Region:Global

Author(s):Rebecca

Product Code:KRAB0304

Pages:100

Published On:August 2025

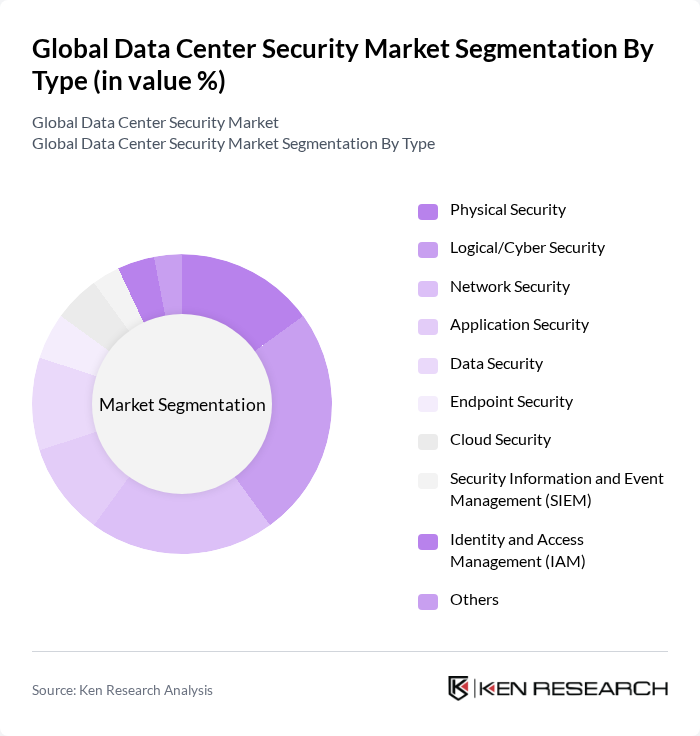

By Type:

The Logical/Cyber Security subsegment is currently dominating the market due to the increasing sophistication and frequency of cyber threats and the critical need for organizations to protect digital assets. As businesses accelerate migration to cloud and hybrid environments, the demand for robust cybersecurity solutions—including firewalls, intrusion detection systems, encryption, and AI-driven security—has surged. This trend is further fueled by global regulatory requirements and heightened awareness of data privacy and compliance.

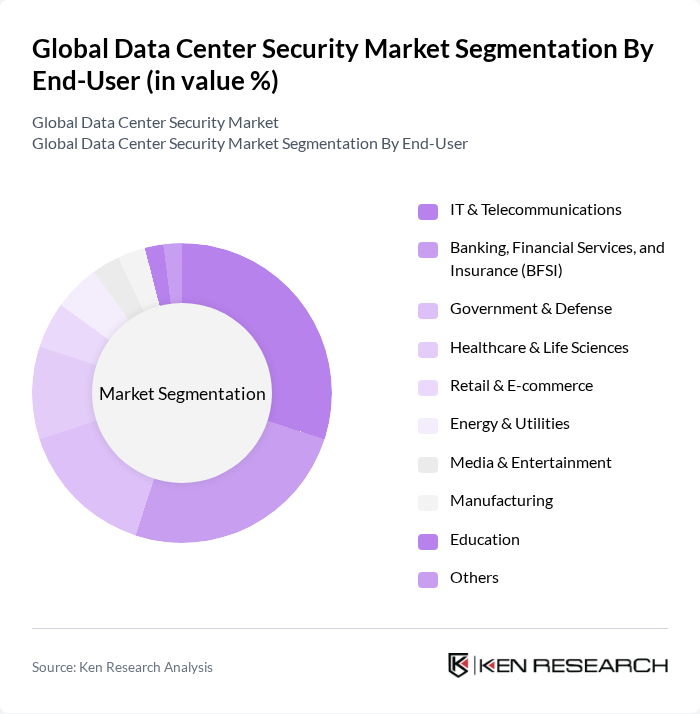

By End-User:

The IT & Telecommunications sector is the leading end-user in the data center security market, driven by rapid digital transformation, the proliferation of cloud services, and the management of vast volumes of sensitive data. Organizations in this sector prioritize advanced security measures to counter increasingly complex cyber threats. The BFSI sector is also a major contributor, as stringent regulatory requirements and the need for data integrity drive significant investments in security solutions. This trend is expected to persist as both sectors continue to evolve with new technologies and regulatory landscapes.

The Global Data Center Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., IBM Corporation, McAfee Corp., Trend Micro Incorporated, Trellix (formerly FireEye, Inc. and McAfee Enterprise), Splunk Inc., RSA Security LLC, CrowdStrike Holdings, Inc., Zscaler, Inc., CyberArk Software Ltd., Barracuda Networks, Inc., A10 Networks, Inc., Juniper Networks, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Broadcom Inc. (Symantec Enterprise Division), Imperva, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of data center security is poised for transformative growth, driven by technological advancements and evolving threat landscapes. As organizations increasingly adopt integrated security solutions, the focus will shift towards automation and AI-driven analytics to enhance threat detection and response capabilities. Additionally, the expansion of remote work will necessitate stronger security measures, prompting investments in innovative technologies that ensure data integrity and compliance with emerging regulations, ultimately shaping a more secure digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Logical/Cyber Security Network Security Application Security Data Security Endpoint Security Cloud Security Security Information and Event Management (SIEM) Identity and Access Management (IAM) Others |

| By End-User | IT & Telecommunications Banking, Financial Services, and Insurance (BFSI) Government & Defense Healthcare & Life Sciences Retail & E-commerce Energy & Utilities Media & Entertainment Manufacturing Education Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Component | Hardware Software Services (Consulting, Integration, Managed) |

| By Data Center Type | Hyperscale/Cloud Service Providers Colocation Enterprise & Edge |

| By Geography | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Singapore, Australia, Malaysia, Rest of Asia-Pacific) South America (Brazil, Chile, Argentina, Rest of South America) Middle East (UAE, Saudi Arabia, Turkey, Rest of Middle East) Africa (South Africa, Nigeria, Rest of Africa) |

| By Policy Support | Government Initiatives Industry Standards Incentives for Cybersecurity Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Security | 100 | IT Security Managers, Data Center Operations Heads |

| Cloud Service Provider Security | 80 | Cloud Security Architects, Compliance Officers |

| Colocation Facility Security | 60 | Facility Managers, Security Compliance Managers |

| Government Data Center Security | 50 | Government IT Directors, Cybersecurity Analysts |

| SME Data Center Security Solutions | 40 | IT Managers, Small Business Owners |

The Global Data Center Security Market is valued at approximately USD 18 billion, reflecting significant growth driven by increasing cyber threats, demand for data privacy, and the expansion of cloud and hybrid IT environments.