Region:Asia

Author(s):Dev

Product Code:KRAC2789

Pages:82

Published On:October 2025

Products Market.png)

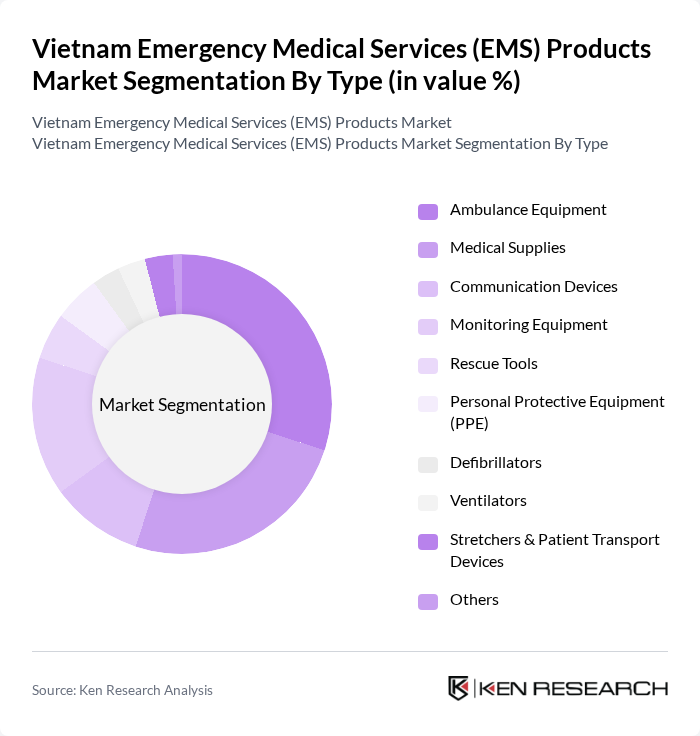

By Type:The EMS products market can be segmented into various types, including Ambulance Equipment, Medical Supplies, Communication Devices, Monitoring Equipment, Rescue Tools, Personal Protective Equipment (PPE), Defibrillators, Ventilators, Stretchers & Patient Transport Devices, and Others. Among these, Medical Supplies and Ambulance Equipment are the leading segments due to their essential role in emergency response and patient care. The increasing demand for high-quality medical supplies, driven by the growing number of emergency cases, has significantly contributed to the market's expansion. The regulatory emphasis on ALS systems has also accelerated adoption of advanced monitoring and life-support equipment in ambulances.

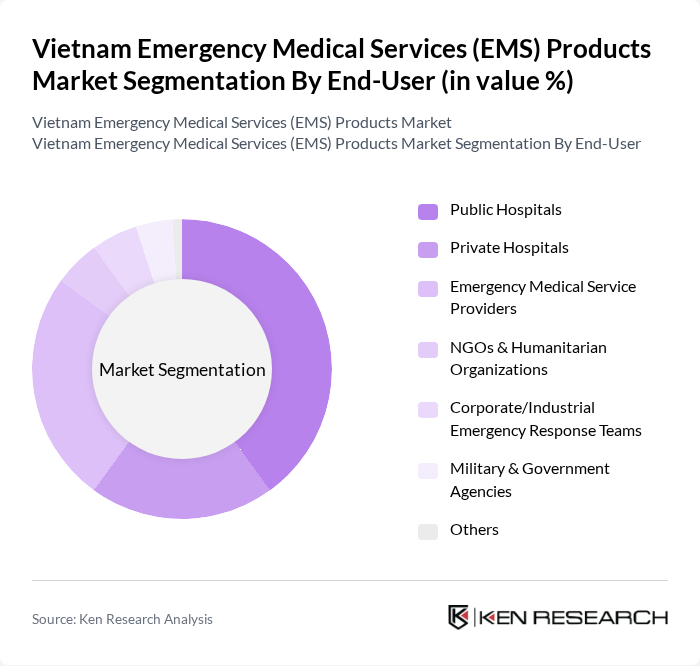

By End-User:The EMS products market is segmented by end-users, including Public Hospitals, Private Hospitals, Emergency Medical Service Providers, NGOs & Humanitarian Organizations, Corporate/Industrial Emergency Response Teams, Military & Government Agencies, and Others. Public Hospitals and Emergency Medical Service Providers are the dominant segments, driven by the increasing number of emergency cases and the need for efficient medical response systems. The growing collaboration between public hospitals and private entities has also enhanced the demand for EMS products. The hospital sector in Vietnam is forecasted to reach USD 9.9 billion by the end of 2024, indicating a substantial base for EMS product consumption.

The Vietnam Emergency Medical Services (EMS) Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, Vingroup Joint Stock Company (Vinmec Healthcare System), Hoan My Medical Corporation, Hanoi Medical Equipment and Pharmaceutical Joint Stock Company (HAMEPHARM), Medtronic Vietnam Co., Ltd., Johnson & Johnson Vietnam Co., Ltd., Siemens Healthineers Vietnam Co., Ltd., Philips Vietnam Co., Ltd., GE Healthcare Vietnam Co., Ltd., B. Braun Vietnam Co., Ltd., Abbott Laboratories S.A. Vietnam, Fresenius Kabi Vietnam Co., Ltd., Stryker Vietnam Co., Ltd., Olympus Vietnam Co., Ltd., 3M Vietnam Co., Ltd., Hope Ambulance Service Vietnam, Asia Medvac Services Vietnam, Red Ambulance Services Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam EMS products market appears promising, driven by ongoing government initiatives and increasing public awareness. As the healthcare infrastructure continues to develop, the demand for advanced EMS solutions is expected to rise significantly. Innovations in telemedicine and mobile EMS technologies will likely enhance service delivery, while partnerships with international providers can facilitate knowledge transfer and improve service quality. Overall, the market is poised for growth, addressing both current challenges and emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Ambulance Equipment Medical Supplies Communication Devices Monitoring Equipment Rescue Tools Personal Protective Equipment (PPE) Defibrillators Ventilators Stretchers & Patient Transport Devices Others |

| By End-User | Public Hospitals Private Hospitals Emergency Medical Service Providers NGOs & Humanitarian Organizations Corporate/Industrial Emergency Response Teams Military & Government Agencies Others |

| By Application | Pre-Hospital Emergency Care Patient Transport Disaster & Mass Casualty Management Training & Simulation Event Medical Coverage Others |

| By Distribution Channel | Direct Tender/Procurement Distributors/Dealers Online Platforms Retail Pharmacies/Medical Stores Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand Reputation | International Brands Regional/Asian Brands Local Vietnamese Brands Others |

| By Product Lifecycle Stage | Introduction Stage Products Growth Stage Products Maturity Stage Products Declining Stage Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Emergency Departments | 60 | Emergency Room Managers, Medical Directors |

| Private EMS Providers | 50 | Operations Managers, Fleet Supervisors |

| Government Health Agencies | 40 | Policy Makers, Health Program Coordinators |

| Medical Equipment Distributors | 50 | Sales Managers, Product Specialists |

| Training Institutions for EMS Personnel | 40 | Training Coordinators, Curriculum Developers |

The Vietnam Emergency Medical Services (EMS) Products Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased healthcare investments and a rising demand for advanced medical equipment.