Region:Middle East

Author(s):Rebecca

Product Code:KRAC8578

Pages:89

Published On:November 2025

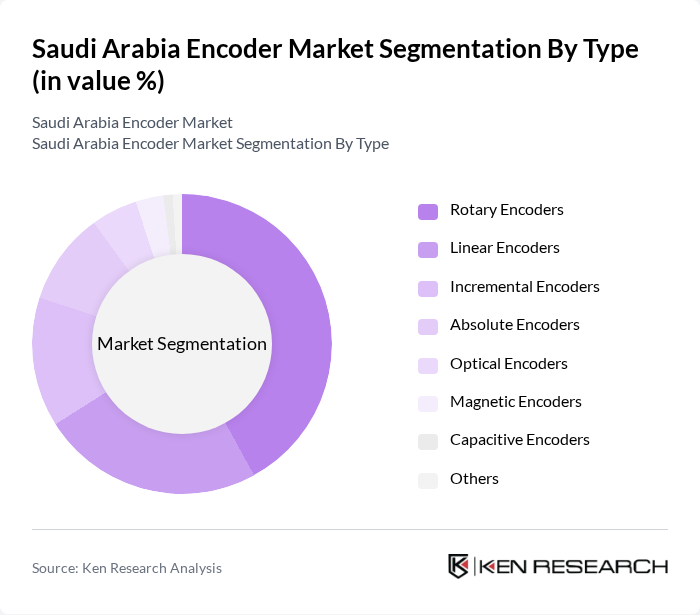

By Type:The encoder market can be segmented into Rotary Encoders, Linear Encoders, Incremental Encoders, Absolute Encoders, Optical Encoders, Magnetic Encoders, Capacitive Encoders, and Others. Among these, Rotary Encoders hold the largest market share, driven by their extensive use in industrial automation, robotics, and motion control applications. Their ability to deliver high-precision position and speed feedback makes them essential for modern machinery, robotics, and process automation. Linear Encoders are gaining traction in sectors such as CNC machining and semiconductor manufacturing, where accurate linear displacement measurement is critical.

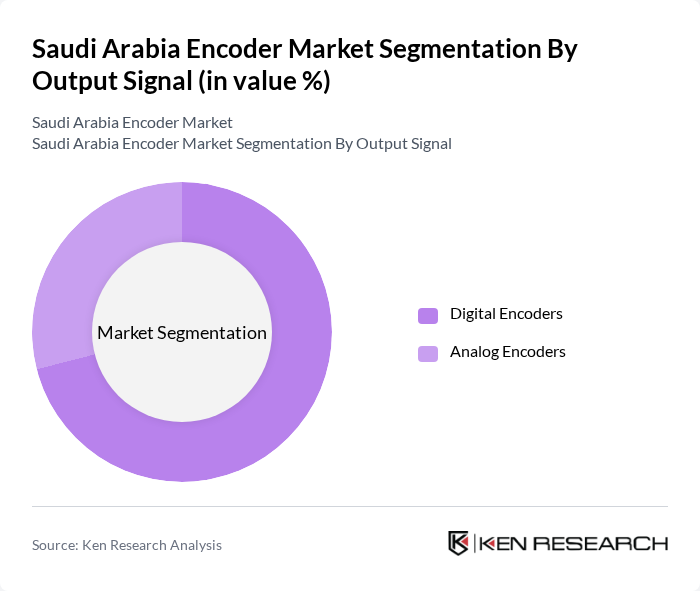

By Output Signal:The output signal segmentation includes Digital Encoders and Analog Encoders. Digital Encoders dominate this segment due to their superior accuracy, noise immunity, and seamless integration with modern industrial control systems. The growing trend toward digitalization and smart manufacturing in Saudi Arabia further accelerates the adoption of digital encoders, making them the preferred choice for most industrial and automation applications.

The Saudi Arabia Encoder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric, Rockwell Automation, Baumer Group, Omron Corporation, Honeywell International Inc., Pepperl+Fuchs, Leine & Linde (Heidenhain Group), Dynapar (Fortive Corporation), IFM Electronic, SICK AG, Al-Falak Electronic Equipment & Supplies, Advanced Electronics Company, Saudi Encoder Solutions, and Al-Jazira Equipment Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the encoder market in Saudi Arabia appears promising, driven by technological advancements and increasing digitalization across various sectors. The integration of artificial intelligence and machine learning into encoding processes is expected to enhance efficiency and reduce operational costs. Additionally, the growing emphasis on energy-efficient technologies will likely lead to the development of innovative encoder solutions that meet sustainability goals, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Encoders Linear Encoders Incremental Encoders Absolute Encoders Optical Encoders Magnetic Encoders Capacitive Encoders Others |

| By Output Signal | Digital Encoders Analog Encoders |

| By Product Design | Hollow Shaft Encoders Solid Shaft Encoders |

| By End-User Industry | Industrial Automation Automotive Aerospace Medical Devices Printing Food and Beverage Oil and Gas Consumer Electronics Textile Others |

| By Application | Motion Control Robotics CNC Machines Elevators and Conveyors Video Broadcasting Data Transmission Others |

| By Size | Less than 30 mm mm–70 mm mm–100 mm More than 100 mm |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Ethernet Encoders Serial Encoders USB Encoders Wireless Encoders Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Sector | 100 | Automation Engineers, Production Managers |

| Automotive Encoder Applications | 60 | Quality Control Managers, R&D Engineers |

| Aerospace and Defense Encoders | 50 | Project Managers, Systems Engineers |

| Consumer Electronics Market | 70 | Product Development Managers, Marketing Directors |

| Robotics and Automation Solutions | 40 | Robotics Engineers, Technical Sales Representatives |

The Saudi Arabia Encoder Market is valued at approximately USD 155 million, driven by increasing automation demands in various industries, including manufacturing, automotive, and oil & gas, alongside government initiatives like Vision 2030 promoting industrial modernization.