Region:Global

Author(s):Geetanshi

Product Code:KRAA1238

Pages:95

Published On:August 2025

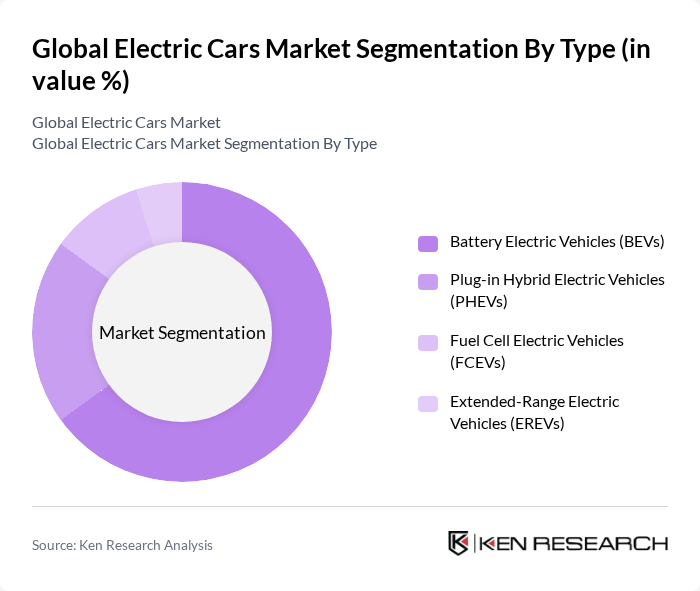

By Type:The electric cars market is segmented into four main types: Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), and Extended-Range Electric Vehicles (EREVs). Among these, Battery Electric Vehicles (BEVs) are leading the market due to their fully electric nature, which appeals to environmentally conscious consumers. The growing availability of charging infrastructure and advancements in battery technology have further fueled the adoption of BEVs, making them the preferred choice for many consumers.

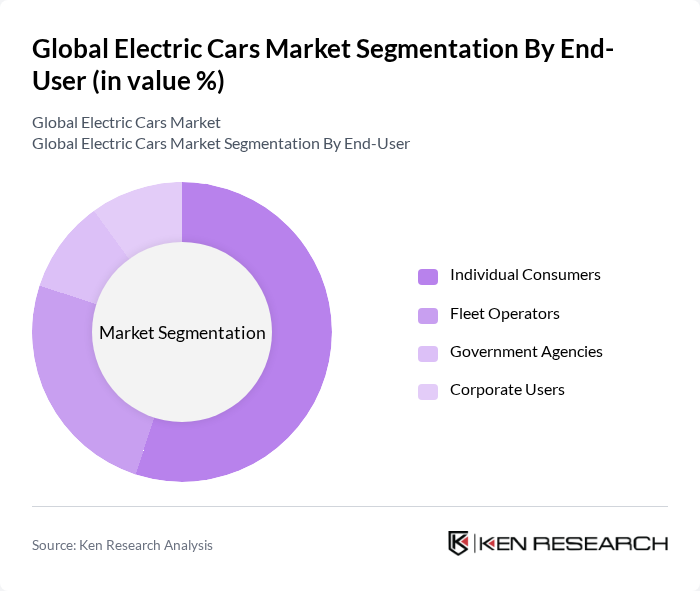

By End-User:The market is segmented by end-user into Individual Consumers, Fleet Operators, Government Agencies, and Corporate Users. Individual Consumers dominate the market, driven by increasing awareness of environmental issues, the desire for cost-effective transportation solutions, and the expanding selection of affordable EV models. Fleet operators are also emerging as significant users, as they seek to reduce operational costs and meet sustainability goals. The trend towards electrification in public transport and corporate fleets is expected to continue, further boosting the market.

The Global Electric Cars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BYD Company Limited, Volkswagen AG, SAIC Motor Corporation Limited, Geely Automobile Holdings Limited, Hyundai Motor Company, Kia Corporation, BMW AG, Mercedes-Benz Group AG, Nissan Motor Corporation, General Motors Company, Ford Motor Company, Rivian Automotive, Inc., Lucid Group, Inc., Polestar Automotive Holding UK PLC, XPeng Inc., NIO Inc., Li Auto Inc., Fisker Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric car market in None appears promising, driven by technological advancements and increasing consumer demand for sustainable transportation. As battery costs continue to decline and charging infrastructure expands, more consumers are likely to consider electric vehicles as a viable alternative. Additionally, the integration of smart technologies and autonomous features is expected to enhance the appeal of electric cars, attracting a broader demographic. Overall, the market is poised for significant growth, supported by favorable government policies and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) Extended-Range Electric Vehicles (EREVs) |

| By End-User | Individual Consumers Fleet Operators Government Agencies Corporate Users |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Lithium-Ion Batteries Solid-State Batteries Fast Charging Technology Vehicle-to-Grid (V2G) Technology |

| By Application | Personal Transportation Public Transportation Commercial Use Ride-Hailing & Car Sharing |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Venture Capital & Strategic Investments |

| By Policy Support | Tax Incentives Grants and Subsidies Regulatory Support Zero-Emission Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electric Vehicle Adoption | 120 | Car Owners, Potential Buyers |

| Fleet Management Insights | 60 | Fleet Managers, Logistics Coordinators |

| Charging Infrastructure Development | 50 | Infrastructure Developers, City Planners |

| Automotive Industry Expert Opinions | 40 | Automotive Engineers, Product Development Managers |

| Government Policy Impact Assessment | 45 | Policy Makers, Regulatory Affairs Specialists |

The Global Electric Cars Market is valued at approximately USD 900 billion, reflecting significant growth driven by increasing consumer demand for sustainable transportation and advancements in battery technology.