Region:Global

Author(s):Dev

Product Code:KRAA2550

Pages:100

Published On:August 2025

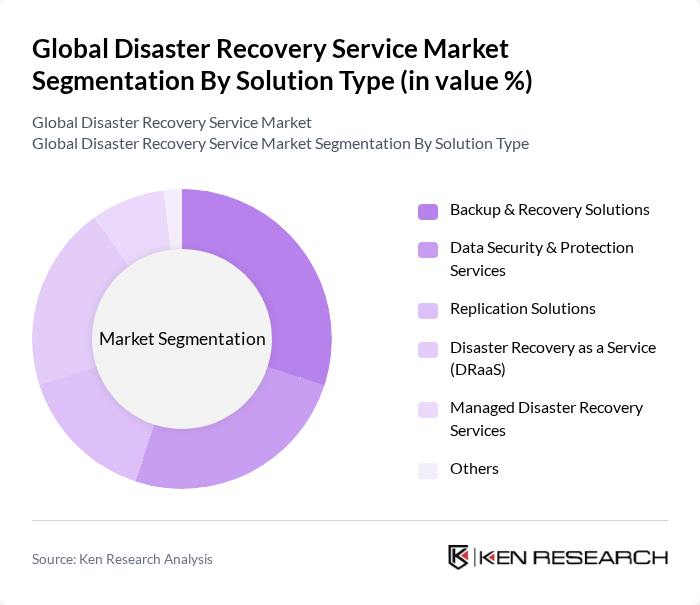

By Solution Type:The solution type segmentation includes various subsegments that cater to different aspects of disaster recovery. The primary subsegments are Backup & Recovery Solutions, Data Security & Protection Services, Replication Solutions, Disaster Recovery as a Service (DRaaS), Managed Disaster Recovery Services, and Others. Each of these subsegments plays a crucial role in ensuring data integrity and availability during unforeseen events.

The Backup & Recovery Solutions subsegment is currently dominating the market due to the increasing reliance on data and the necessity for organizations to have reliable backup systems in place. This trend is driven by the growing volume of data generated and the need for quick recovery options in case of data loss. Organizations are prioritizing solutions that offer seamless backup and recovery processes, which enhances their operational efficiency and minimizes downtime .

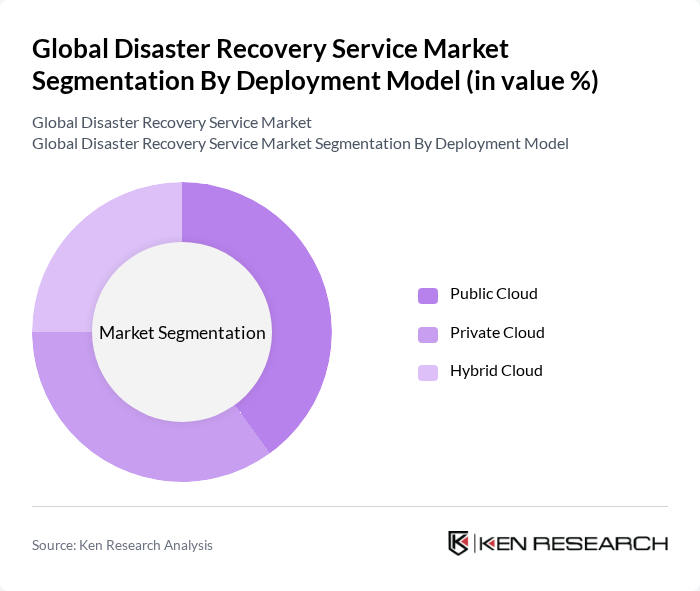

By Deployment Model:The deployment model segmentation includes Public Cloud, Private Cloud, and Hybrid Cloud. Each model offers distinct advantages, catering to different organizational needs and preferences regarding data security, accessibility, and cost-effectiveness.

The Public Cloud deployment model is leading the market due to its scalability, cost-effectiveness, and ease of access. Organizations are increasingly adopting public cloud solutions for disaster recovery as they provide flexible resources and reduce the need for significant upfront investments in infrastructure. This model is particularly appealing to small and medium enterprises (SMEs) that require robust disaster recovery solutions without the associated high costs of private cloud setups .

The Global Disaster Recovery Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Dell Technologies Inc., VMware Inc., Acronis International GmbH, Zerto Inc., Commvault Systems Inc., Veritas Technologies LLC, Arcserve LLC, Sungard Availability Services, Datto Inc., Rackspace Technology Inc., Iron Mountain Incorporated, Barracuda Networks Inc., Veeam Software, Amazon Web Services, Inc. (AWS), Google LLC (Google Cloud), Fujitsu Limited, Hewlett Packard Enterprise (HPE), Cisco Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the disaster recovery service market is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid recovery solutions, the integration of cloud and on-premises strategies will become more prevalent. Additionally, the focus on cybersecurity will intensify, with businesses prioritizing secure recovery processes to protect sensitive data. This shift will create a dynamic landscape where innovative solutions and strategic partnerships will play a crucial role in shaping recovery practices and enhancing resilience.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Backup & Recovery Solutions Data Security & Protection Services Replication Solutions Disaster Recovery as a Service (DRaaS) Managed Disaster Recovery Services Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-Use Industry | BFSI (Banking, Financial Services, and Insurance) Government & Public Sector Healthcare IT & Telecommunications Manufacturing Retail Energy & Utilities Education Others |

| By Service Provider | Cloud Service Providers Managed Service Providers Telecom Service Providers Others |

| By Geographic Coverage | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Payment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Disaster Recovery Services | 100 | IT Managers, Chief Information Officers |

| Infrastructure Restoration Services | 60 | Project Managers, Civil Engineers |

| Consulting Services for Disaster Preparedness | 40 | Disaster Recovery Consultants, Risk Management Officers |

| Emergency Response Training Programs | 50 | Training Coordinators, Safety Officers |

| Business Continuity Planning Services | 45 | Business Continuity Managers, Operations Directors |

The Global Disaster Recovery Service Market is valued at approximately USD 13.8 billion, reflecting a significant investment by organizations in disaster recovery solutions to protect data and ensure business continuity amid increasing cyber threats and natural disasters.