Region:Global

Author(s):Shubham

Product Code:KRAC0773

Pages:95

Published On:August 2025

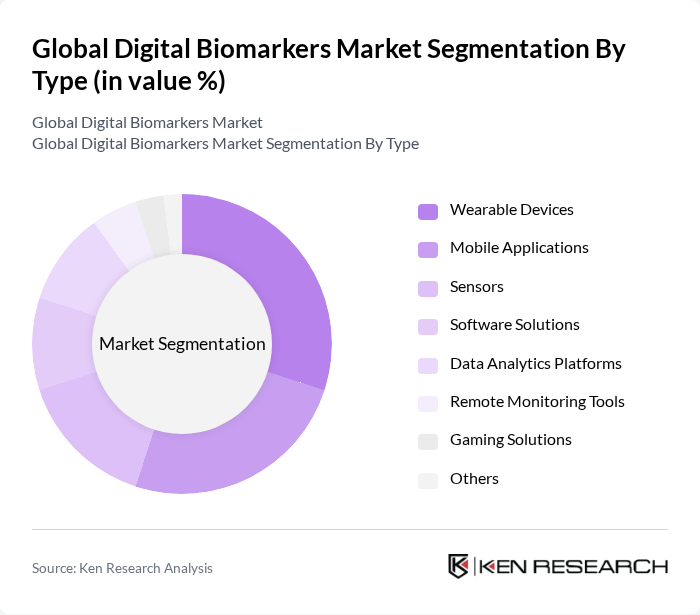

By Type:The market is segmented into various types, including wearable devices, mobile applications, sensors, software solutions, data analytics platforms, remote monitoring tools, gaming solutions, and others. Each of these subsegments plays a crucial role in the overall market dynamics. Wearable devices and mobile applications are at the forefront, driven by their widespread adoption for continuous health monitoring and patient engagement. Sensors and data analytics platforms are increasingly critical for real-time data collection and actionable insights, while remote monitoring tools and software solutions support clinical decision-making and chronic disease management. Gaming solutions are emerging as innovative tools for behavioral and cognitive assessments in clinical research and patient care.

The wearable devices segment is currently dominating the market due to the increasing consumer preference for health and fitness tracking. These devices provide real-time data and insights, which are essential for chronic disease management and preventive healthcare. The trend towards personalized health solutions and the growing awareness of health and wellness among consumers further bolster the demand for wearable technology. Additionally, advancements in sensor technology, artificial intelligence, and connectivity options have made these devices more accessible and user-friendly, contributing to their market leadership.

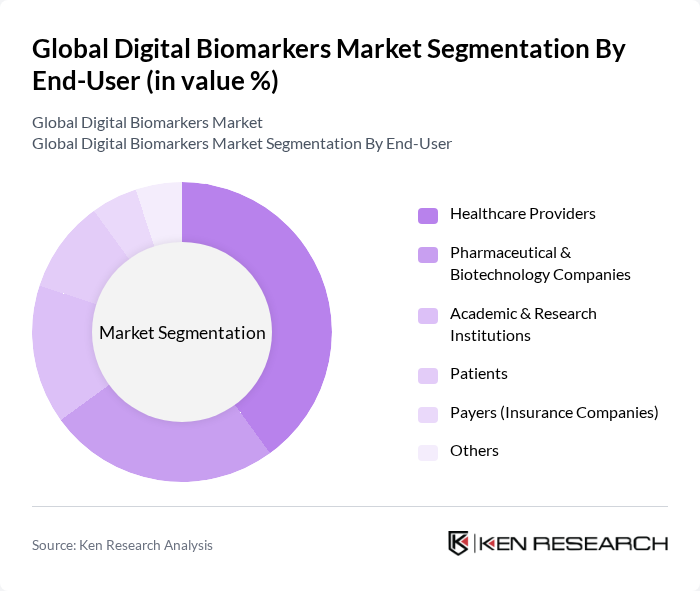

By End-User:The market is segmented by end-users, including healthcare providers, pharmaceutical and biotechnology companies, academic and research institutions, patients, payers (insurance companies), and others. Each segment has unique needs and contributes differently to the market. Healthcare providers are the largest end-users, leveraging digital biomarkers for enhanced patient monitoring, chronic disease management, and integration into telehealth services. Pharmaceutical and biotechnology companies use digital biomarkers for clinical trial optimization and drug development, while academic and research institutions drive innovation through validation studies. Patients are increasingly engaged through self-monitoring tools, and payers are adopting digital biomarkers to support value-based care and reimbursement models.

Healthcare providers are the leading end-users in the market, driven by the need for efficient patient monitoring and management solutions. The integration of digital biomarkers into clinical workflows enhances patient care and outcomes, making them indispensable tools for healthcare professionals. The increasing adoption of telehealth services, remote monitoring solutions, and AI-powered diagnostic tools has further solidified the position of healthcare providers as the primary consumers of digital biomarkers.

The Global Digital Biomarkers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, IBM Watson Health, Fitbit, Inc. (now part of Google), Apple Inc., Biogen Inc., Roche Diagnostics, Siemens Healthineers, Medtronic plc, Omron Healthcare, Inc., AliveCor, Inc., DarioHealth Corp., BioTelemetry, Inc. (now part of Philips), Clario (formerly ERT, Inc.), Evidation Health, Inc., Pear Therapeutics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital biomarkers market in future appears promising, driven by technological advancements and increasing healthcare demands. As telehealth services expand, the integration of AI and machine learning will enhance the accuracy and efficiency of digital biomarkers. Furthermore, the development of regulatory frameworks will facilitate the safe use of these technologies, ensuring patient data protection while promoting innovation. This evolving landscape is expected to foster greater collaboration between healthcare providers and technology companies, ultimately improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Devices Mobile Applications Sensors Software Solutions Data Analytics Platforms Remote Monitoring Tools Gaming Solutions Others |

| By End-User | Healthcare Providers Pharmaceutical & Biotechnology Companies Academic & Research Institutions Patients Payers (Insurance Companies) Others |

| By Application | Chronic Disease Management Drug Development & Clinical Trials Diagnostic & Early Detection Monitoring & Predictive Insights Preventive Healthcare Personalized Medicine Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Customer Type | B2B B2C Government Non-Profit Organizations Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management | 120 | Healthcare Providers, Clinical Researchers |

| Wearable Technology Adoption | 90 | Technology Developers, Product Managers |

| Patient Engagement Strategies | 60 | Patient Advocates, Health Coaches |

| Regulatory Compliance in Digital Health | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends in Digital Biomarkers | 70 | Market Analysts, Business Development Managers |

The Global Digital Biomarkers Market is valued at approximately USD 5.1 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases, demand for remote patient monitoring, and advancements in digital health technologies.