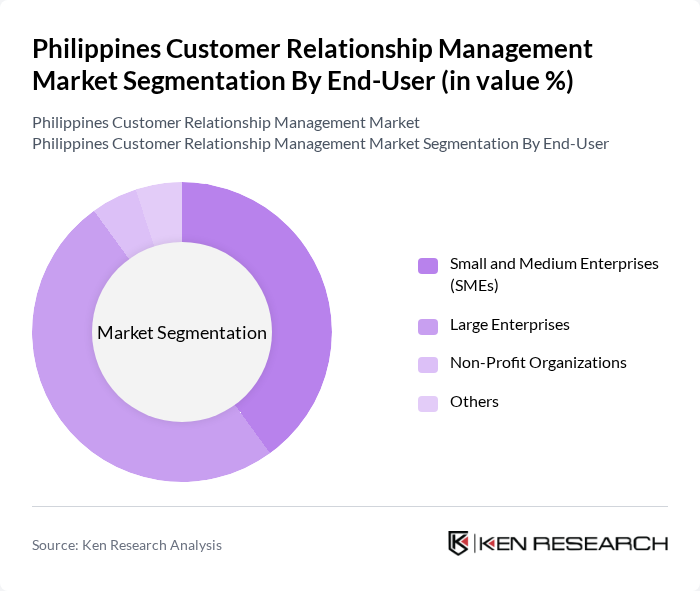

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Non-Profit Organizations, and Others. SMEs are increasingly adopting CRM solutions to enhance customer interactions and streamline operations, while large enterprises leverage advanced CRM systems for comprehensive customer insights and analytics.

The Philippines Customer Relationship Management market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, HubSpot, Zoho CRM, Microsoft Dynamics 365, Oracle CRM, SAP CRM, Freshworks, Pipedrive, SugarCRM, Insightly, Nimble, Close.io, Keap, Bitrix24, Agile CRM contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CRM market in the Philippines appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly recognize the importance of data-driven decision-making, the integration of AI and machine learning into CRM systems will enhance customer insights and engagement strategies. Furthermore, the shift towards omnichannel communication will enable companies to provide seamless experiences across various platforms, fostering stronger customer relationships and loyalty in the long term.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Cloud-Based CRM Social CRM Mobile CRM Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Non-Profit Organizations Others |

| By Industry Vertical | Retail Banking and Financial Services Telecommunications Healthcare Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Functionality | Sales Automation Marketing Automation Customer Service Automation Others |

| By Customer Type | B2B B2C C2C Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail CRM Adoption | 100 | Store Managers, Marketing Directors |

| Banking Sector CRM Strategies | 80 | Customer Service Managers, IT Heads |

| Telecommunications Customer Engagement | 75 | Product Managers, Customer Experience Officers |

| SME CRM Implementation | 90 | Business Owners, Operations Managers |

| Healthcare CRM Solutions | 70 | Practice Managers, IT Administrators |

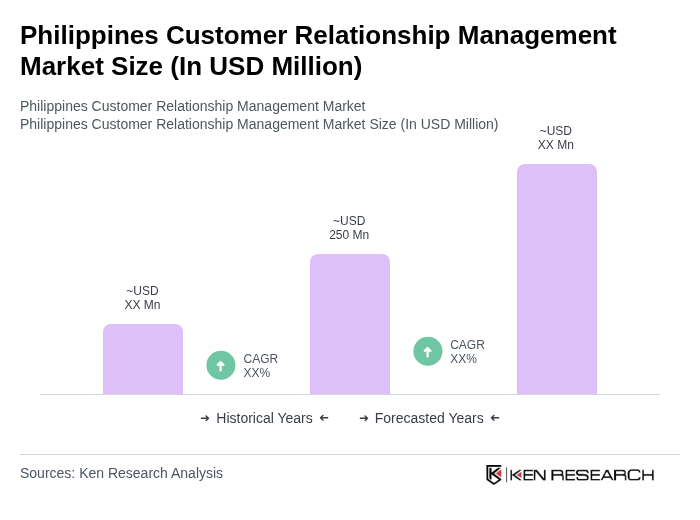

The Philippines Customer Relationship Management market is valued at approximately USD 250 million, reflecting significant growth driven by digital technology adoption, e-commerce expansion, and the integration of AI and analytics in CRM systems.