Region:Global

Author(s):Shubham

Product Code:KRAD6689

Pages:98

Published On:December 2025

Products Market.png)

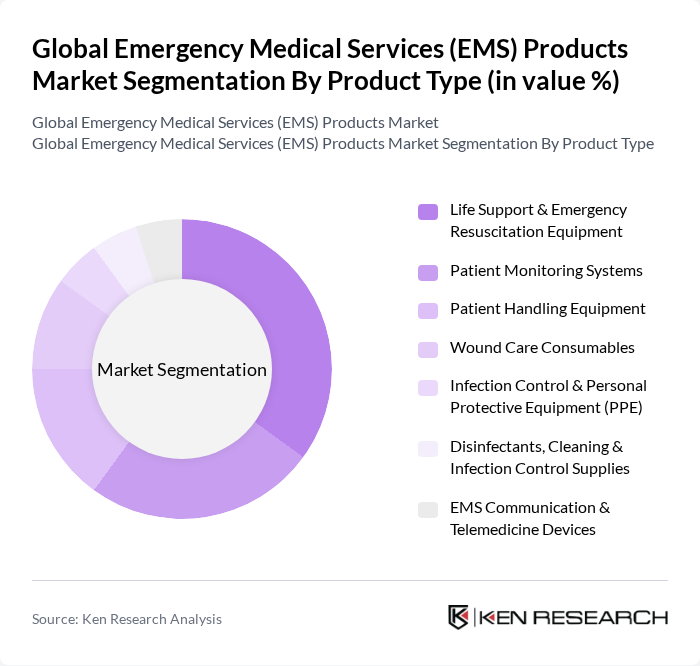

By Product Type:The product type segmentation includes various categories that cater to different needs within the EMS sector. The dominant sub-segment is Life Support & Emergency Resuscitation Equipment, which includes defibrillators, ventilators, and laryngoscopes. This segment is crucial due to the increasing number of cardiac emergencies and the need for immediate life-saving interventions. Patient Monitoring Systems also hold significant market share, driven by the growing demand for real-time health monitoring in emergency situations. The focus on advanced technology and patient safety continues to propel these segments forward.

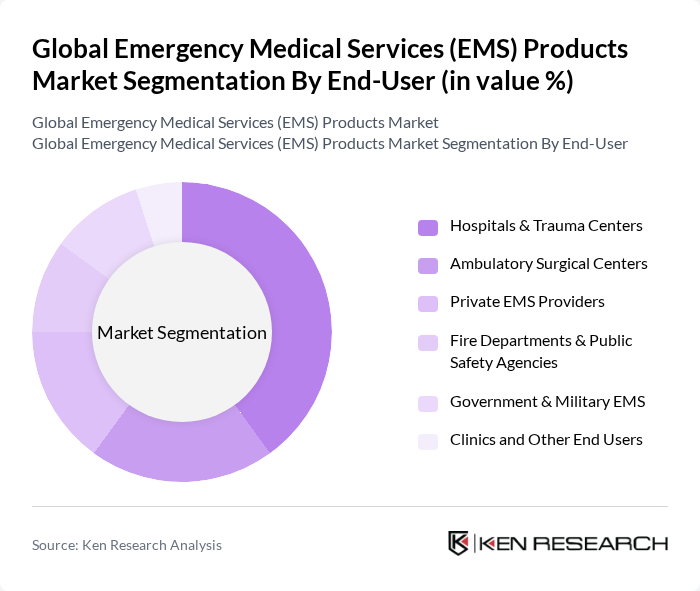

By End-User:The end-user segmentation highlights the various sectors utilizing EMS products, with Hospitals & Trauma Centers being the leading segment. This dominance is attributed to the high volume of emergency cases handled in hospitals, necessitating advanced EMS products for effective patient care. Private EMS Providers also play a significant role, driven by the increasing demand for rapid response services in urban areas. The growing trend of outsourcing emergency services to private entities further supports the expansion of this segment.

The Global Emergency Medical Services (EMS) Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Medtronic plc, ZOLL Medical Corporation (an Asahi Kasei company), Philips Healthcare (Koninklijke Philips N.V.), GE HealthCare Technologies Inc., Smiths Medical (ICU Medical, Inc.), Cardinal Health, Inc., 3M Company, Teleflex Incorporated, B. Braun Melsungen AG, Smith & Nephew plc, Fresenius Kabi AG, Ferno-Washington, Inc., Masimo Corporation, Global Medical Response, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EMS products market is poised for transformation, driven by technological advancements and a growing emphasis on patient-centered care. As telemedicine and remote monitoring become integral to emergency response, the integration of AI and machine learning will enhance decision-making processes. Furthermore, the focus on sustainability will lead to the development of eco-friendly EMS products, aligning with global environmental goals. These trends will shape the market landscape, ensuring that EMS providers can deliver efficient and effective care in diverse settings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Life Support & Emergency Resuscitation Equipment (defibrillators, ventilators, laryngoscopes, others) Patient Monitoring Systems (ECG monitors, pulse oximeters, capnography, others) Patient Handling Equipment (stretchers, wheelchairs, stair chairs, others) Wound Care Consumables (dressings & bandages, sutures & staples, others) Infection Control & Personal Protective Equipment (PPE) Disinfectants, Cleaning & Infection Control Supplies EMS Communication & Telemedicine Devices |

| By End-User | Hospitals & Trauma Centers Ambulatory Surgical Centers Private EMS Providers Fire Departments & Public Safety Agencies Government & Military EMS Clinics and Other End Users |

| By Application | Cardiac Care Trauma Injuries Respiratory Care Oncology & Critical Care Support Disaster & Mass Casualty Response Other Applications |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology / Level of Care | Basic Life Support (BLS) Equipment Advanced Life Support (ALS) Equipment Telemedicine & Connected EMS Solutions Mobile Health (mHealth) Applications for EMS Other EMS Technologies |

| By Service Environment | Pre-hospital & Out-of-hospital EMS Settings In-hospital Emergency & Critical Care Settings Air Ambulance & Transport EMS Other EMS Service Environments |

| By Procurement / Funding Source | Public / Government-funded Procurement Private Healthcare & Corporate Procurement Non-profit, NGO & Donor-funded Procurement Hybrid and Other Funding Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Emergency Medical Equipment Suppliers | 120 | Product Managers, Sales Directors |

| Ambulance Service Providers | 90 | Operations Managers, Fleet Supervisors |

| Healthcare Facility Administrators | 80 | Procurement Officers, Facility Managers |

| First Responder Training Organizations | 70 | Training Coordinators, Program Directors |

| Government Health Agencies | 60 | Policy Makers, Health Program Managers |

The Global Emergency Medical Services (EMS) Products Market is valued at approximately USD 31 billion, reflecting significant growth driven by advancements in medical technology and increasing demand for emergency services.