Region:Global

Author(s):Geetanshi

Product Code:KRAA0100

Pages:81

Published On:August 2025

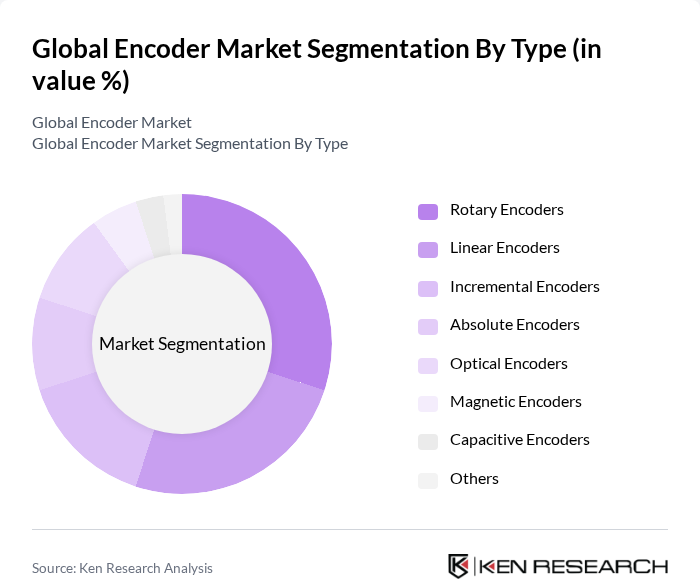

By Type:The encoder market is segmented into Rotary Encoders, Linear Encoders, Incremental Encoders, Absolute Encoders, Optical Encoders, Magnetic Encoders, Capacitive Encoders, and Others. Each type serves specific applications and industries, offering varying levels of precision and functionality .

The Rotary Encoders segment leads the market, driven by their widespread application in industrial automation, robotics, and machinery requiring precise position feedback. The ongoing trend toward automation in manufacturing processes has further fueled the demand for rotary encoders, as they are integral to motion control systems. Advancements in miniaturization and efficiency have also enhanced their adoption in diverse applications .

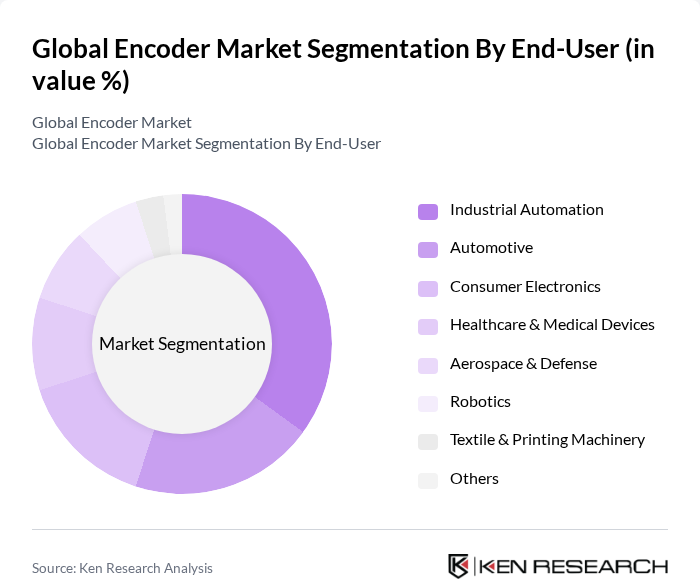

By End-User:The encoder market is also segmented by end-user industries, including Industrial Automation, Automotive, Consumer Electronics, Healthcare & Medical Devices, Aerospace & Defense, Robotics, Textile & Printing Machinery, and Others. Each sector utilizes encoders for various applications, driving demand based on specific needs and technological advancements .

The Industrial Automation segment is the largest end-user of encoders, supported by the increasing adoption of automation technologies in manufacturing. Industries are integrating encoders to enhance efficiency, accuracy, and productivity. The push for smart factories and Industry 4.0 initiatives has further accelerated demand, as encoders are critical for real-time feedback and control in automated systems .

The Global Encoder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Rockwell Automation, Inc., Schneider Electric SE, Omron Corporation, Renishaw plc, Bourns, Inc., Heidenhain Corporation, SICK AG, Baumer Group, Dynapar Corporation, Pepperl+Fuchs GmbH, Tamagawa Seiki Co., Ltd., Kuebler Group, Ametek, Inc., Sensata Technologies, Inc., Maxon Motor AG, TE Connectivity Ltd., Allied Motion Technologies Inc., and Leine & Linde AB contribute to innovation, geographic expansion, and service delivery in this space .

The future of the encoder market in None appears promising, driven by ongoing technological advancements and increasing automation across various sectors. As industries continue to embrace digital transformation, the demand for high-precision encoders is expected to rise. Additionally, the integration of encoders with emerging technologies such as AI and IoT will enhance their functionality, making them indispensable in modern manufacturing and robotics. This trend will likely lead to innovative applications and improved operational efficiencies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Encoders Linear Encoders Incremental Encoders Absolute Encoders Optical Encoders Magnetic Encoders Capacitive Encoders Others |

| By End-User | Industrial Automation Automotive Consumer Electronics Healthcare & Medical Devices Aerospace & Defense Robotics Textile & Printing Machinery Others |

| By Application | Motion Control Robotics CNC Machines Packaging Material Handling Elevators & Lifts Renewable Energy Systems Others |

| By Technology | Optical Encoders Magnetic Encoders Capacitive Encoders Inductive Encoders Wireless Encoders Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Manufacturing Oil & Gas Mining Telecommunications Food & Beverage Power & Energy Others |

| By Pricing Model | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Dynamic Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Applications | 100 | Automation Engineers, Production Managers |

| Automotive Encoder Usage | 80 | Quality Control Managers, Design Engineers |

| Consumer Electronics Integration | 60 | Product Development Engineers, R&D Managers |

| Robotics and Motion Control | 50 | Robotics Engineers, System Integrators |

| Healthcare Equipment Applications | 40 | Biomedical Engineers, Equipment Managers |

The Global Encoder Market is valued at approximately USD 3 billion, reflecting a robust growth trajectory driven by increasing industrial automation, technological advancements, and the demand for precision in motion control applications across various sectors.