Region:Asia

Author(s):Rebecca

Product Code:KRAA2158

Pages:80

Published On:August 2025

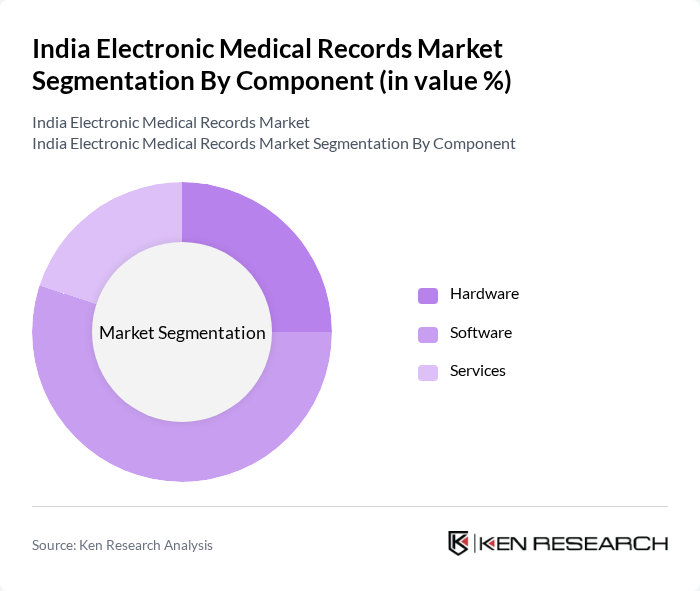

By Component:The components of the electronic medical records market include hardware, software, and services. Among these,softwareis the leading sub-segment, driven by the increasing demand for user-friendly and integrated solutions that enhance clinical workflows and patient care. The rise in cloud-based solutions has also contributed to the software segment's dominance, as healthcare providers seek scalable and cost-effective options. Hardware and services follow, with hardware being essential for system implementation and services encompassing support and maintenance.

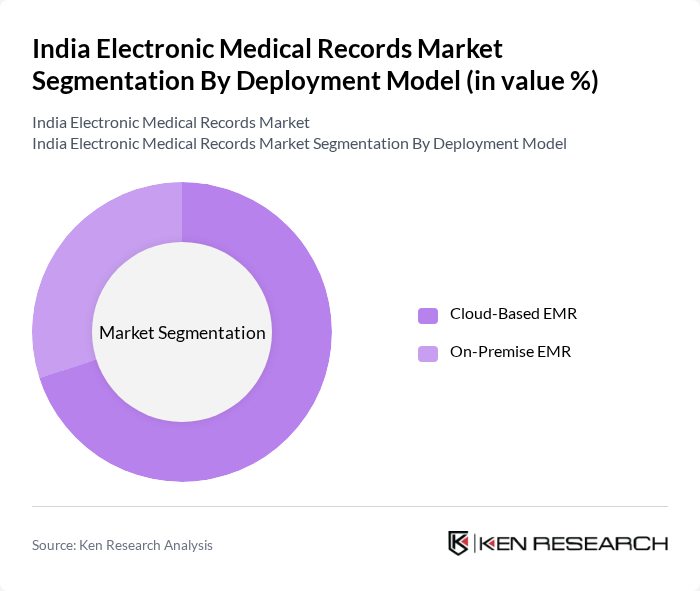

By Deployment Model:The deployment models for electronic medical records include cloud-based and on-premise solutions.Cloud-based EMR systemsare gaining significant traction due to their flexibility, lower upfront costs, and ease of access from multiple locations. This model allows healthcare providers to scale their operations efficiently and ensures data security through advanced encryption methods. On-premise solutions, while still relevant, are gradually being overshadowed by the advantages offered by cloud-based systems.

The India Electronic Medical Records Market is characterized by a dynamic mix of regional and international players. Leading participants such as Practo Technologies Pvt. Ltd., DocEngage Informatics Pvt. Ltd., Meditab Software Pvt. Ltd., Attune Technologies Pvt. Ltd., OMRON Healthcare India Pvt. Ltd., Cerner Corporation, Veradigm LLC, Medical Information Technology, Inc. (Meditech), Athenahealth, eClinicalWorks, NextGen Healthcare, GE Healthcare, Philips Healthcare, Oracle Health Sciences, Infor Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Electronic Medical Records market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence and machine learning into EMR systems is expected to enhance data analytics capabilities, leading to improved patient outcomes. Additionally, the ongoing government initiatives to promote digital health will likely facilitate the transition to interoperable systems, ensuring seamless data exchange among healthcare providers and enhancing overall efficiency in patient care.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Deployment Model | Cloud-Based EMR On-Premise EMR |

| By Type | General EMR Specialty EMR |

| By End-User | Hospitals Clinics Ambulatory Surgical Centers Diagnostic Centers |

| By Application | Cardiology Neurology Radiology Oncology Other Applications |

| By Region | North India South India East India West India |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Integration Capability | Standalone EMR Integrated EMR with Other Systems Interoperable EMR Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital EMR Adoption | 100 | IT Directors, Chief Information Officers |

| Clinic EMR Implementation | 80 | Practice Managers, Healthcare Administrators |

| Healthcare IT Vendors | 60 | Product Managers, Sales Executives |

| Regulatory Impact on EMR | 40 | Policy Makers, Compliance Officers |

| Patient Experience with EMR | 50 | Patients, Caregivers, Healthcare Advocates |

The India Electronic Medical Records Market is valued at approximately USD 730 million, driven by the increasing adoption of digital health solutions, government initiatives for healthcare digitization, and advancements in technology such as cloud computing and artificial intelligence.