Region:Middle East

Author(s):Shubham

Product Code:KRAB8841

Pages:82

Published On:October 2025

Market.png)

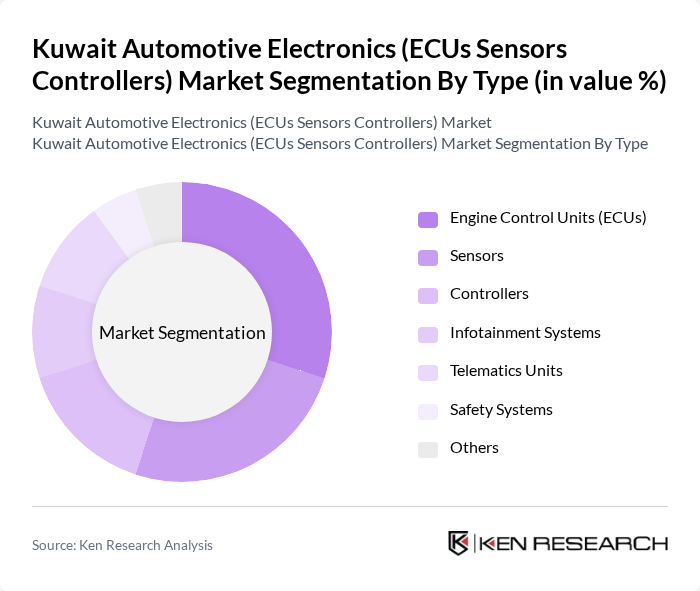

By Type:The market is segmented into various types, including Engine Control Units (ECUs), Sensors, Controllers, Infotainment Systems, Telematics Units, Safety Systems, and Others. Among these, Engine Control Units (ECUs) are leading the market due to their critical role in vehicle performance and efficiency. The increasing complexity of automotive systems and the demand for fuel-efficient vehicles are driving the adoption of advanced ECUs, making them a focal point for manufacturers and consumers alike.

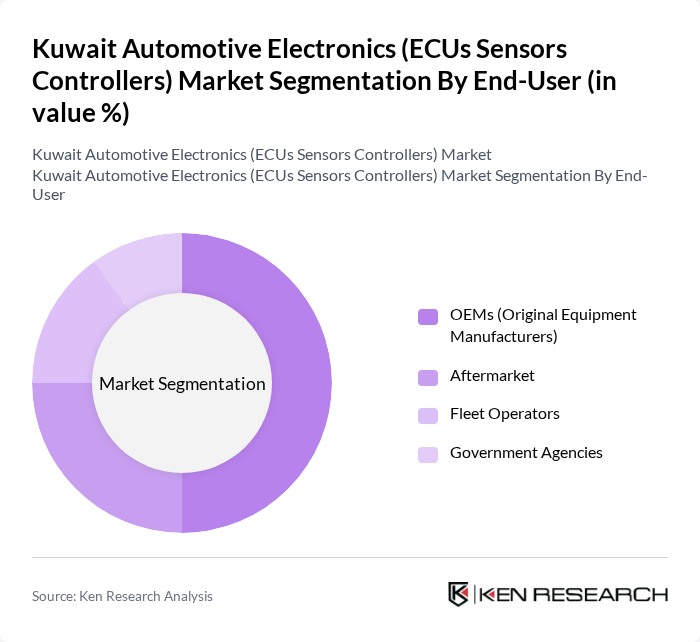

By End-User:The end-user segmentation includes OEMs (Original Equipment Manufacturers), Aftermarket, Fleet Operators, and Government Agencies. OEMs dominate the market as they are the primary manufacturers of vehicles and are increasingly integrating advanced electronics into their models to meet consumer demands for safety and connectivity. The trend towards electric vehicles and smart technologies is further propelling OEMs to invest in innovative automotive electronics.

The Kuwait Automotive Electronics (ECUs Sensors Controllers) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Abdulmohsen Al-Babtain Group, Alghanim Industries, KIA Motors Kuwait, Al-Mansour Automotive, Al-Sayer Group, Al-Jazeera Automotive, Al-Muhaidib Group, Al-Mazaya Holding, Gulf Automotive, Al-Homaizi Group, Al-Qatami Global for General Trading, Al-Sabhan Group, Al-Khaldi Group, Al-Mutawa Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive electronics market in Kuwait appears promising, driven by the increasing integration of smart technologies and a shift towards sustainable practices. As the government continues to promote electric vehicles and smart transportation initiatives, the demand for advanced electronic components is expected to rise. Additionally, the focus on enhancing vehicle safety and connectivity will likely lead to further investments in research and development, fostering innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Control Units (ECUs) Sensors Controllers Infotainment Systems Telematics Units Safety Systems Others |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket Fleet Operators Government Agencies |

| By Application | Passenger Vehicles Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Component | Hardware Software Services |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Conventional Technology Advanced Technology Hybrid Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Product Development Managers, R&D Engineers |

| Electronic Component Suppliers | 80 | Sales Directors, Technical Support Engineers |

| Automotive Service Providers | 70 | Service Managers, Workshop Owners |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Industry Experts and Consultants | 60 | Market Analysts, Automotive Consultants |

The Kuwait Automotive Electronics market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for advanced automotive technologies, including electric vehicles and enhanced safety features.