Region:Global

Author(s):Geetanshi

Product Code:KRAA2768

Pages:88

Published On:August 2025

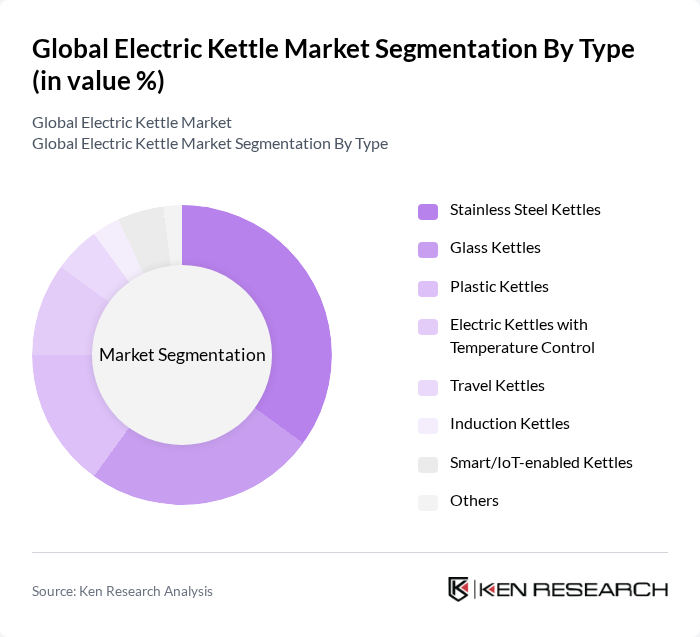

By Type:The electric kettle market is segmented into various types, including stainless steel kettles, glass kettles, plastic kettles, electric kettles with temperature control, travel kettles, induction kettles, smart/IoT-enabled kettles, and others. Among these, stainless steel kettles are the most popular due to their durability, aesthetic appeal, and ability to retain heat. Glass kettles are also gaining traction for their modern look and the ability to see the water level. The trend towards smart kettles is on the rise, driven by consumer interest in connected home devices and enhanced safety features such as automatic shutoff and boil-dry protection .

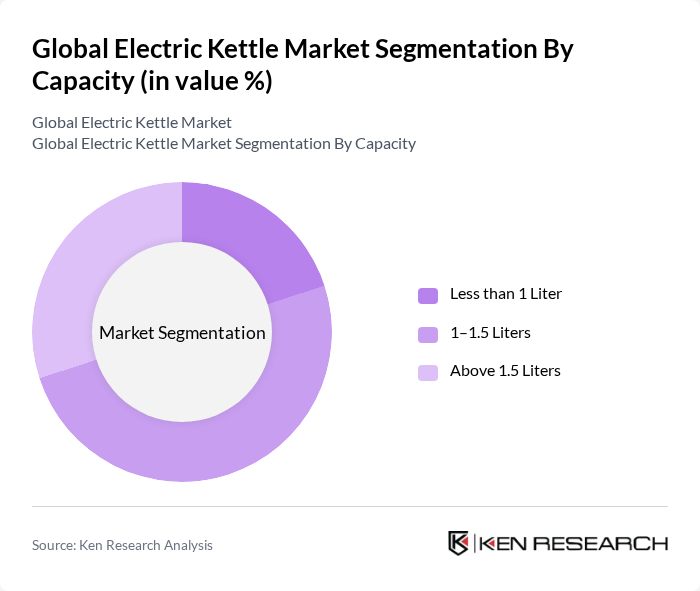

By Capacity:The market is also segmented by capacity, including kettles with less than 1 liter, 1–1.5 liters, and above 1.5 liters. Kettles with a capacity of 1–1.5 liters dominate the market, as they are ideal for both individual and family use. The growing trend of smaller households and the need for compact appliances have also contributed to the popularity of kettles with less than 1 liter capacity. Additionally, larger kettles are preferred for commercial use, particularly in cafes and restaurants. The residential segment accounts for the majority of demand, while commercial applications are expanding in hospitality and foodservice sectors .

The Global Electric Kettle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Electronics N.V., Breville Group Ltd., Cuisinart (Conair Corporation), Hamilton Beach Brands Holding Company, Black+Decker (Stanley Black & Decker, Inc.), Groupe SEB (Tefal), Russell Hobbs (Spectrum Brands), Sunbeam Products, Inc. (Newell Brands), Zojirushi Corporation, Smeg S.p.A., Braun GmbH, Kenwood Limited (De'Longhi Group), Oster (Newell Brands), Morphy Richards, Xiaomi Corporation, Midea Group, Joyoung Co., Ltd., Havells India Ltd., Bajaj Electricals Ltd., Bosch Hausgeräte (BSH Home Appliances) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric kettle market appears promising, driven by technological advancements and evolving consumer preferences. As smart home integration becomes more prevalent, electric kettles with IoT capabilities are expected to gain traction. Additionally, the focus on sustainability will likely lead to increased demand for energy-efficient models. Manufacturers that prioritize innovation and eco-friendly practices will be well-positioned to capture market share and meet the needs of environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Stainless Steel Kettles Glass Kettles Plastic Kettles Electric Kettles with Temperature Control Travel Kettles Induction Kettles Smart/IoT-enabled Kettles Others |

| By Capacity | Less than 1 Liter –1.5 Liters Above 1.5 Liters |

| By End-User | Residential Commercial (Hotels, Cafés, Offices) Industrial |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Kettles Mid-range Kettles Premium Kettles |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Features | Auto Shut-off Keep Warm Function Boil Dry Protection LED Indicators Variable Temperature Control Rapid Boil |

| By Material | Stainless Steel Glass Plastic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Electric Kettles | 120 | Household Consumers, Kitchen Appliance Enthusiasts |

| Retail Insights on Electric Kettle Sales | 70 | Store Managers, Sales Representatives |

| Market Trends in Kitchen Appliances | 60 | Industry Analysts, Market Researchers |

| Product Development Feedback | 50 | Product Designers, R&D Managers |

| Distribution Channel Effectiveness | 40 | Logistics Managers, Supply Chain Coordinators |

The Global Electric Kettle Market is valued at approximately USD 4.5 billion, driven by increasing demand for convenient kitchen appliances, rising disposable incomes, and a trend towards energy-efficient products.