Region:Global

Author(s):Rebecca

Product Code:KRAD4981

Pages:83

Published On:December 2025

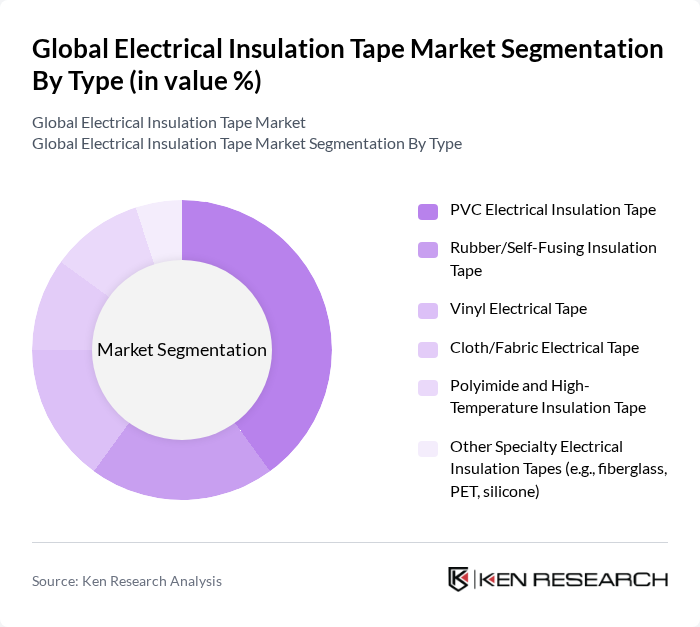

By Type:The electrical insulation tape market is segmented into various types, including PVC Electrical Insulation Tape, Rubber/Self?Fusing Insulation Tape, Vinyl Electrical Tape, Cloth/Fabric Electrical Tape, Polyimide and High?Temperature Insulation Tape, and Other Specialty Electrical Insulation Tapes. PVC Electrical Insulation Tape is the most widely used product category, supported by its good dielectric strength, flame retardancy options, ease of application, and competitive cost, making it suitable for low? to medium?voltage wiring, harness wrapping, and color coding in residential, commercial, and industrial environments. Rubber and self?fusing tapes are increasingly adopted for higher?voltage joints, moisture sealing, and outdoor applications, while high?temperature polyimide and specialty tapes are gaining traction in electronics, EVs, and aerospace where heat and chemical resistance are critical.

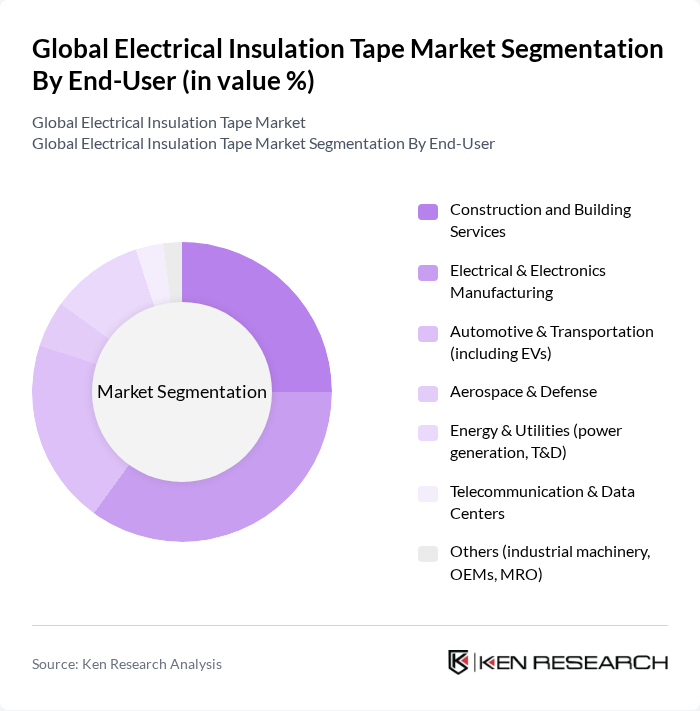

By End-User:The market is also segmented by end?user industries, including Construction and Building Services, Electrical & Electronics Manufacturing, Automotive & Transportation (including EVs), Aerospace & Defense, Energy & Utilities (power generation, T&D), Telecommunication & Data Centers, and Others (industrial machinery, OEMs, MRO). The Electrical & Electronics Manufacturing sector is the largest end?user, supported by the growing production of consumer electronics, industrial control equipment, and communication devices that require tape for wire harnessing, coil insulation, PCB masking, and component protection. The automotive sector is also witnessing significant growth due to the rising demand for electric and hybrid vehicles, where complex high?voltage cable harnesses, battery packs, and onboard electronics necessitate high?performance insulation materials with heat, abrasion, and chemical resistance. Construction, energy, and telecom applications additionally use electrical insulation tapes for cable bundling, phase identification, maintenance, and protection in power distribution and communication networks.

The Global Electrical Insulation Tape Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Nitto Denko Corporation, Avery Dennison Corporation, tesa SE, Compagnie de Saint?Gobain S.A., Intertape Polymer Group Inc. (IPG), Scapa Group Ltd. (a Mativ Holdings company), Henkel AG & Co. KGaA, Sika AG, Achem Technology Corporation, Shurtape Technologies, LLC, HellermannTyton Group, Teraoka Seisakusho Co., Ltd., Pidilite Industries Limited, and Yamato International Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrical insulation tape market appears promising, driven by ongoing technological advancements and a shift towards sustainable practices. As industries increasingly adopt smart electrical systems, the demand for specialized insulation tapes tailored for specific applications is expected to rise. Furthermore, the growing focus on eco-friendly materials will likely lead to the development of innovative products that meet both performance and environmental standards, fostering market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | PVC Electrical Insulation Tape Rubber/Self?Fusing Insulation Tape Vinyl Electrical Tape Cloth/Fabric Electrical Tape Polyimide and High?Temperature Insulation Tape Other Specialty Electrical Insulation Tapes (e.g., fiberglass, PET, silicone) |

| By End-User | Construction and Building Services Electrical & Electronics Manufacturing Automotive & Transportation (including EVs) Aerospace & Defense Energy & Utilities (power generation, T&D) Telecommunication & Data Centers Others (industrial machinery, OEMs, MRO) |

| By Application | Electrical Wires and Cables Insulation Motors and Generators Winding Insulation Transformers and Coil Insulation Switchgear and Control Panels Wire Harnessing and Bundling Repair, Maintenance & Splicing Others (surface protection, shielding, marking) |

| By Material | Polyvinyl Chloride (PVC) Rubber and Ethylene Propylene Rubber (EPR) Polyethylene (PE) and Polyolefin Polyester (PET) and Polyimide Films Cloth/Fabric (glass cloth, cotton) Others (silicone, fluoropolymer, paper) |

| By Thickness | Up to 0.13 mm (standard household/low?voltage) mm to 0.20 mm Above 0.20 mm Custom/Other Thicknesses |

| By Color | Black Single?Color Phase Identification Tapes (red, yellow, blue, green, etc.) Green/Yellow Earth & Grounding Tapes Multi?Color and Printed Identification Tapes Others (transparent, specialty coded) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Electrical Insulation | 110 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Applications | 85 | Product Managers, R&D Engineers |

| Construction Industry Usage | 75 | Construction Project Managers, Electrical Contractors |

| Industrial Applications | 95 | Maintenance Supervisors, Operations Managers |

| Retail Distribution Insights | 65 | Supply Chain Managers, Retail Buyers |

The Global Electrical Insulation Tape Market is valued at approximately USD 14.5 billion, driven by increasing demand across various industries such as construction, automotive, and electronics, as well as a focus on safety standards and regulations.