Region:Global

Author(s):Rebecca

Product Code:KRAA1367

Pages:89

Published On:August 2025

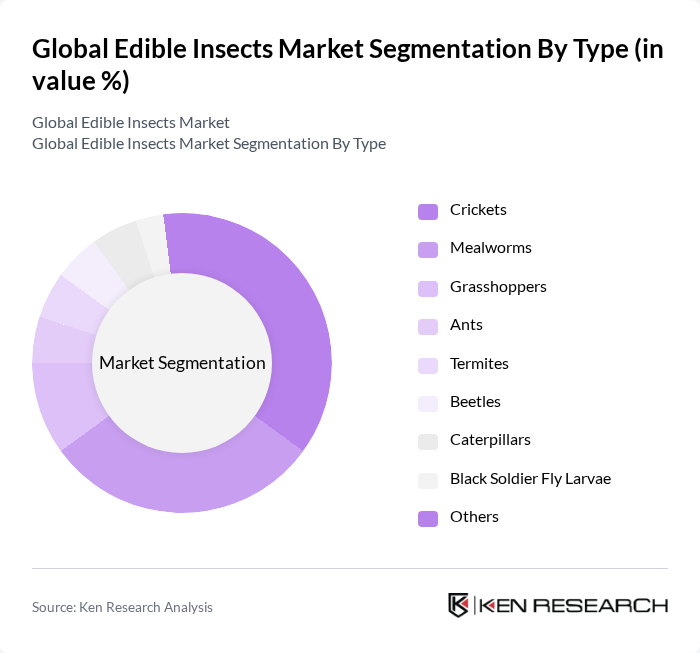

By Type:The edible insects market is segmented into various types, including Crickets, Mealworms, Grasshoppers, Ants, Termites, Beetles, Caterpillars, Black Soldier Fly Larvae, and Others. Among these, crickets and mealworms are the most popular due to their high protein content, efficient feed conversion, and versatility in food and feed applications. Crickets are particularly favored for their nutritional profile and are widely used in protein bars, snacks, and powders, while mealworms are gaining traction in both animal feed and human food products due to their mild flavor and ease of farming .

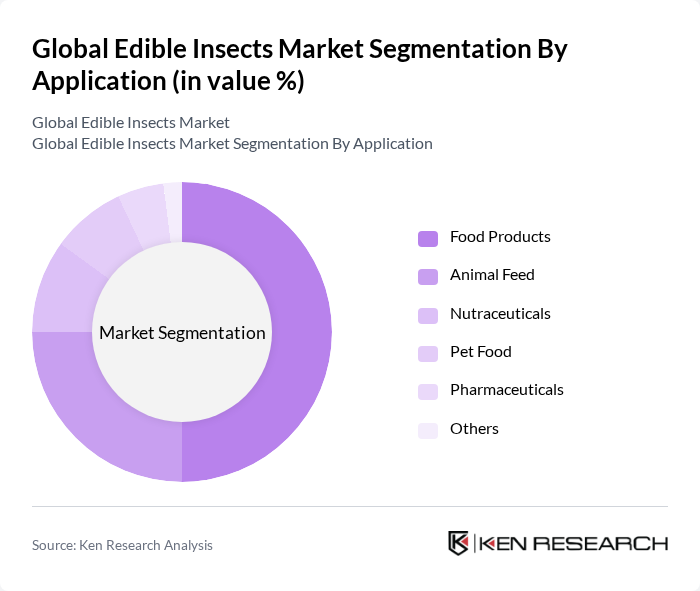

By Application:The applications of edible insects include Food Products, Animal Feed, Nutraceuticals, Pet Food, Pharmaceuticals, and Others. The food products segment is the most significant, driven by the rising trend of protein-rich snacks, functional foods, and sustainable health foods. Insect protein is increasingly being incorporated into protein bars, snacks, baked goods, and meat alternatives, appealing to health-conscious consumers and those seeking environmentally friendly protein sources. Animal feed and pet food segments are also expanding rapidly due to the nutritional benefits and cost-effectiveness of insect-based ingredients .

The Global Edible Insects Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aspire Food Group, Exo Protein, Cricket Flours, Tiny Farms, Protix, Ynsect, Bugsolutely, Eat Grub, Six Foods, The Cricket Company, Hargol FoodTech, AgriProtein, Gourmet Grubb, Beta Bugs, Innovafeed, FarmInsect, LIVIN farms, Haocheng Mealworms, Beta Hatch contribute to innovation, geographic expansion, and service delivery in this space.

The future of the edible insects market appears promising, driven by increasing consumer awareness and a shift towards sustainable food sources. Innovations in farming technologies and product development are expected to enhance production efficiency and product variety. As more companies enter the market, competition will likely spur further advancements. Additionally, collaborations with established food brands will facilitate wider acceptance and distribution, paving the way for a more robust market presence in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Crickets Mealworms Grasshoppers Ants Termites Beetles Caterpillars Black Soldier Fly Larvae Others |

| By Application | Food Products Animal Feed Nutraceuticals Pet Food Pharmaceuticals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Food Service (Restaurants, Cafés) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Consumer Segment | Health-Conscious Consumers Environmentally Conscious Consumers Gourmet Food Enthusiasts Pet Owners Livestock Producers Others |

| By Product Form | Whole Insects Insect Powder Insect Protein Bars Insect Snacks Insect Oil Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Insect Farming Operations | 60 | Farm Owners, Production Managers |

| Food Product Manufacturers | 60 | Product Development Managers, Quality Assurance Officers |

| Retailers of Edible Insects | 40 | Category Managers, Purchasing Agents |

| Consumers of Edible Insects | 100 | Health-Conscious Consumers, Sustainability Advocates |

| Regulatory Bodies | 40 | Food Safety Inspectors, Policy Makers |

The Global Edible Insects Market is valued at approximately USD 4.0 billion, driven by increasing consumer awareness of sustainable food sources, rising protein demand, and the environmental benefits of insect farming.