Region:Global

Author(s):Dev

Product Code:KRAC0509

Pages:94

Published On:August 2025

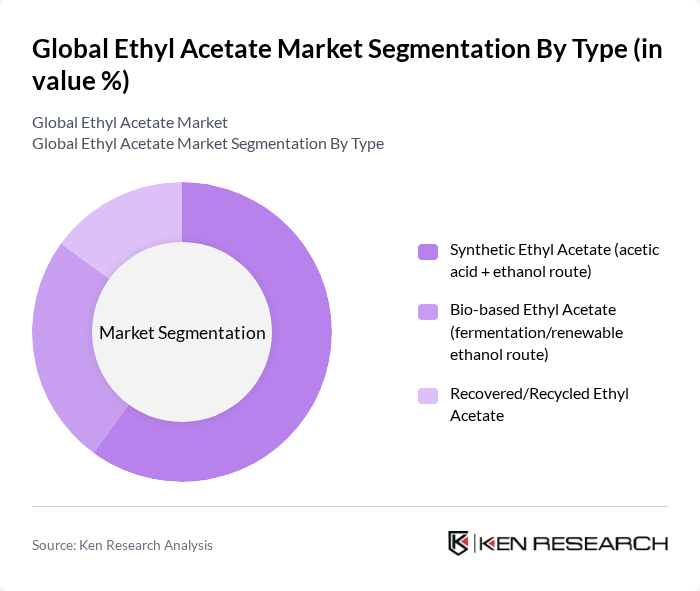

By Type:The ethyl acetate market is segmented into three main types: Synthetic Ethyl Acetate, Bio-based Ethyl Acetate, and Recovered/Recycled Ethyl Acetate. Among these, Synthetic Ethyl Acetate, produced through the acetic acid and ethanol route, dominates the market due to its cost-effectiveness and widespread availability. Bio-based Ethyl Acetate is gaining traction as consumers and industries shift towards sustainable solutions, while Recovered/Recycled Ethyl Acetate is emerging as a viable option in response to environmental regulations.

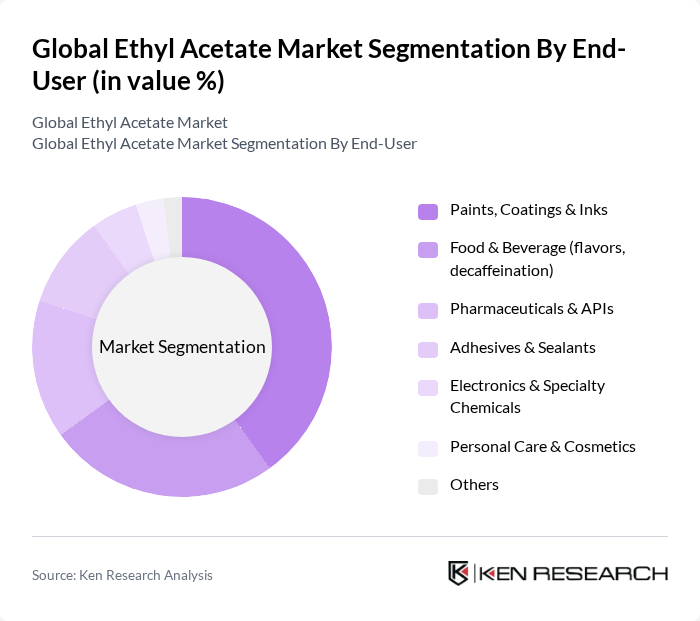

By End-User:The end-user segmentation includes Paints, Coatings & Inks, Food & Beverage, Pharmaceuticals & APIs, Adhesives & Sealants, Electronics & Specialty Chemicals, Personal Care & Cosmetics, and Others. The Paints, Coatings & Inks segment is the largest consumer of ethyl acetate, driven by the growing construction and automotive industries. The Food & Beverage sector is also significant, utilizing ethyl acetate for flavoring and decaffeination, while the Pharmaceuticals segment is expanding due to the increasing demand for active pharmaceutical ingredients (APIs).

The Global Ethyl Acetate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Celanese Corporation, Eastman Chemical Company, BASF SE, Mitsubishi Chemical Group Corporation, Daicel Corporation, OQ Chemicals GmbH, Jiangsu Sopo (Group) Co., Ltd., INEOS Oxide, Yip's Chemical Holdings Limited, Shandong Jinyimeng Group Co., Ltd., LyondellBasell Industries N.V., Solvay S.A., Sekab Biofuels & Chemicals AB, GreenChem Industries LLC, Hubei Greenhome Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ethyl acetate market appears promising, driven by the increasing focus on sustainability and eco-friendly products. As industries shift towards greener alternatives, the demand for bio-based ethyl acetate is expected to rise significantly. Additionally, technological advancements in production processes will likely enhance efficiency and reduce costs, further supporting market growth. Strategic partnerships among key players will also play a crucial role in expanding market reach and innovation in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Ethyl Acetate (acetic acid + ethanol route) Bio-based Ethyl Acetate (fermentation/renewable ethanol route) Recovered/Recycled Ethyl Acetate |

| By End-User | Paints, Coatings & Inks Food & Beverage (flavors, decaffeination) Pharmaceuticals & APIs Adhesives & Sealants Electronics & Specialty Chemicals Personal Care & Cosmetics Others |

| By Application | Solvent (coatings, inks, adhesives) Flavoring & Fragrance Agent Extractant (pharma, food processing) Intermediate for Chemical Synthesis Others |

| By Distribution Channel | Direct Sales (producers to OEMs/formulators) Chemical Distributors Online/B2B Platforms Others |

| By Packaging Type | Drums IBC Totes ISO Tanks/Bulk Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coatings and Paints Industry | 100 | Product Managers, R&D Directors |

| Food and Beverage Sector | 80 | Quality Assurance Managers, Procurement Officers |

| Pharmaceutical Manufacturing | 70 | Regulatory Affairs Specialists, Production Managers |

| Adhesives and Sealants Market | 90 | Technical Sales Representatives, Operations Managers |

| Personal Care Products | 75 | Formulation Chemists, Brand Managers |

The Global Ethyl Acetate Market is valued at approximately USD 5.2 billion, driven by increasing demand across various applications such as paints, coatings, adhesives, and the food and beverage sector, where it serves as a flavoring agent and in decaffeination processes.