Region:Middle East

Author(s):Shubham

Product Code:KRAD0990

Pages:90

Published On:November 2025

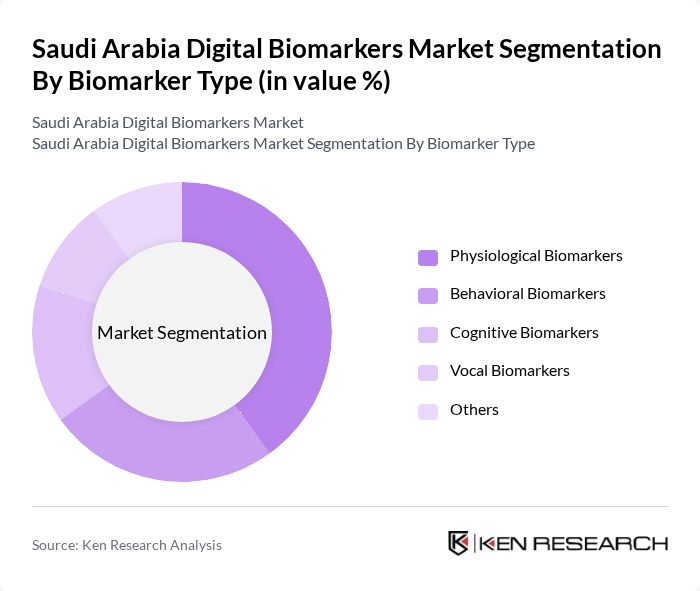

By Biomarker Type:The market is segmented into various biomarker types, including physiological, behavioral, cognitive, vocal, and others. Each of these subsegments plays a crucial role in the overall market dynamics, with specific applications and technologies driving their growth. Physiological and behavioral biomarkers together account for over 60% of the digital biomarkers market demand, reflecting the strong adoption of wearable and sensor-based health monitoring solutions .

The physiological biomarkers segment is currently dominating the market due to their extensive application in monitoring vital signs and chronic disease management. These biomarkers are crucial for real-time health monitoring, which is increasingly being adopted by healthcare providers and patients alike. The growing trend of wearable health devices that track physiological parameters such as heart rate, blood pressure, and glucose levels is significantly contributing to the market's growth in this segment. As a result, physiological biomarkers are expected to maintain their leadership position in the market .

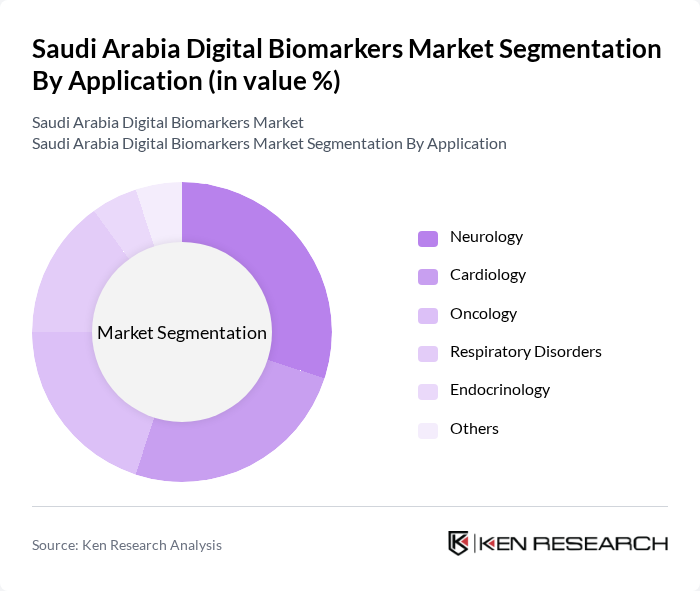

By Application:The applications of digital biomarkers are diverse, including neurology, cardiology, oncology, respiratory disorders, endocrinology, and others. Each application area utilizes specific biomarkers to enhance diagnosis, treatment, and patient management. Neurology and cardiology together represent the largest share, reflecting the high demand for digital solutions in managing neurological and cardiovascular diseases .

Among the application segments, neurology is leading the market due to the increasing prevalence of neurological disorders such as Alzheimer's and Parkinson's disease. The demand for early diagnosis and continuous monitoring of these conditions is driving the adoption of digital biomarkers in neurology. Additionally, advancements in neuroimaging, wearable technologies, and AI-powered analytics are enhancing the capabilities of neurological assessments, further solidifying this segment's dominance in the market .

The Saudi Arabia Digital Biomarkers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, IBM Watson Health, Medtronic, Roche Diagnostics, Abbott Laboratories, BioTelemetry, Inc. (now part of Philips), Omada Health, Fitbit, Inc. (now part of Google), Apple Inc., Samsung Health, Cerner Corporation (now part of Oracle Health), DarioHealth Corp., WellDoc, LifeScan, King Faisal Specialist Hospital & Research Centre, Saudi German Health, Altibbi, Vezeeta, Tawuniya (Company for Cooperative Insurance) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital biomarkers market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare demands. As the government continues to invest in healthcare infrastructure, the integration of digital health solutions will likely accelerate. Furthermore, the growing emphasis on preventive care and chronic disease management will enhance the adoption of digital biomarkers. Collaborative efforts between healthcare providers and technology firms will also foster innovation, ensuring that the market remains dynamic and responsive to patient needs.

| Segment | Sub-Segments |

|---|---|

| By Biomarker Type | Physiological Biomarkers Behavioral Biomarkers Cognitive Biomarkers Vocal Biomarkers Others |

| By Application | Neurology Cardiology Oncology Respiratory Disorders Endocrinology Others |

| By Platform | Wearables Mobile Apps Biosensors Digital Platforms Others |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By End User | Pharmaceutical & Biopharma Companies Contract Research Organizations (CROs) Healthcare Providers Payers Academic & Research Institutes Patients |

| By Distribution Channel | Direct Sales Online Retail Distributors Partnerships with Healthcare Providers Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Grants Tax Incentives Research Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Nurses, Health Administrators |

| Digital Health Startups | 60 | Founders, Product Managers, R&D Heads |

| Patients Using Digital Biomarkers | 50 | Chronic Disease Patients, Wellness Program Participants |

| Regulatory Bodies | 40 | Policy Makers, Health Regulators |

| Technology Developers | 40 | Software Engineers, Data Scientists, UX Designers |

The Saudi Arabia Digital Biomarkers Market is valued at approximately USD 740 million, driven by the increasing prevalence of chronic diseases, the adoption of digital health technologies, and the demand for personalized medicine.