Region:Global

Author(s):Rebecca

Product Code:KRAA2463

Pages:100

Published On:August 2025

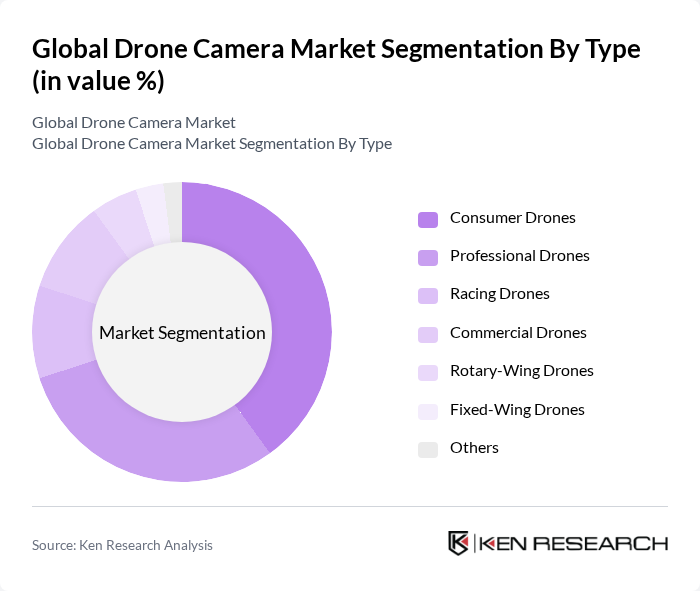

By Type:The market is segmented into various types of drones, each catering to distinct consumer needs and applications. The primary subsegments include Consumer Drones, Professional Drones, Racing Drones, Commercial Drones, Rotary-Wing Drones, Fixed-Wing Drones, and Others. Consumer Drones are gaining significant traction due to affordability, user-friendly interfaces, and widespread adoption among hobbyists and casual users. Professional Drones are preferred by businesses for advanced features such as autonomous flight modes, high-resolution imaging, and integration with specialized sensors for commercial and industrial applications.

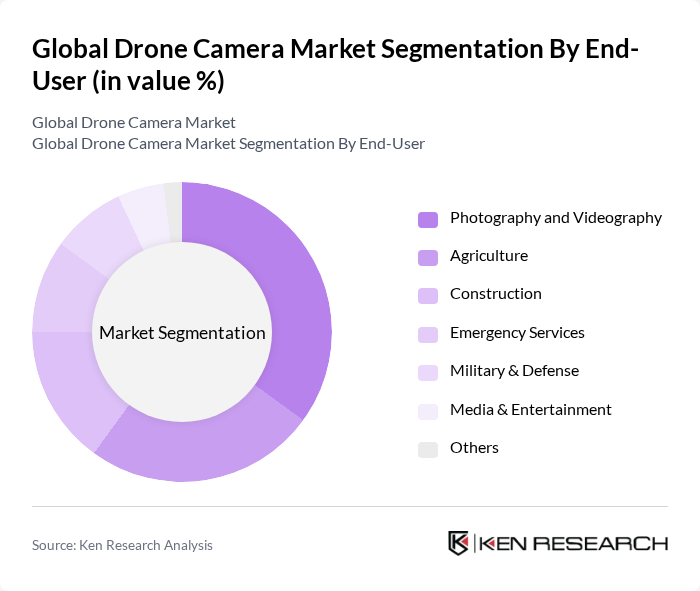

By End-User:The end-user segmentation reflects the diverse industries utilizing drone cameras, including Photography and Videography, Agriculture, Construction, Emergency Services, Military & Defense, Media & Entertainment, and Others. The Photography and Videography segment remains dominant, driven by the increasing popularity of aerial shots in both personal and commercial projects. Agriculture is a rapidly expanding segment, as farmers adopt drone technology for crop monitoring, precision farming, and resource management. Construction and emergency services also show robust growth due to the need for real-time aerial data and monitoring.

The Global Drone Camera Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A., Yuneec International Co., Ltd., Autel Robotics Co., Ltd., Skydio, Inc., GoPro, Inc., senseFly SA, Delair SAS, Insitu, Inc. (a Boeing Company), Aeryon Labs Inc. (FLIR Systems), Kespry, Inc., Wingtra AG, Quantum Systems GmbH, Flyability SA, EHang Holdings Limited, AiDrones GmbH, Canon Inc., Panasonic Corporation, Sony Group Corporation, Guangzhou EHang Intelligent Technology Co., Ltd., Shenzhen Dajiang Lingmou Technology Co., Ltd. (iFlight Technology Company Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drone camera market appears promising, driven by technological advancements and increasing adoption across various sectors. As industries continue to recognize the value of aerial imagery, the integration of AI and machine learning will enhance operational efficiency and data analysis capabilities. Furthermore, the shift towards hybrid drone models, which combine traditional and advanced features, is expected to cater to a broader range of applications, ensuring sustained growth and innovation in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Drones Professional Drones Racing Drones Commercial Drones Rotary-Wing Drones Fixed-Wing Drones Others |

| By End-User | Photography and Videography Agriculture Construction Emergency Services Military & Defense Media & Entertainment Others |

| By Application | Aerial Photography Surveying and Mapping Inspection and Monitoring Delivery Services Precision Agriculture Infrastructure Inspection Surveillance & Security Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Budget Drones Mid-Range Drones Premium Drones Others |

| By Camera Quality | SD Cameras HD Cameras K Cameras K Cameras Thermal Cameras Multispectral Cameras Others |

| By Payload Capacity | Light Payload Drones Medium Payload Drones Heavy Payload Drones Others |

| By Resolution | Up to 12 MP to 20 MP to 32 MP Above 32 MP |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drone Camera Users | 100 | Agronomists, Farm Managers |

| Real Estate Drone Photography | 60 | Real Estate Agents, Marketing Directors |

| Film and Media Production | 50 | Directors, Cinematographers |

| Surveying and Mapping Applications | 40 | Surveyors, GIS Specialists |

| Drone Service Providers | 70 | Business Owners, Operations Managers |

The Global Drone Camera Market is valued at approximately USD 11.2 billion, reflecting significant growth driven by advancements in camera technology and increasing demand across various industries such as agriculture, construction, and surveillance.