Region:Asia

Author(s):Shubham

Product Code:KRAC0733

Pages:86

Published On:August 2025

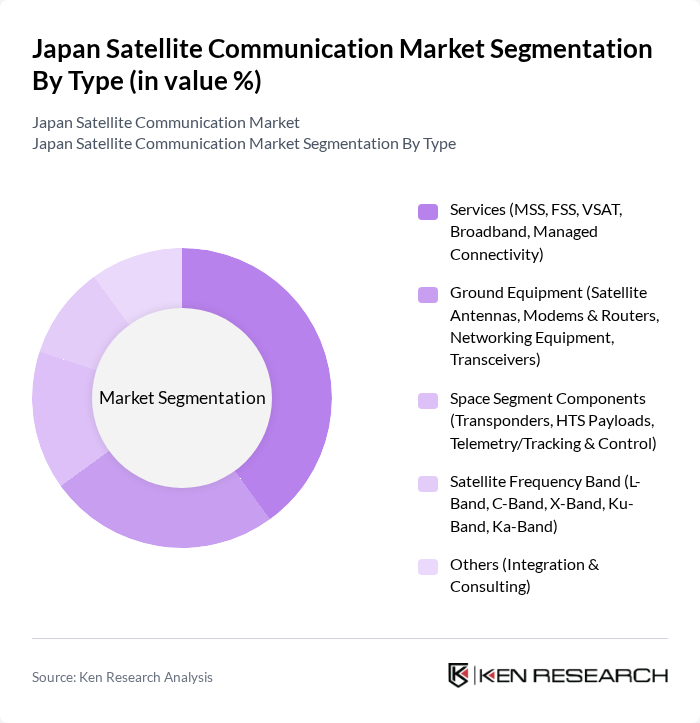

By Type:The market is segmented into various types, including services, ground equipment, space segment components, satellite frequency bands, and others. Each of these segments plays a crucial role in the overall functionality and efficiency of satellite communication systems.

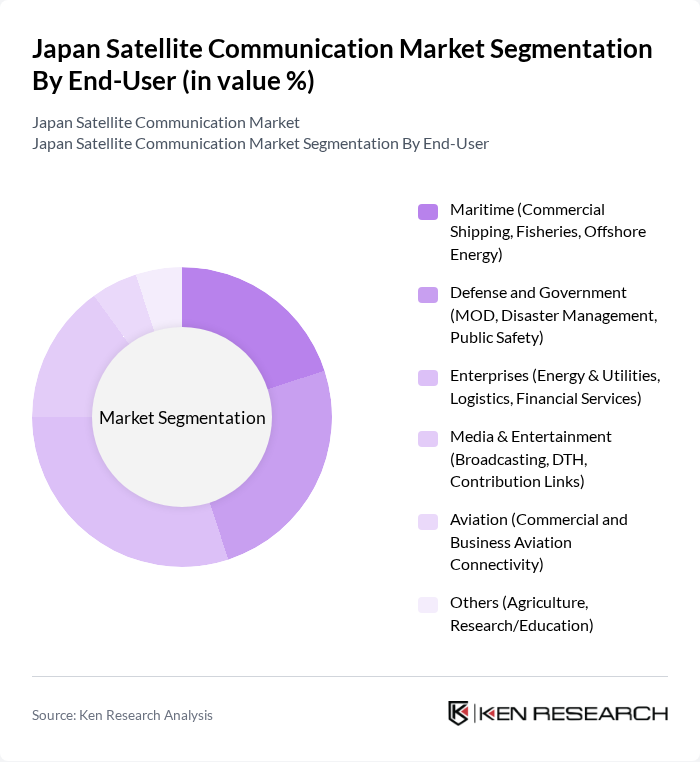

By End-User:The end-user segmentation includes various sectors such as maritime, defense and government, enterprises, media and entertainment, aviation, and others. Each sector utilizes satellite communication for different applications, contributing to the overall market growth.

The Japan Satellite Communication Market is characterized by a dynamic mix of regional and international players. Leading participants such as SKY Perfect JSAT Corporation, NEC Corporation, KDDI Corporation, SoftBank Corp., NTT DOCOMO, Inc., Mitsubishi Electric Corporation, Fujitsu Limited, Panasonic Avionics Corporation, Intelsat, SES, Eutelsat Group, Inmarsat (a Viasat company), Viasat, Inc., Telesat, and Iridium Communications Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite communication market in Japan appears promising, driven by technological advancements and increasing demand for connectivity. The shift towards low Earth orbit (LEO) satellites is expected to enhance service delivery and reduce latency, making satellite communication more competitive with terrestrial options. Additionally, the integration of artificial intelligence in satellite operations will optimize resource management and improve data analytics, further enhancing service offerings and operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Services (MSS, FSS, VSAT, Broadband, Managed Connectivity) Ground Equipment (Satellite Antennas, Modems & Routers, Networking Equipment, Transceivers) Space Segment Components (Transponders, HTS Payloads, Telemetry/Tracking & Control) Satellite Frequency Band (L-Band, C-Band, X-Band, Ku-Band, Ka-Band) Others (Integration & Consulting) |

| By End-User | Maritime (Commercial Shipping, Fisheries, Offshore Energy) Defense and Government (MOD, Disaster Management, Public Safety) Enterprises (Energy & Utilities, Logistics, Financial Services) Media & Entertainment (Broadcasting, DTH, Contribution Links) Aviation (Commercial and Business Aviation Connectivity) Others (Agriculture, Research/Education) |

| By Application | Broadband & Backhaul (HTS/LEO backhaul, Rural connectivity) Mobility Services (Maritime, Aero, Land-mobile) Enterprise Data & IoT (M2M, Asset tracking, SCADA) Broadcast & Media (DTH, Occasional Use, Contribution/Distribution) Government & Defense Communications (Secure voice/data, ISR support) Others (Emergency/Disaster Recovery, Telemedicine, Education) |

| By Service Type | Capacity Leasing (FSS, HTS, Managed Capacity) Mobile Satellite Services (Voice, Data, Push-to-Talk) VSAT Services (Corporate networks, Maritime VSAT, Aero IFC) Earth Observation & Data Services (EO downlink, Data distribution) Managed Services & Integration (SLA-backed end-to-end) |

| By Distribution Channel | Direct (Operators to Enterprise/Government) Service Providers/ISPs & System Integrators Channel Partners/Resellers (Maritime/Aero specialists) Online & Self-Service Portals |

| By Pricing Model | Subscription/Commitment (Monthly bandwidth commitments) Usage-Based/Pay-As-You-Go (Metered data, burstable) SLA-Based/Managed Service Bundles Project/One-Time (Installation, Integration, EO tasking) |

| By Customer Segment | Large Enterprises SMEs Government & Defense Agencies Individual & Prosumer Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Services | 100 | Broadcast Engineers, Media Executives |

| Government Communication Systems | 80 | Government Officials, Policy Makers |

| Commercial Satellite Internet | 120 | IT Managers, Network Administrators |

| Aerospace and Defense Applications | 70 | Defense Contractors, Aerospace Engineers |

| Rural Connectivity Solutions | 90 | Community Leaders, Telecommunications Planners |

The Japan Satellite Communication Market is valued at approximately USD 5.6 billion, driven by the increasing demand for high-speed connectivity and advancements in satellite technology, including HTS/Ka-band and LEOGEO multi-orbit services.