Region:Global

Author(s):Geetanshi

Product Code:KRAA2817

Pages:90

Published On:August 2025

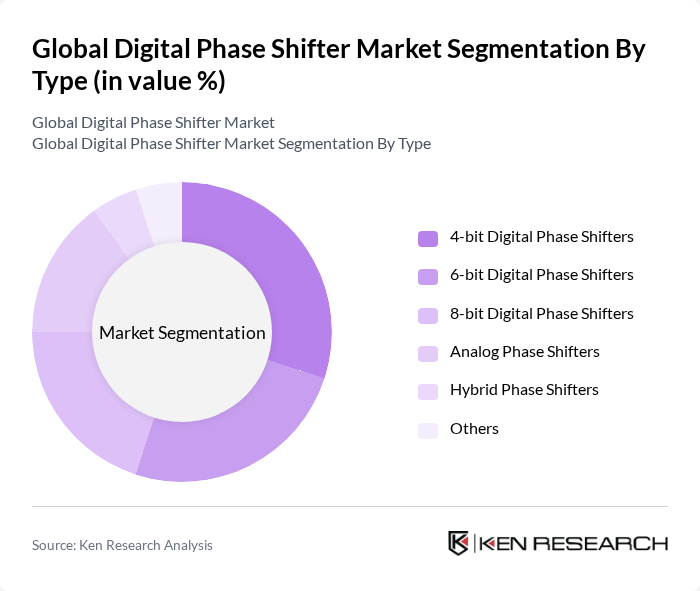

By Type:The digital phase shifter market is segmented into various types, including 4-bit, 6-bit, 8-bit, analog, hybrid, and others. Among these, 4-bit digital phase shifters are gaining traction due to their cost-effectiveness and suitability for a wide range of applications. The increasing demand for compact and efficient devices in telecommunications and consumer electronics is driving the growth of this segment. Hardware innovation, such as the migration from GaAs to GaN and SiGe-BiCMOS cores, is enabling higher power handling and improved phase accuracy in next-generation devices .

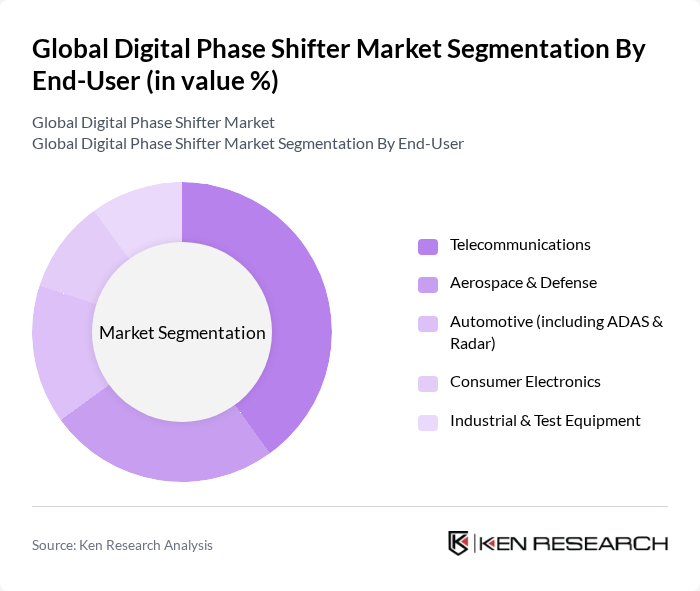

By End-User:The end-user segmentation includes telecommunications, aerospace & defense, automotive, consumer electronics, and industrial & test equipment. The telecommunications sector is the dominant end-user, driven by the rapid deployment of 5G networks and the need for advanced communication systems. This sector's growth is fueled by increasing data consumption, the rollout of massive-MIMO infrastructure, and the demand for high-speed, low-latency connectivity. Aerospace & defense applications are also significant, leveraging digital phase shifters for AESA radar modernization and satellite communications .

The Global Digital Phase Shifter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Analog Devices, Inc., Texas Instruments Incorporated, NXP Semiconductors N.V., Qorvo, Inc., Broadcom Inc., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Skyworks Solutions, Inc., MACOM Technology Solutions Holdings, Inc., Mini-Circuits, Teledyne Technologies Incorporated, Aelius Semiconductors, Peregrine Semiconductor (pSemi Corporation), L3Harris Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital phase shifter market appears promising, driven by technological advancements and increasing demand across various sectors. As 5G networks expand, the need for efficient signal processing will continue to rise, fostering innovation in digital phase shifter technologies. Additionally, the integration of artificial intelligence in signal processing is expected to enhance performance and efficiency, paving the way for new applications and market growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | bit Digital Phase Shifters bit Digital Phase Shifters bit Digital Phase Shifters Analog Phase Shifters Hybrid Phase Shifters Others |

| By End-User | Telecommunications Aerospace & Defense Automotive (including ADAS & Radar) Consumer Electronics Industrial & Test Equipment |

| By Application | Satellite Communication Radar Systems (Military & Civil) Wireless Communication (5G/6G, mmWave) Electronic Warfare Broadcasting Others |

| By Component | RF Integrated Circuits (RFICs) MMICs (Monolithic Microwave ICs) Control Circuits Power Supply Units Others |

| By Frequency Range | –10 GHz –40 GHz Above 40 GHz |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Price Range | Low Price Mid Price High Price |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Infrastructure | 100 | Network Engineers, RF Design Specialists |

| Aerospace Applications | 60 | Systems Engineers, Aerospace Technicians |

| Consumer Electronics | 50 | Product Development Managers, Electronics Engineers |

| Automotive Industry | 40 | Automotive Engineers, R&D Managers |

| Industrial Automation | 45 | Operations Managers, Automation Specialists |

The Global Digital Phase Shifter Market is valued at approximately USD 820 million, driven by the increasing demand for advanced communication systems in sectors like telecommunications and aerospace, particularly with the rapid deployment of 5G technologies.