Region:Global

Author(s):Dev

Product Code:KRAC0400

Pages:98

Published On:August 2025

By Type:The epoxy adhesives market is segmented into various types, including Two-Part (2K) Epoxy Adhesives, One-Part (1K) Epoxy Adhesives, Reactive Hot-Melt Epoxy Adhesives, UV/Heat-Curable Epoxy Adhesives, Waterborne/Low-VOC Epoxy Adhesives, and Others. Among these, Two-Part (2K) Epoxy Adhesives dominate the market due to their superior bonding strength and versatility in various applications. The demand for these adhesives is driven by their extensive use in automotive and construction sectors, where high-performance bonding is critical.

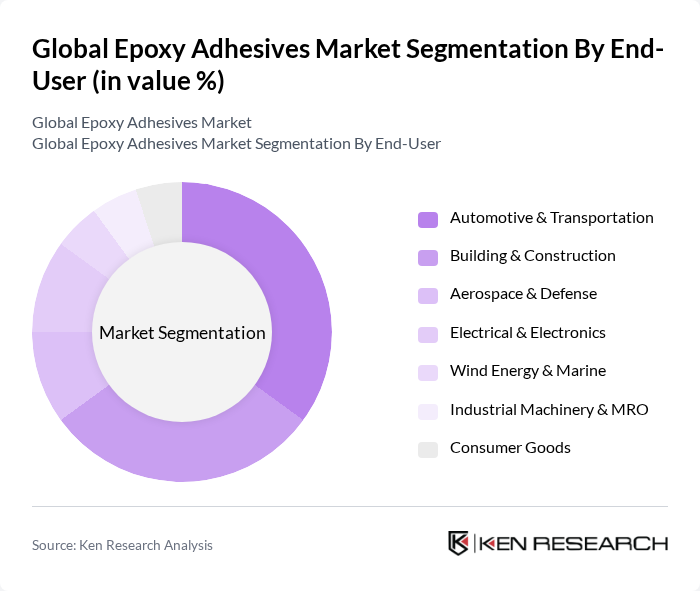

By End-User:The market is also segmented by end-user industries, including Automotive & Transportation, Building & Construction, Aerospace & Defense, Electrical & Electronics, Wind Energy & Marine, Industrial Machinery & MRO, Consumer Goods, and Others. The Automotive & Transportation sector is the leading end-user, driven by the increasing demand for lightweight and durable materials in vehicle manufacturing. The trend towards electric vehicles further boosts the need for advanced adhesive solutions in this sector.

The Global Epoxy Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, Arkema S.A. (Bostik), Dow Inc., Huntsman Corporation (Araldite), LORD Corporation (Parker LORD), ITW Performance Polymers (Devcon, Plexus Epoxy), Master Bond Inc., Permabond LLC, 3M Scotch-Weld Epoxy Adhesives, DELO Industrie Klebstoffe GmbH & Co. KGaA, J-B Weld Company, LLC, Panacol-Elosol GmbH (Dr. Hönle Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the epoxy adhesives market appears promising, driven by the ongoing shift towards sustainable practices and the integration of smart technologies. As industries increasingly prioritize eco-friendly solutions, the demand for bio-based epoxy adhesives is expected to rise significantly. Additionally, advancements in e-commerce platforms will facilitate easier access to adhesive products, enhancing market penetration. Companies that invest in innovative formulations and sustainable practices are likely to gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Two-Part (2K) Epoxy Adhesives One-Part (1K) Epoxy Adhesives Reactive Hot-Melt Epoxy Adhesives UV/Heat-Curable Epoxy Adhesives Waterborne/Low-VOC Epoxy Adhesives Others |

| By End-User | Automotive & Transportation Building & Construction Aerospace & Defense Electrical & Electronics Wind Energy & Marine Industrial Machinery & MRO Consumer Goods Others |

| By Application | Structural Bonding Assembly and Panel Bonding Potting, Encapsulation & Underfill Electrical/Electronic Conductive Bonding Sealants & Gap Filling Coatings & Protective Linings Others |

| By Distribution Channel | Direct Sales (OEM/Tier Suppliers) Industrial Distributors Online (Manufacturer Portals & E-commerce) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Dual Cartridges/Syringes Bottles Tubes Pails/Drums/IBCs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 120 | Project Managers, Site Supervisors |

| Automotive Adhesives | 90 | Manufacturing Engineers, Quality Control Managers |

| Aerospace Adhesives | 60 | R&D Engineers, Compliance Officers |

| Electronics Adhesives | 70 | Product Development Managers, Supply Chain Analysts |

| Marine Adhesives | 50 | Marine Engineers, Procurement Specialists |

The Global Epoxy Adhesives Market is valued at approximately USD 10 billion, driven by increasing demand for high-performance adhesives across various industries such as automotive, construction, and electronics, highlighting their versatility and superior bonding properties.