Region:Asia

Author(s):Shubham

Product Code:KRAD0910

Pages:95

Published On:November 2025

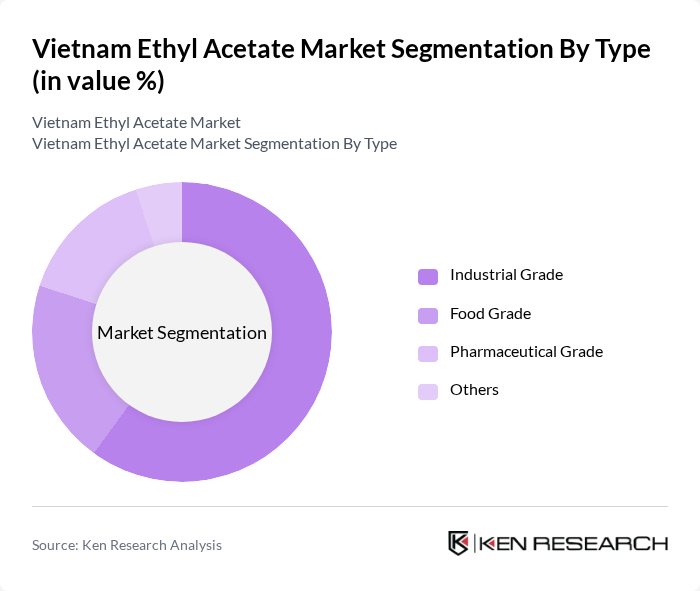

By Type:The market is segmented into Industrial Grade, Food Grade, Pharmaceutical Grade, and Others. The Industrial Grade segment remains the most dominant, driven by its extensive use in paints, coatings, adhesives, and packaging. Growing industrial activities and demand for high-quality solvents in manufacturing processes are key factors for this segment’s leadership. The Food Grade and Pharmaceutical Grade segments are also significant, addressing the stringent quality and safety requirements of the food and pharmaceutical sectors .

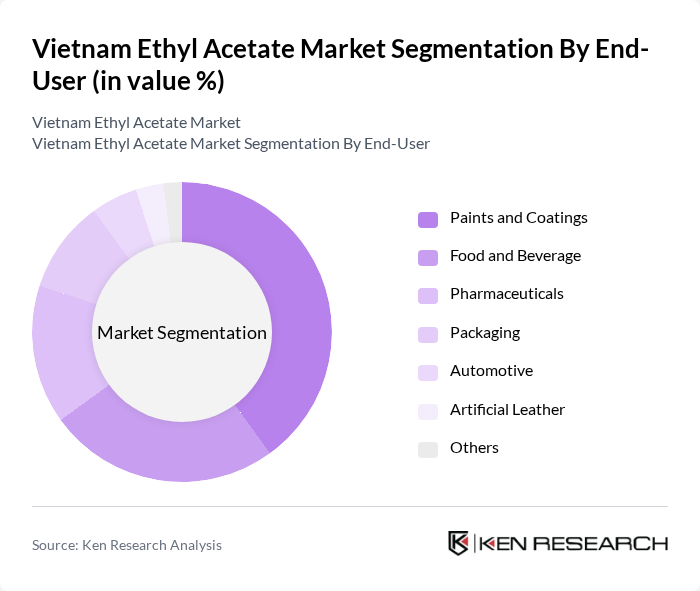

By End-User:The end-user segmentation includes Paints and Coatings, Food and Beverage, Pharmaceuticals, Packaging, Automotive, Artificial Leather, and Others. The Paints and Coatings segment leads the market, supported by robust growth in construction and automotive industries, both of which require high-performance solvents. The Food and Beverage segment is expanding as manufacturers seek safe, compliant solvents for food processing. Increasing demand for eco-friendly and sustainable products is further accelerating growth across these segments .

The Vietnam Ethyl Acetate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinachem (Vietnam National Chemical Group), An Phat Holdings, Southern Basic Chemicals JSC, Binh Duong Chemical Joint Stock Company, Quang Ninh Chemical Joint Stock Company, Long Son Petrochemicals, PetroVietnam (Vietnam Oil and Gas Group), Tien Phong Plastic Joint Stock Company, Hoang Ha Chemical Group, HCMC Chemical Company, Dong Nai Chemical Joint Stock Company, Phu My Plastics & Chemicals Co., Ltd., Binh Minh Plastics Joint Stock Company, Vietnam Chemical Corporation, and An Giang Chemical Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam ethyl acetate market is poised for significant growth, driven by increasing demand across various sectors, including coatings, food, and pharmaceuticals. As the government emphasizes sustainable practices, manufacturers are likely to invest in eco-friendly production methods. Additionally, the rise of bio-based alternatives may reshape the market landscape. Strategic partnerships with key industries will further enhance market resilience, ensuring that the ethyl acetate sector remains competitive and innovative in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Food Grade Pharmaceutical Grade Others |

| By End-User | Paints and Coatings Food and Beverage Pharmaceuticals Packaging Automotive Artificial Leather Others |

| By Application | Adhesives and Sealants Printing Ink Process Solvents Chemical Intermediate Extraction Solvent Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Offline Sales Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Packaging Type | Bulk Packaging Drum Packaging Bottle Packaging Others |

| By Production Method | Ethanol-based Production Acetic Acid-based Production Bio-based Production Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 50 | Production Managers, Quality Control Officers |

| Food and Beverage Sector | 40 | Product Development Managers, Regulatory Affairs Specialists |

| Coatings and Adhesives | 45 | Technical Directors, R&D Managers |

| Consumer Goods Manufacturing | 50 | Supply Chain Managers, Procurement Specialists |

| Environmental Compliance | 40 | Environmental Managers, Compliance Officers |

The Vietnam Ethyl Acetate Market is valued at approximately USD 70 million, reflecting a steady growth driven by increasing demand from various end-user industries, including paints, coatings, food processing, and packaging.