Region:Global

Author(s):Shubham

Product Code:KRAC0811

Pages:91

Published On:August 2025

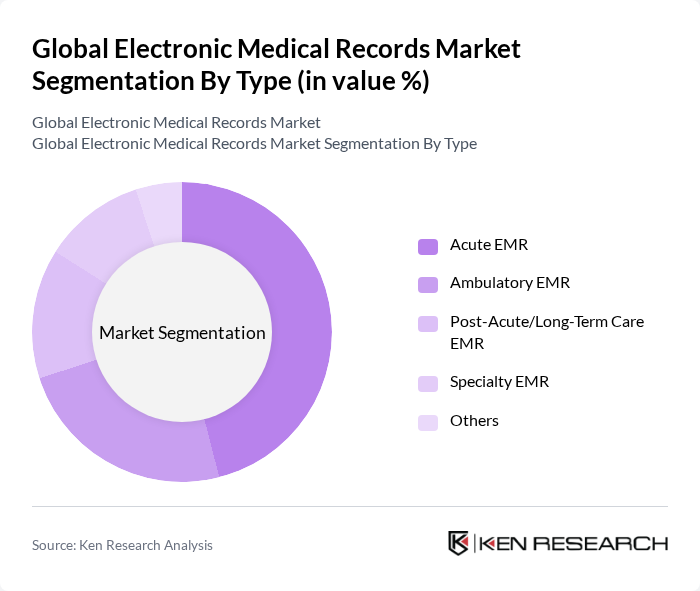

By Type:The market is segmented into various types, including Acute EMR, Ambulatory EMR, Post-Acute/Long-Term Care EMR, Specialty EMR, and Others. Among these, the Acute EMR segment is currently leading the market due to its critical role in hospitals and emergency care settings, where timely access to patient data is essential for effective treatment. The increasing focus on patient-centered care and the need for real-time data access are driving the demand for Acute EMR solutions. The acute segment accounted for the largest revenue share, supported by government initiatives for EHR adoption in small-scale facilities and the growing need for rapid clinical decision-making .

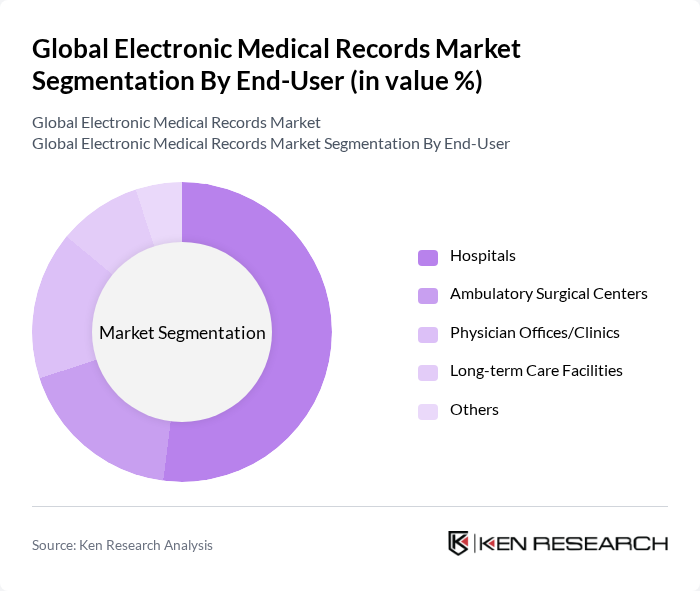

By End-User:The market is categorized by end-users, including Hospitals, Ambulatory Surgical Centers, Physician Offices/Clinics, Long-term Care Facilities, and Others. Hospitals are the dominant end-user segment, driven by the need for comprehensive patient management systems and the increasing volume of patient data. The shift towards value-based care and the integration of technology in hospital settings are further propelling the adoption of electronic medical records. Hospitals hold the largest market share, while ambulatory centers and clinics are rapidly adopting EMR solutions due to the growing emphasis on outpatient care and interoperability .

The Global Electronic Medical Records Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Corporation (Cerner), Allscripts Healthcare Solutions, Inc. (now Veradigm Inc.), MEDITECH (Medical Information Technology, Inc.), athenahealth, Inc., NextGen Healthcare, Inc., eClinicalWorks, LLC, GE HealthCare Technologies Inc., McKesson Corporation, Siemens Healthineers AG, Philips Healthcare (Royal Philips NV), IBM Watson Health (now Merative), Greenway Health, LLC, Practice Fusion, Inc., CureMD Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic medical records market appears promising, driven by technological advancements and evolving healthcare needs. As healthcare providers increasingly prioritize patient-centric care, the demand for integrated EMR solutions will likely rise. Additionally, the ongoing shift towards value-based care models will necessitate enhanced data analytics capabilities, further propelling EMR adoption. The focus on interoperability among systems will also play a crucial role in shaping the market landscape, ensuring seamless data exchange and improved patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Acute EMR Ambulatory EMR Post-Acute/Long-Term Care EMR Specialty EMR Others |

| By End-User | Hospitals Ambulatory Surgical Centers Physician Offices/Clinics Long-term Care Facilities Others |

| By Deployment Model | Cloud-Based On-Premise Hybrid |

| By Component | Software Hardware Services |

| By Region | North America U.S. Canada Europe UK Germany France Italy Spain Denmark Sweden Norway Asia-Pacific China Japan India South Korea Australia Thailand Latin America Brazil Argentina Middle East & Africa South Africa Saudi Arabia UAE Kuwait |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Integration Capability | Standalone EMR Integrated EMR Interoperable EMR |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital EMR Implementation | 100 | IT Directors, Chief Information Officers |

| Clinic EMR Adoption | 80 | Practice Managers, Physicians |

| Specialty Practice EMR Usage | 60 | Specialist Physicians, Office Administrators |

| Patient Experience with EMR | 90 | Patients, Caregivers |

| Healthcare IT Vendor Insights | 50 | Product Managers, Sales Executives |

The Global Electronic Medical Records Market is valued at approximately USD 33 billion, driven by the increasing adoption of digital health solutions and the need for improved patient care and efficient healthcare management systems.