Region:Middle East

Author(s):Shubham

Product Code:KRAA8567

Pages:93

Published On:November 2025

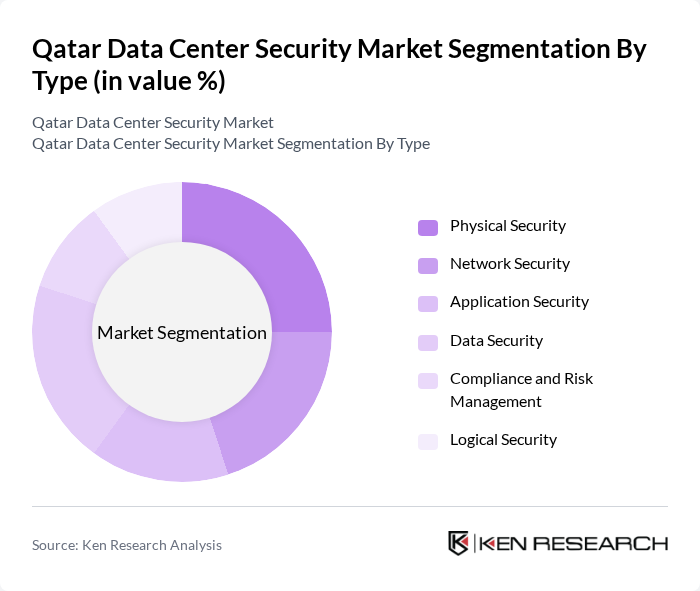

By Type:The market is segmented into various types of security solutions, including Physical Security, Network Security, Application Security, Data Security, Compliance and Risk Management, and Logical Security. Each of these segments plays a crucial role in addressing specific security needs within data centers. Physical Security focuses on access controls and surveillance, Network Security addresses firewall and intrusion detection, Application Security targets software vulnerabilities, Data Security ensures encryption and data loss prevention, Compliance and Risk Management covers regulatory adherence, and Logical Security manages user authentication and access rights .

The Physical Security segment is currently dominating the market due to the increasing need for physical access controls, surveillance systems, and environmental controls in data centers. Organizations are prioritizing the protection of their physical assets to prevent unauthorized access and ensure the safety of sensitive data. The rise in security breaches and theft incidents has further propelled investments in physical security measures, making it a critical focus area for data center operators .

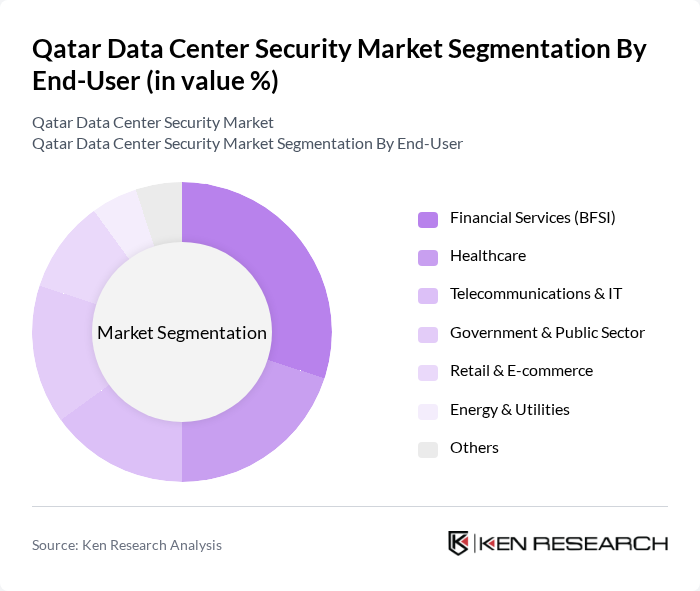

By End-User:The end-user segmentation includes Financial Services (BFSI), Healthcare, Telecommunications & IT, Government & Public Sector, Retail & E-commerce, Energy & Utilities, and Others. Each sector has unique security requirements that drive the demand for tailored solutions. Financial Services require advanced encryption and regulatory compliance, Healthcare focuses on patient data privacy, Telecommunications & IT need network integrity, Government emphasizes national security, Retail & E-commerce prioritize transaction security, and Energy & Utilities demand operational resilience .

The Financial Services (BFSI) sector is the leading end-user in the market, driven by stringent regulatory requirements and the need for robust data protection measures. Financial institutions are increasingly investing in advanced security solutions to safeguard sensitive customer information and comply with regulations. The high value of financial data and the potential impact of breaches make this sector a primary focus for security investments .

The Qatar Data Center Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo Qatar, Vodafone Qatar, Meeza, Gulf Bridge International (GBI), Qatar Data Center (QDC), Microsoft Qatar, IBM Qatar, Cisco Systems Qatar, Fortinet, Palo Alto Networks, Check Point Software Technologies, Trend Micro, McAfee, Huawei Technologies Qatar, Dell Technologies Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar data center security market appears promising, driven by technological advancements and increasing regulatory pressures. As organizations prioritize data protection, the integration of AI and machine learning into security protocols is expected to enhance threat detection and response capabilities. Furthermore, the government's commitment to fostering a secure digital landscape will likely lead to increased investments in data center security, ensuring compliance with evolving regulations and standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Network Security Application Security Data Security Compliance and Risk Management Logical Security |

| By End-User | Financial Services (BFSI) Healthcare Telecommunications & IT Government & Public Sector Retail & E-commerce Energy & Utilities Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation & Integration Services Managed Security Services Support and Maintenance |

| By Security Solution | Intrusion Detection & Prevention Systems (IDPS) Firewalls & Unified Threat Management Antivirus & Anti-Malware Software Encryption Solutions Identity & Access Management (IAM) Data Loss Prevention (DLP) Physical Security Systems (CCTV, Biometric Access) Others |

| By Industry Vertical | Energy and Utilities Manufacturing Transportation and Logistics Education Media & Entertainment Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Data Centers | 50 | IT Security Managers, Compliance Officers |

| Healthcare Data Centers | 40 | Data Protection Officers, IT Administrators |

| Telecommunications Data Centers | 40 | Network Security Engineers, Operations Managers |

| Cloud Service Providers | 45 | Security Architects, Product Managers |

| Government Data Centers | 40 | IT Directors, Cybersecurity Analysts |

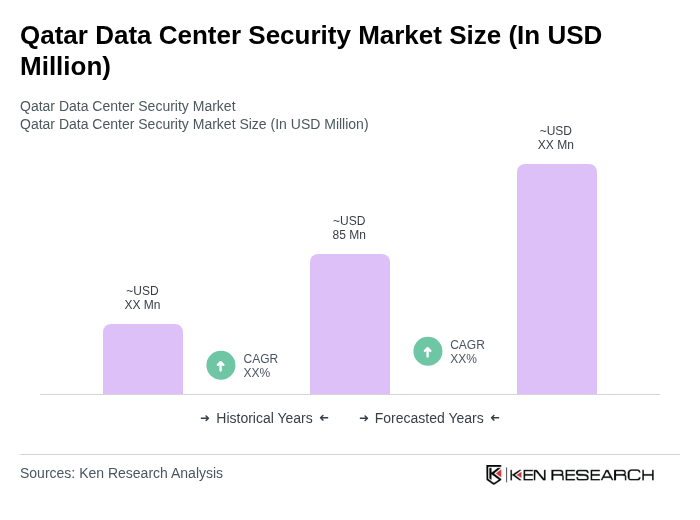

The Qatar Data Center Security Market is valued at approximately USD 85 million, reflecting a robust growth driven by increasing demand for data protection, regulatory compliance, and rising cyber threats in the region.